- Traders are displaying robust confidence in Litecoin’s upward trajectory, evident in the overwhelming leverage applied in the derivatives market.

- This optimism, coupled with positive on-chain indicators such as a consistent positive Hodler Net Position Change and declining dormant circulation, suggests the potential for Litecoin to defy bearish expectations.

In comparison to the rest of the cryptocurrency market sliding down considerably, the Litecoin ($LTC) price has managed to hold firmly its support levels. While most altcoins have recorded double-digit losses on the weekly chart, $LTC price is down just 1.61% currently trading at $83.36 with a market cap of $6.2 billion.

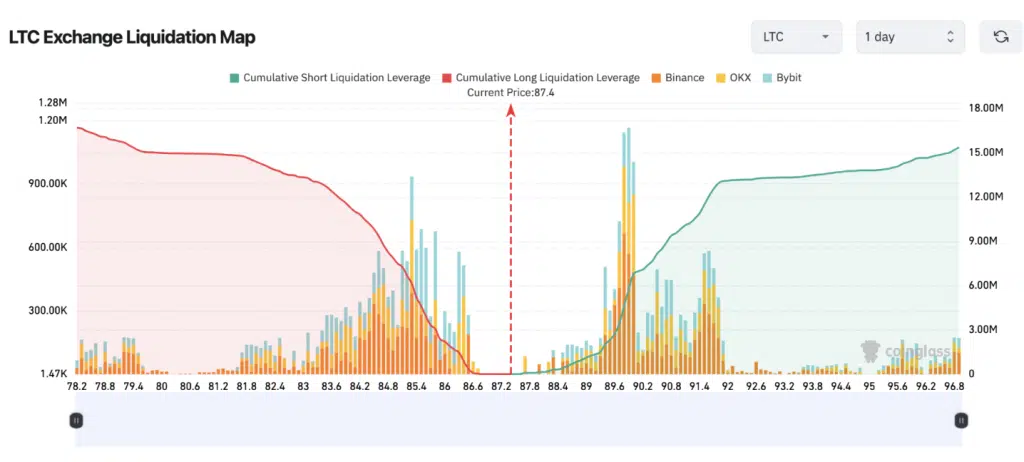

A significant number of traders are showing strong confidence in Litecoin’s upward trajectory, as evidenced by the overwhelming leverage being applied in the derivatives market. According to data from Coinglass, the bullish sentiment prevails, with the value of long-leveraged positions surpassing shorts by a considerable margin. This optimistic stance is exerting significant pressure on short sellers, who risk substantial losses if the price continues to climb.

The current price movement suggests the potential for a short squeeze. Short sellers typically borrow $LTC tokens, selling them at a higher price with the expectation of repurchasing them later at a lower price to profit from the difference.

However, if the price rises instead of falling, short sellers are compelled to buy back $LTC at a loss to cover their positions. This rush to buy and minimize losses further drives up the price, leading to a cascading effect.

Analysts estimate that even a modest 10% price increase, pushing $LTC to $96, could trigger short sellers to liquidate positions worth $16 million. Conversely, bullish traders have accumulated leveraged long positions exceeding $16 million at the current price level. This disparity in leverage positions empowers the bulls to potentially propel the price towards the significant $100 milestone in the near future, per the CNF report.

