The cryptocurrency market has been trading sideways in the past week as traders seek insight into its next direction. Nevertheless, the short-selling open interest remains unbalanced for two cryptocurrencies that could experience a short squeeze next week.

When cryptocurrency traders open short positions, they provide collateral and agree upon a liquidation price above the position’s opening. If the underlying asset’s index price reaches this target, the exchange forcefully closes the position and liquidates the collateral.

Furthermore, derivatives exchanges set a funding rate according to the long/short ratio to keep the market balanced. In summary, short sellers must pay a funding rate interest to long-position traders if there are too many short positions. This also threatens liquidation, as the collateral is drained within the usually 8-hour interest payment.

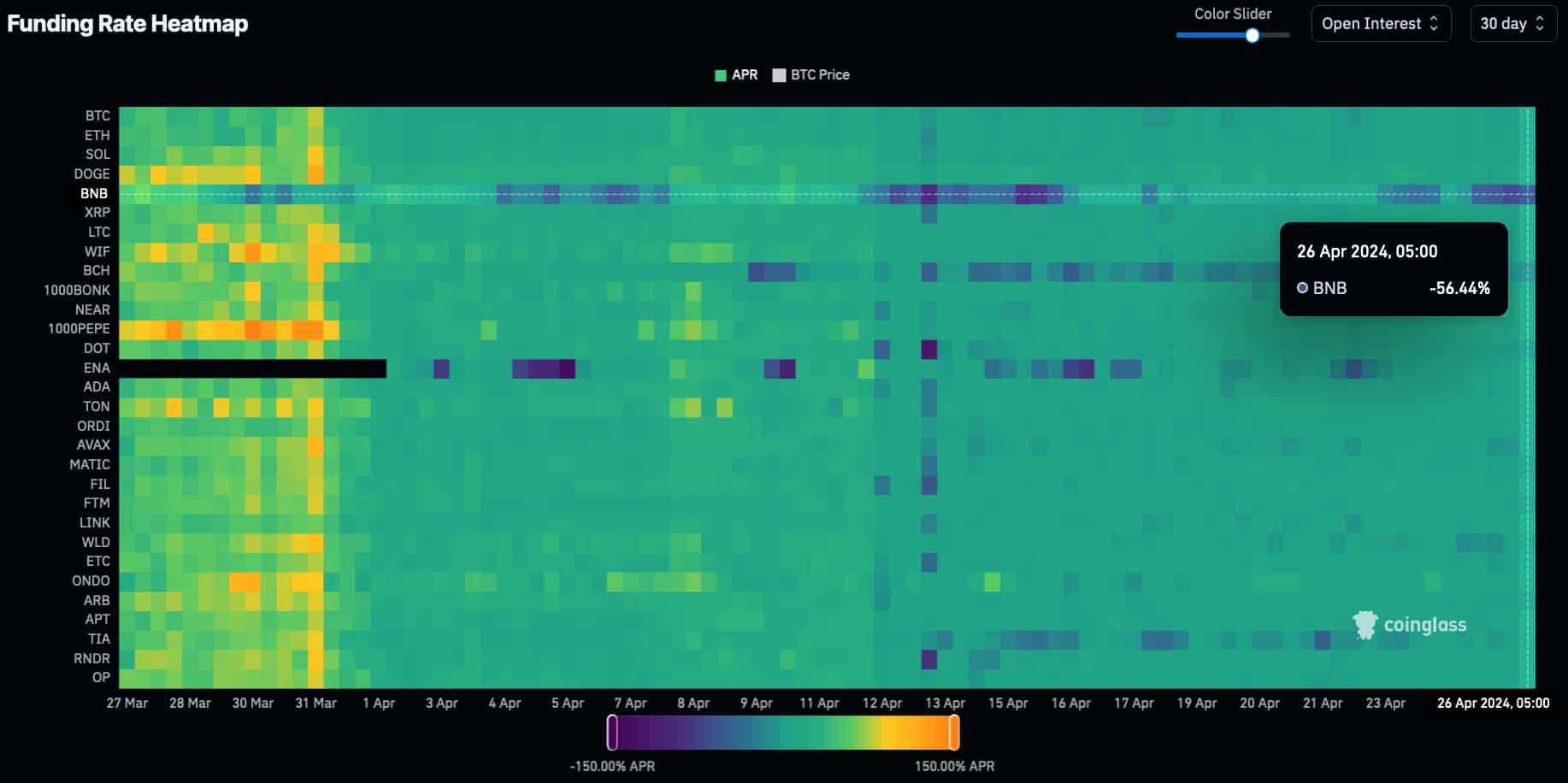

Therefore, looking at funding rates and liquidation heatmaps gives valuable insights into potential short squeezes for cryptocurrencies. Finbold gathered data from CoinGlass on Friday, April 26, and found two likely short squeeze alerts for next week.

