The cryptocurrency market remains neutral, led by Bitcoin’s (BTC) apparent consolidation phase. In the meantime, two cryptocurrencies present a relevant potential for a short squeeze as the week develops.

The recent week’s geopolitical tensions have caused market turmoil, dropping the prices and the overall sentiment regarding cryptocurrencies. In a suddenly bearish landscape, crypto traders started to open leveraged short positions, which might backfire.

Interestingly, whenever traders open a short position, they leave liquidity behind in the form of collateral assets that the crypto exchange can liquidate if the underlying asset’s price rises to an agreed-upon target. The sequential liquidation of multiple short positions drives the price upwards, and traders know it as a short squeeze.

In particular, Litecoin ($LTC) and Bitcoin Cash ($BCH) have meaningful liquidity pools at higher prices. Bitcoin record fees above $100 could trigger a surge for these alternative coins, similar to the reported $1 feeless opportunity.

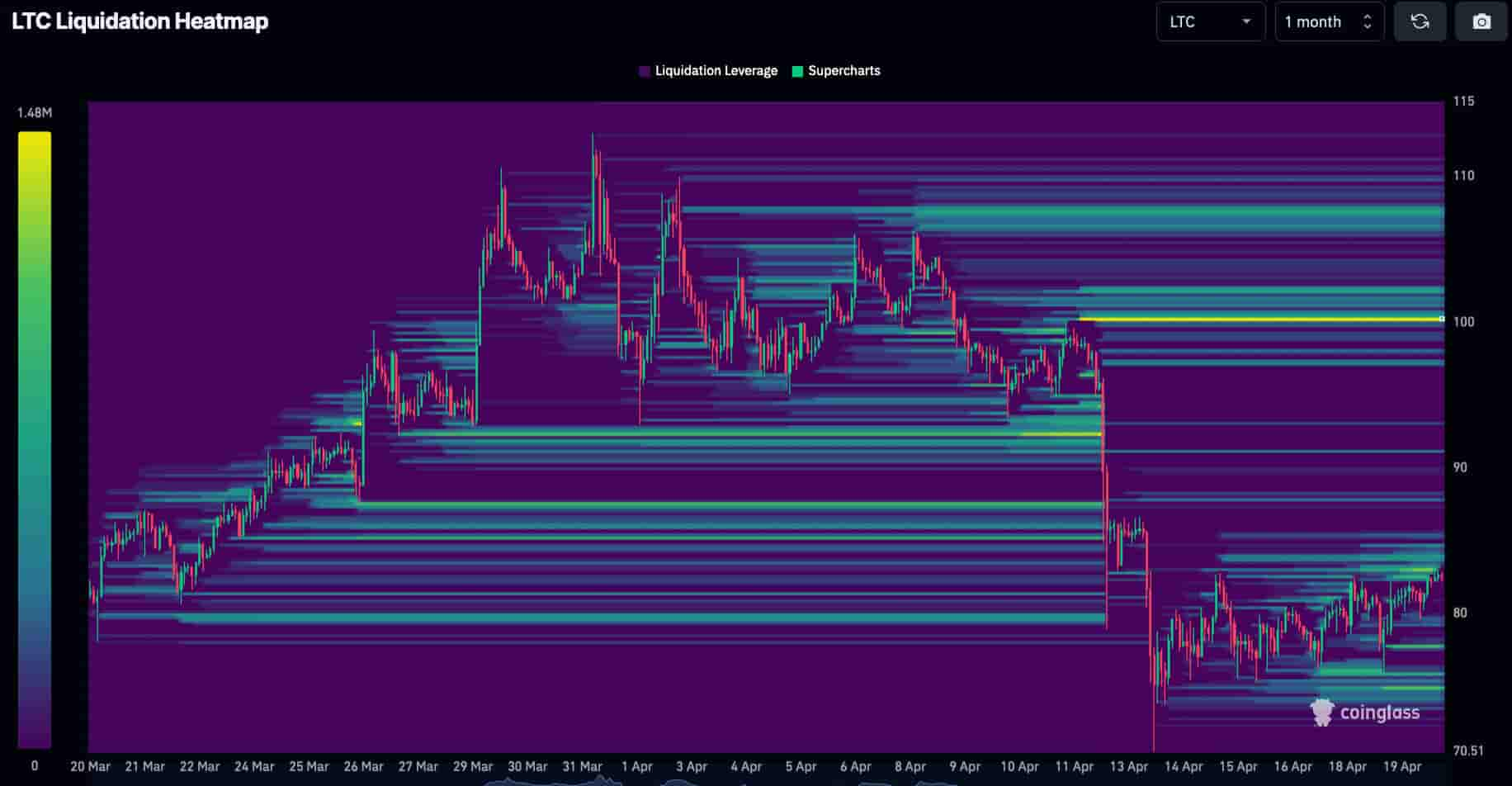

Litecoin ($LTC)

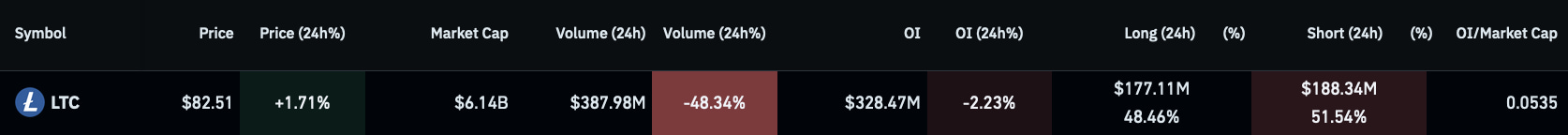

First, Litecoin trades at $82.51, with a slightly positive intraday of 1.71% gains, data from CoinGlass shows. Nevertheless, short-sellers dominate the 24-hour volume with $188.34 million positions opened, for 51.54% of the total volume.

