Bitcoin’s weekend was relatively positive as the asset climbed above $64,000 yesterday, but the start of the business week has brought more pain, with a new decline to under $62,000.

The altcoins have followed suit with even more severe losses, and the total crypto market cap has decreased by around $60 billion.

BTC’s Latest Nosedive

Last week started on a more positive note as bitcoin jumped from $65,000 to $67,000 by Tuesday. After failing to overcome the latter on its first attempt, BTC returned and tried a few more times.

Yet, to no avail as the bears resumed their control over the market and propelled a violent price decline on Thursday. It resulted in a drop to $62,800 before the cryptocurrency bounced by over two grand in minutes.

However, that was short-lived and bitcoin started losing value again, falling to $62,400 on Saturday. Sunday was more favorable trading day, as the primary digital asset jumped to $64,400. While the community hoped for a similarly positive start of this week, the landscape changed and BTC dumped to a 10-day low of under $62,000 earlier today.

Despite bouncing off to above that level now, bitcoin is still 2.5% down on the day. Its market capitalization has declined to $1.23 trillion on CG, but its dominance over the alts has increased to 50.5%.

Alts Back in Red

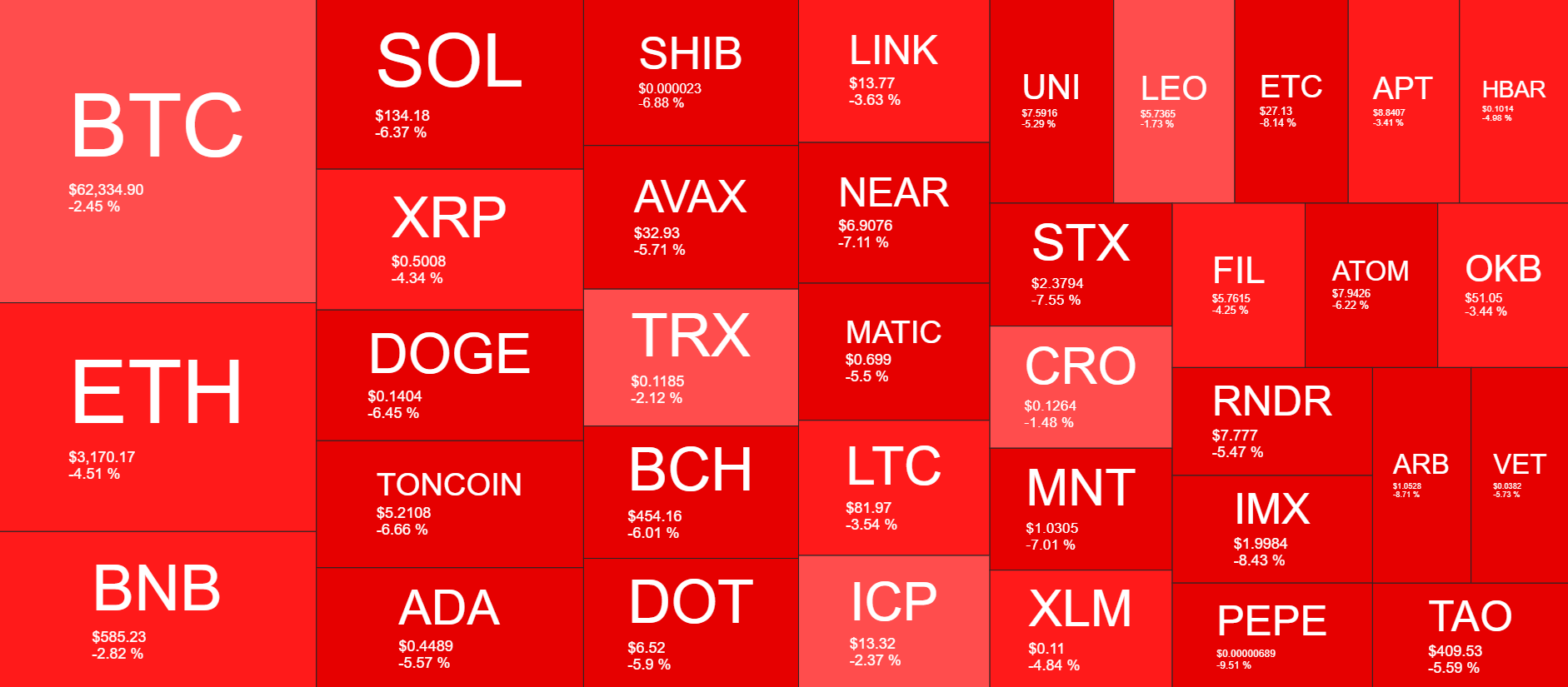

As it typically happens when bitcoin heads south, so do most altcoins. Ethereum was among the top performers yesterday, having surged to over $3,300. All these gains have been erased and a 4% daily drop has pushed the second-largest asset to under $3,200.

Solana, Dogecoin, Toncoin Cardano, Shiba Inu, Avalanche, Bitcoin Cash, and Polkadot have all dropped by somewhere between 5-8% in a day.

BNB, XRP, TRX, and LINK are also in the red, but in a less violent manner. The most substantial daily declines come from CORE (-11.5%), PEPE (-9.3%), GALA (-9.6%), and FLOKI (-9%).

The total crypto market cap has shed just over $60 billion and is down to $2.430 trillion on CG.

cryptopotato.com

cryptopotato.com