Riot’s shares surged by more than 20% fueled by optimistic evaluations from analysts who foresee substantial growth in the company’s financial performance.

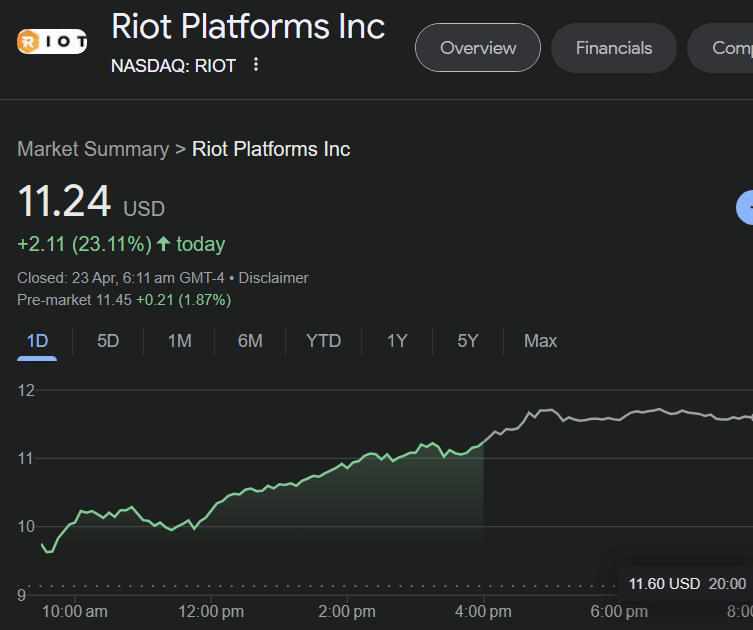

Anticipation surrounding Riot‘s financial performance, particularly in the wake of recent analyst predictions, has fueled significant investor interest. The bullish sentiment was evident as Riot Platform’s stock (RIOT) on Nasdaq surged by 23% to $11.24 as of April 23, according to data from Google Finance.

On April 22, Analyst Mike Colonnese from H.C. Wainwright reaffirmed a Buy rating on Riot Platforms and set a target price of $20.00. He noted the company’s clear growth trajectory and strong financial position as key factors for his positive outlook.

Colonnese highlighted Riot’s plans to significantly enhance its hash rate from 12.4 EH/s to 31.5 EH/s by the end of 2024 and to 41 EH/s by the end of 2025. This strategic increase in capacity is supported by the operational commencement of the first 400 MW substation at the new Corsicana facility in Texas.

Furthermore, the firm’s financial robustness is underscored by its liquidity of over $1.2 billion, positioning it well for future expansions.

Riot’s current low-cost production strategy and the underperformance of its stock year-to-date were identified by Colonnese as an attractive opportunity for investment. He also mentioned the reduced shipment times for necessary mining rigs due to the manufacturing presence of MicroBT in Pennsylvania, which aids Riot’s near-term expansion strategies.

While Colonnese acknowledges some past challenges in deployment timelines, he remains confident in Riot’s capacity for the effective execution of its expansion plans.

You might also like: Riot Platforms Bitcoin mining output surged by 19% in 2023: report

Separately, on the same day, Roth MKM analyst Darren Aftahi expressed a similarly bullish stance on Riot Platforms following his attendance at the company’s Analyst Day in New York.

Aftahi maintained a Buy rating with a price target of $25.50, expecting the company to achieve an EBITDA of $54.7 million on revenue of $391.5 million in fiscal 2024, with further improvements to $144.5 million EBITDA on $516.4 million revenue in fiscal 2025.

The analyst’s optimism is rooted in Riot’s strong financial structure, highlighted by approximately $1.3 billion in cash and Bitcoin holdings as of the end of March.

“Following the halving, we believe RIOT is one of a few miners that has a line of sight to a significantly higher hash rate in the next 6-12 months,” he wrote.

Furthermore, as per the analyst, the partial energization of Corsicana’s first building is a key factor that could drive major growth in Riot’s hash rate and, consequently, its stock valuation in the near term.

Read more: Judge ruling favors Riot in case against energy officials