BNB Chain (BNB) high funding rates

In particular, BNB Chain (BNB) has been massively shorted after Binance’s former CEO and the token’s creator, Changpeng Zhao (CZ), faces the threat of going to jail, as reported by Finbold. This inherently bearish news brought significant imbalance to the market, which could cause a short squeeze before further downtrend.

Notably, BNB has the fifth highest open interest among all cryptocurrencies and currently has the highest negative funding rate at 56.44%. Historically, funding rates APR this negative have ignited short squeezes with short-term upward price action.

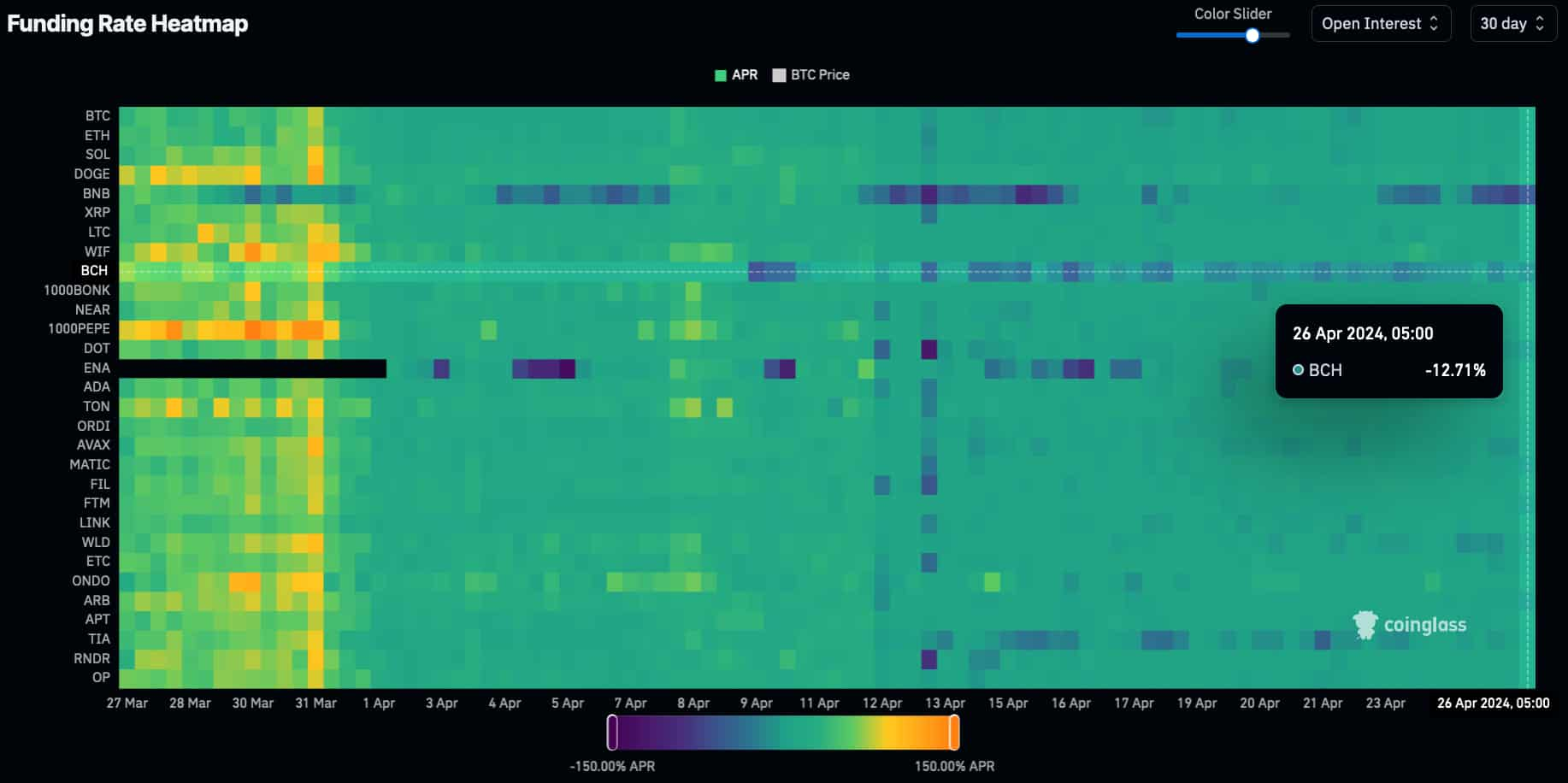

Bitcoin Cash (BCH) short squeeze

Meanwhile, Bitcoin Cash (BCH) also has a significant negative funding rate, which has remained steady this week. As of this writing, BCH short-sellers are paying over 12% interest to long-position traders, the second-highest among other cryptocurrencies.