As a result, $LTC has millions of dollars in liquidity pools that are close to the $100 psychological level. Therefore, a short squeeze from the current prices to this likely resistance would reward investors with over 21% gains.

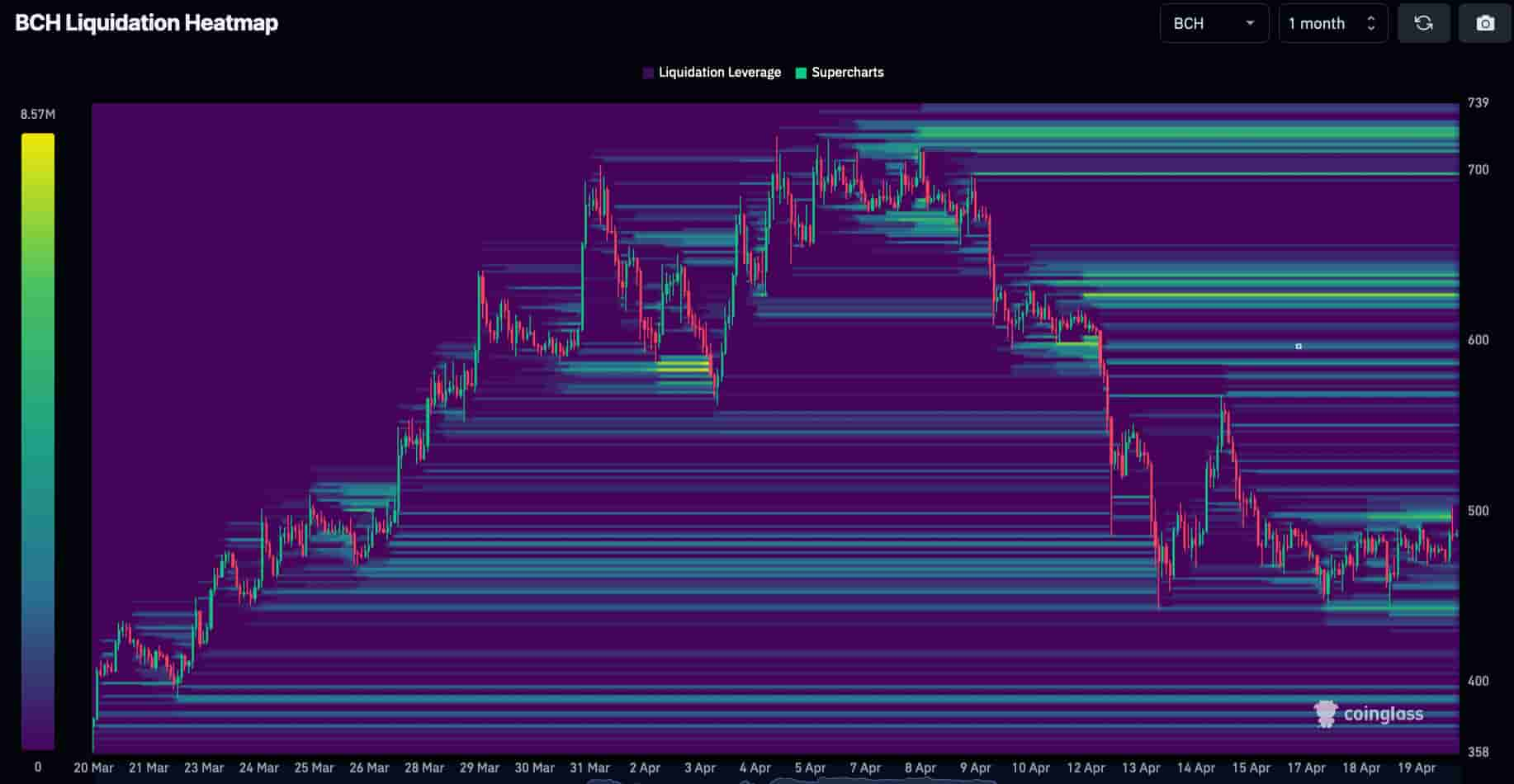

Bitcoin Cash ($BCH)

Second, Bitcoin Cash is another strong competitor that can benefit from the environment of skyrocketing fees for Bitcoin.

Yet, unlike Litecoin’s $100 accumulated liquidations, $BCH has a higher spread among multiple liquidity pools, from $500 to $740. A short squeeze rally through this range has the huge potential of 40% gains for Bitcoin Cash investors.

However, the cryptocurrency market changes every minute, and the liquidity pools mentioned can disappear if traders voluntarily close their positions. Understanding cryptocurrencies’ volatile nature is crucial to navigating the leveraged derivatives market.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com