On-chain Indicators for Litecoin

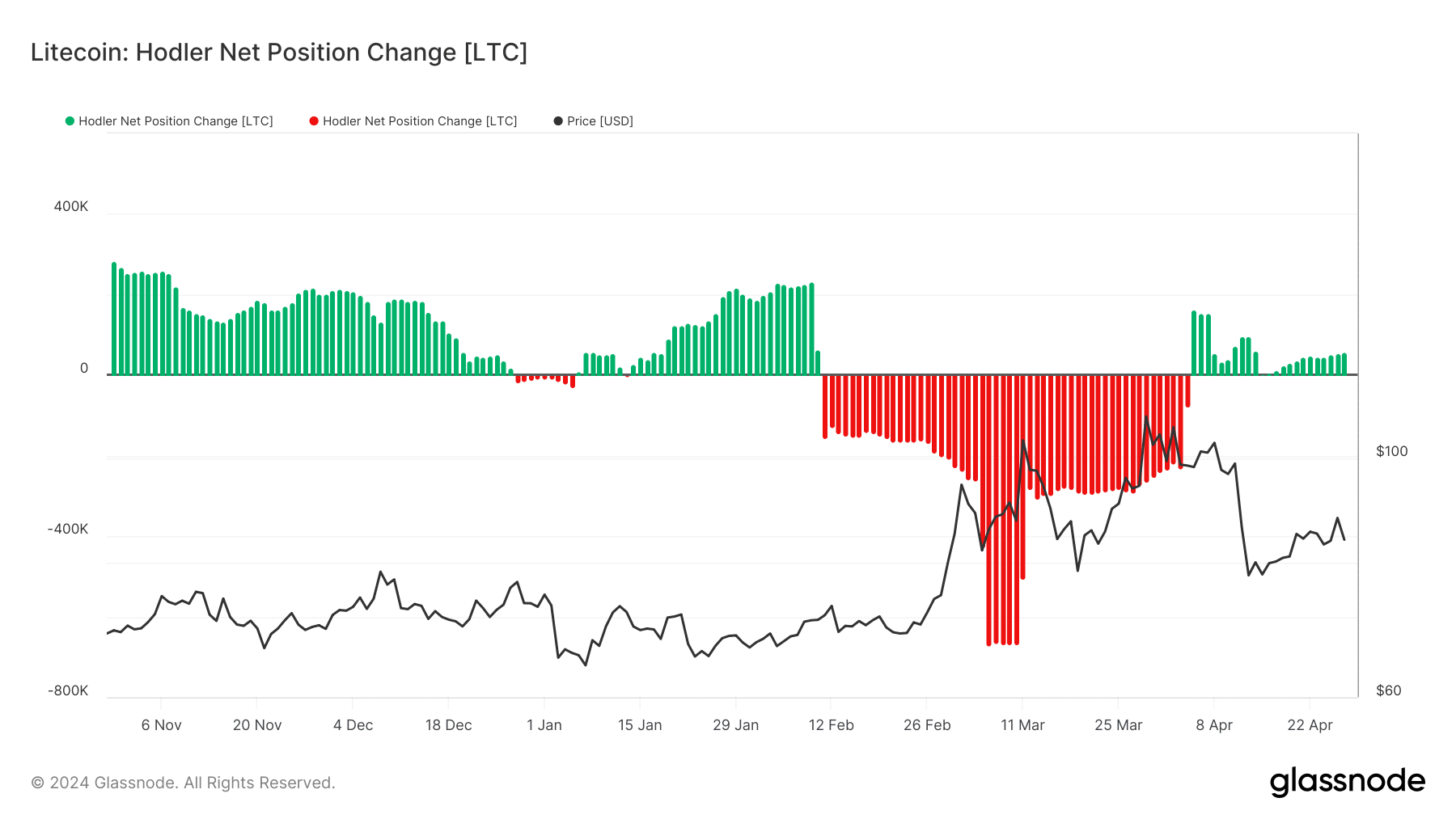

Analysis of Glassnode data reveals a positive Hodler Net Position Change on April 27th, indicating that long-term holders acquired 57,095 coins. This metric had been negative from the second week of February through March, sparking speculation that $LTC might not be among the altcoins poised for significant growth in the coming months.

However, the consistent positive net position change since April 5th suggests a shift in sentiment. If accumulation continues to outpace selling, Litecoin could defy bearish expectations and lean toward a bullish trajectory. As reported by Crypto News Flash, ig players like Grayscale have been accumulating $LTC.

Moreover, the 365-day dormant circulation on the Litecoin network reached its lowest point since April 9th. This suggests that most long-term holders prefer holding onto their coins rather than selling them at current prices.

Additionally, the Mean Dollar Invested Age (MDIA) declined to a low of 348. The MDIA represents the average age of all coins based on their purchase price. A rise in the average age of Litecoin investments would imply that the coin is nearing a local peak. However, the decrease in MDIA indicates the potential for a bullish trend to emerge soon. Seeing how long $LTC takes to rally past $100 will be interesting.