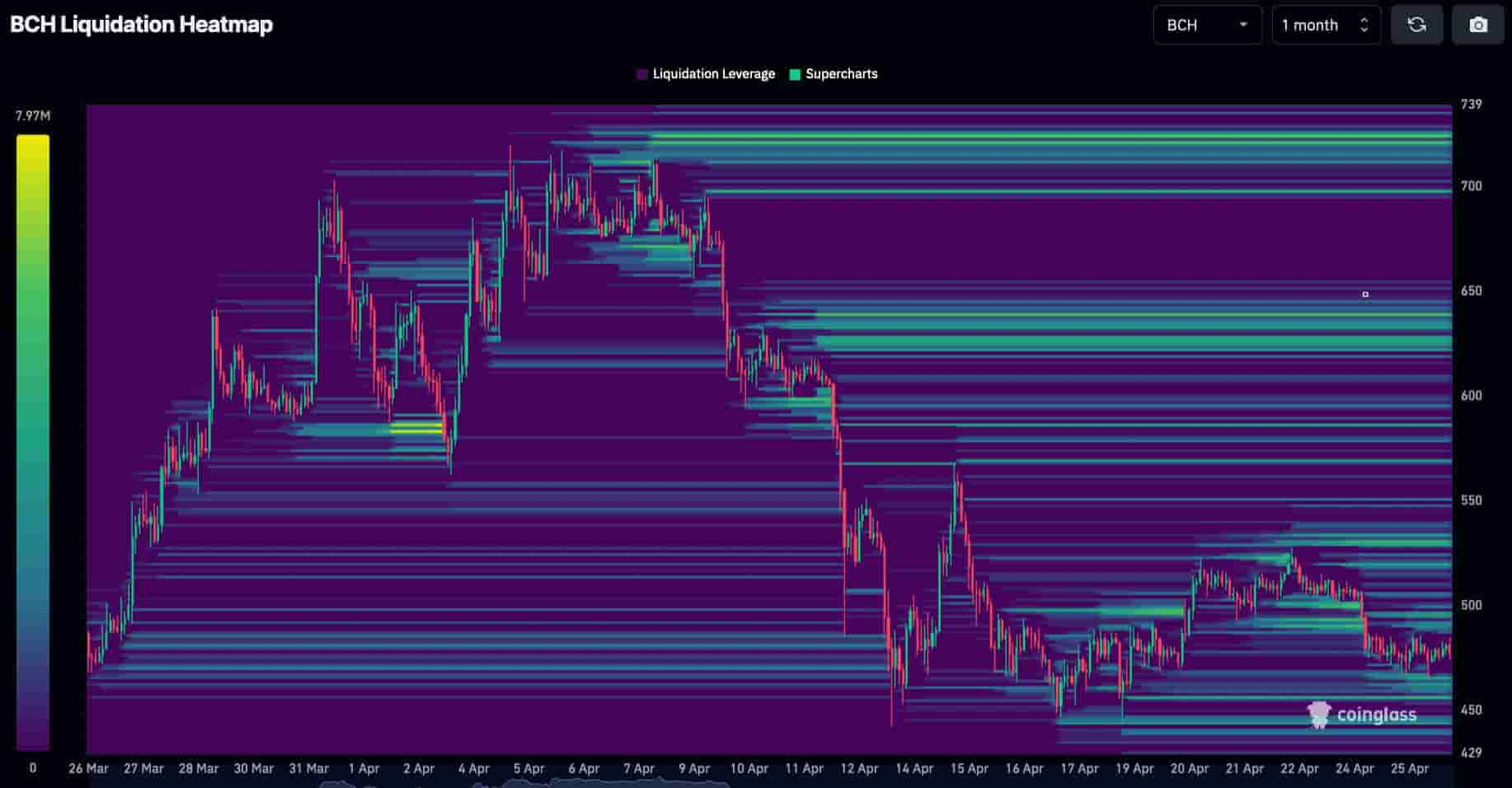

Additionally, the Bitcoin Cash liquidation heatmap shows two meaningful liquidity pools that could become targets for a short squeeze. First, in the $600 to $650 price range, and second, above the $700 level.

However, traders must remain cautious, as high negative funding rates and relevant accumulated liquidations are insufficient to cause a short squeeze. The prices must surge to trigger these liquidations, which requires a positive sentiment to trigger the movement.

Crypto traders must consider different factors to make profitable decisions while remaining cautious and having a solid risk management strategy.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com