The cryptocurrency market is heating up after a week of uncertainties and significant losses. Amid a potential recovery, two cryptocurrencies stand out with notable strong momentum.

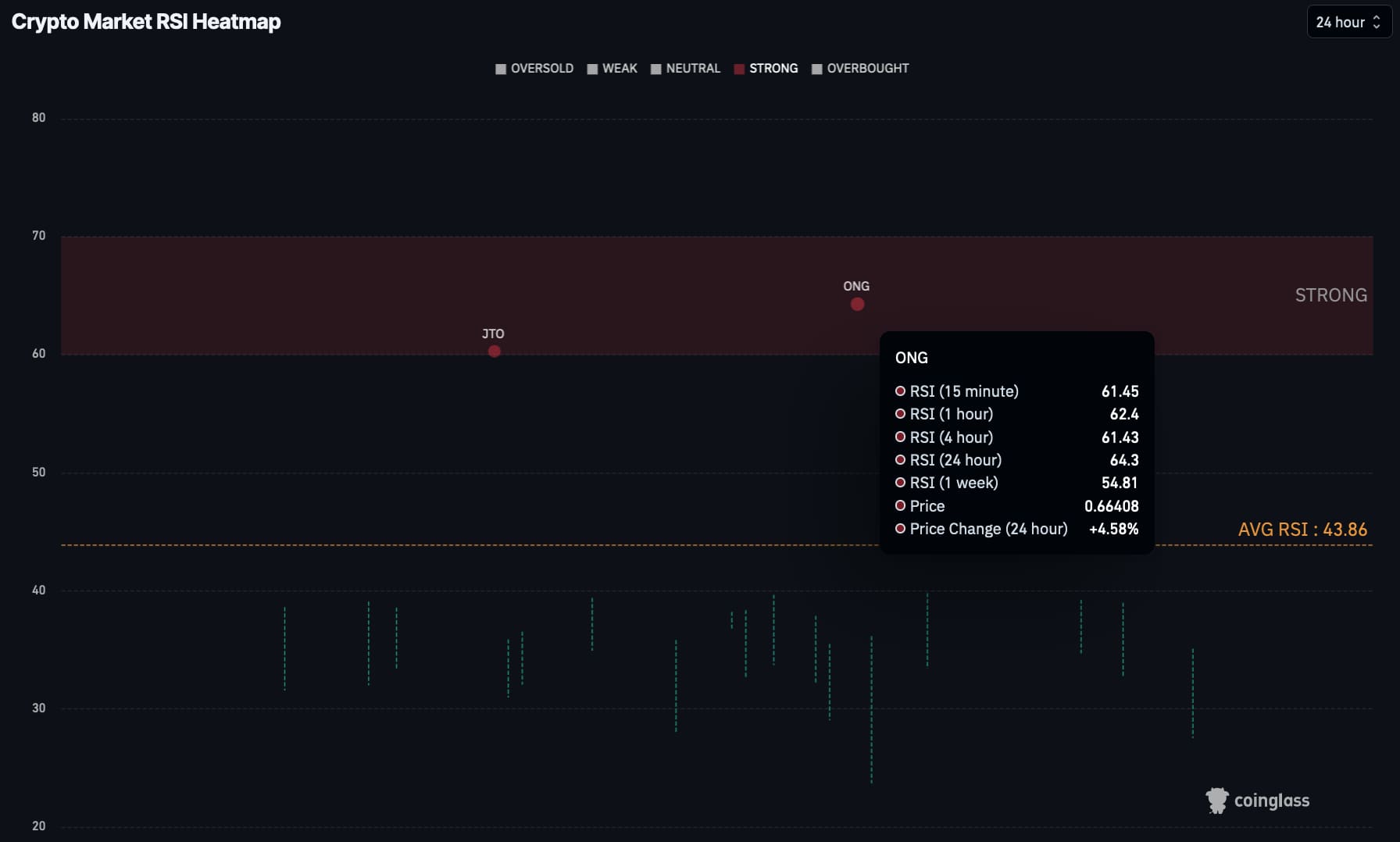

Finbold recurred to the Relative Strength Index (RSI) heatmap from CoinGlass on April 21 to spot potential buy signals.

Overall, the average weekly RSI shows a neutral-50 landscape that could lead these assets in any direction. On the other hand, the average daily RSI navigates below 50 index points as a result of last week’s turmoil.

However, according to this technical indicator, two cryptocurrencies—Jito (JTO) and Ontology Gas (ONG)—display strong momentum. Under the proper conditions, this strength can fuel a bullish continuation next week and represent a current trading buy signal.

Buy signal for Jito (JTO)?

First, Jito is a $500 million capitalization protocol running on Solana (SOL), designed to allow liquid staking through synthetic tokens.

As of this writing, JTO is trading at $4.14, up nearly 10% in the last 24 hours. This recent price action has put Jito in the daily RSI strong zone, slightly above 60 index points. Additionally, the token has a weekly RSI above the average while displaying overbought status in shorter time frames.

The token traded for as high as $5.32 in early April and could revisit this level in a favorable scenario.

Strong momentum for Ontology Gas (ONG)

Meanwhile, a riskier asset stands out above all other cryptocurrencies in terms of its 24-hour relative strength index. Ontology has seen increased demand for its digital ID network, affecting the token used to pay the gas fees, ONG.

Ontology Gas token trades at $0.66, the strongest cryptocurrency in CoinGlass‘s index daily time frame, with 64.3 points. GAS surged by 4.58% in the last 24 hours, achieving a $270 million market cap.

Despite the potential buy signal for these two strong cryptocurrencies, the market is volatile, and things can change quickly. Furthermore, both assets’ low capitalization presents increased risks that traders must be aware of when speculating next week.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk

finbold.com

finbold.com