Uniswap (UNI) is experiencing a bullish recovery push, with market veteran Ali Martinez expecting a rally toward $10 as the TD Sequential indicator shows a buy signal.

This shift in momentum from bearish to bullish comes amid the rebound engineered by Bitcoin (BTC) following the recent collapse below $60,000. Notably, with Israel responding to the previous Iranian attack and the U.S. Federal Reserve looking to delay rate cuts, the crypto market recorded another slump today.

As a result, UNI dropped to a low of $6.708 as it recorded sustained declines earlier today, which culminated in an 8% collapse in four hours. However, Uniswap started recovering these losses when the crypto market witnessed a resurgence.

Uniswap Stages a Comeback

UNI is now up 12.7% from its intraday low, as it pushes to reclaim and hold above the $8 psychological threshold. With the bullish momentum picking up, Ali recently confirmed in his latest analysis that Uniswap is on the verge of a more impressive price rally that could extend for one to four days.

The TD Sequential has flashed a buy signal on the #Uniswap daily chart, suggesting $UNI might be gearing up for a 1-4 day rally, potentially reaching $10! pic.twitter.com/lYuC6UODyA

— Ali (@ali_charts) April 19, 2024

According to him, the factor prompting his confidence in this price surge is the TD Sequential indicator. For context, market analysts typically use this indicator to identify potential trend reversals or trend continuation points for a cryptocurrency.

When a buy signal flashes, it indicates that there is a potential opportunity to purchase an asset as it suggests the beginning of a bullish trend or a continuation of an existing upward trend. Data from an accompanying chart suggests that the TD Sequential is currently flashing this signal for UNI on the daily timeframe.

Resistance Levels Below $10

With Uniswap looking to solidify its recently engineered bullish momentum, the indicator signals growing strength that could help bolster the recovery push. Ali expects this strength to propel UNI toward the $10 level, last seen earlier this month.

However, data from the market analyst’s chart shows multiple resistance levels UNI could face on the path to $10. The first resistance sits at the Fibonacci 0.618 zone, which currently aligns with $8.633. Breaching this point would take Uniswap toward the $9 price territory for the first time in a week.

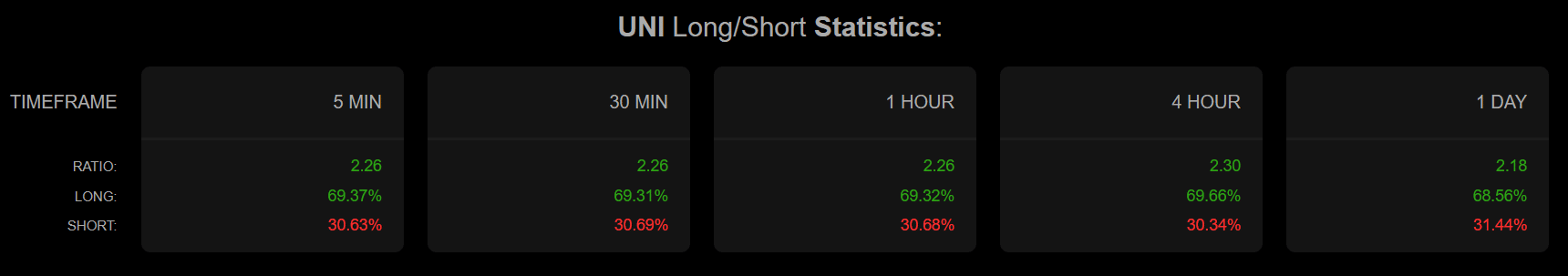

Nonetheless, UNI is likely to witness another pivotal resistance at $9.535, stationed at Fib. 0.5. Should Uniswap capture this level, the recovery push to $10 could finally materialize. This momentum could be bolstered by the resurgence of the bulls, as UNI has witnessed a bullish long/short ratio of 2.18 over the last day, per Coinalyze data.

This comes amid a 5.34% increase in Open Interest to over $74 million in the past 24 hours. The imminent Bitcoin halving could further support the growing momentum. Uniswap currently changes hands at $7.569, up 9.62% since yesterday. Its immediate goal at this point is to reclaim the 50-day EMA currently pegged at $7.888.

thecryptobasic.com

thecryptobasic.com