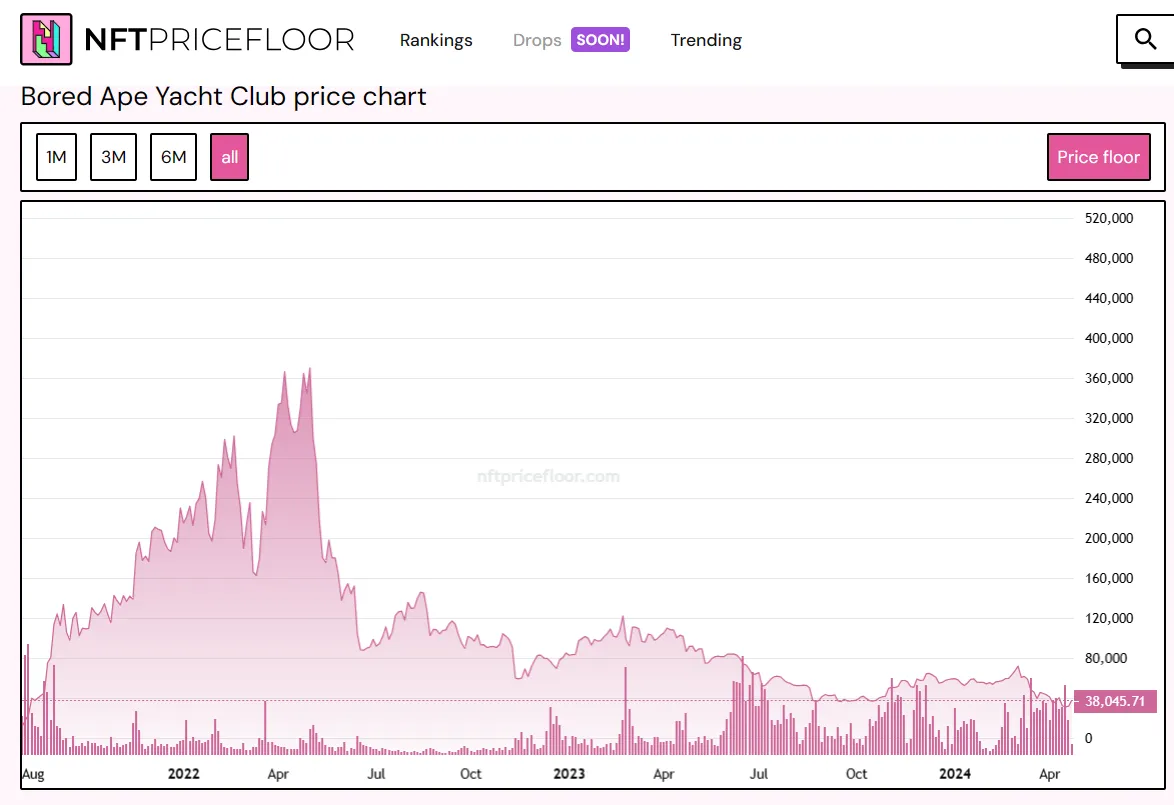

Compounding this, the price floor of BAYC NFTs has been on a downward spiral since last April, falling from a peak of $369K to its current $38K per token, according to $NFT Price Floor.

There now seems to be a glimmer of hope for Apecoin, however. After hitting an all-time low of $0.989 on April 13, the coin has experienced a 35% recovery, reaching its current price of $1.334. In the last 24 hours, Apecoin has surged by 4.82% and is up 12.5% in the last 7 days—although it's still down by 27.93% in the last 30 days, with most of the crash happening in early April.

Part of Apecoin’s recovery could be attributed to the recent efforts of the Apecoin DAO to find new ways to boost engagement and increase use cases for their tokens.

One such initiative is AIP-397, a proposal to launch an “$NFT Launchpad” powered by Apecoin. This platform would encourage the creation and trading of NFTs using Apecoin. The platform would introduce Puffles, “a user-friendly, no-code tool” for people to mint NFTs on various blockchain networks, using Apecoin instead of other cryptocurrencies.

The proposal doesn't seem to be gaining much traction, however, with only 30% of Apecoin holders supporting it as of this writing. Voting is live until May 1, 2024 with many members criticizing the proposal for a lack of details that would make implementation difficult.

A separate proposal was enthusiastically approved, however: AIP-405, which would launch ApeSwap, a native ApeChain DEX in which 50% of all fees are returned to the ApeCoin DAO treasury. This initiative has more than 80% approval with an allocation of around 750,000 Apecoin —just over $1M in today’s prices.

From a technical analysis perspective, Apecoin's price action doesn't look promising. The coin has hit a major volume zone at its lowest level, and the recent 35% spike might encourage swing traders to claim their gains. The coin is meanwhile currently testing the EMA10 zone, which is below the EMA55, indicating that the price of the last 10 days is decelerating faster as time progresses.

The Squeeze Momentum Indicator suggests that a rebound may be starting, but the Average Directional Indez (ADX) at 36 shows that the bearish trend is still strong. The Relative Strenght Indicator (RSI) shows that the coin is oversold, with bears dominating 60% of the trades.

If Apecoin remains bearish, it may lose its recent 35% gains and retest its all-time low in the $1 to $1.10 zone. However, if it maintains its momentum, it could spike an additional 35% until it tests the resistance set by the EMA55 at around $1.66.

decrypt.co

decrypt.co