The cryptocurrency market is a place of risks and opportunities that speculators should be aware of while trading cryptocurrencies. Avoiding particular projects when risks are too elevated is essential to achieve better results.

Overall, geopolitical tensions have increased the already inherent risks of the crypto environment, exposing investors to increased volatility and uncertainties.

On April 19, leveraged traders lost nearly $300 million in short and long-position liquidations. Before that, the market crashed by $430 billion in 48 hours, liquidating over $2 billion in trading positions.

For that reason, Finbold selected three cryptocurrencies to avoid trading in the following days, considering specific economic fundamentals around them. In particular, Ripple ($XRP), Arbitrum ($ARB), and $BONK may expose investors to even higher risks, facing possible sell-offs.

Ripple ($XRP)

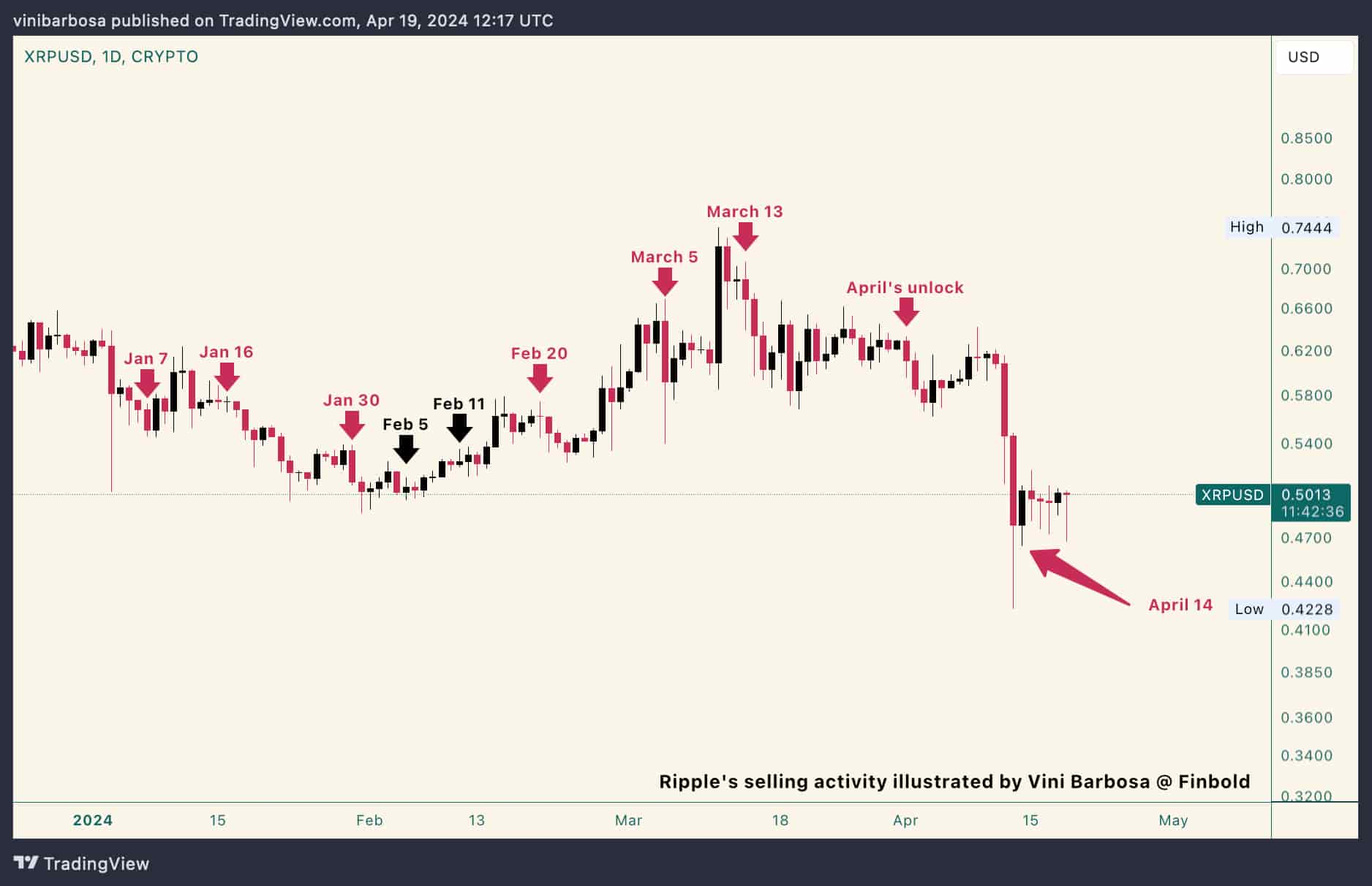

Ripple is the largest $XRP holder and occasionally does significant sell-offs of its holdings, which have historically impacted the token.

The company unlocked 1 billion $XRP in April and reserved 20% for this month’s selling activities. On April 14, Finbold reported Ripple selling 100 million tokens amid the Iran-Israel war escalation.

Notably, the remaining 100 million $XRP are worth $50 million, as the token trades at $0.50 by press time. An upcoming sell-off could again bring more volatility to Ripple’s token as it tests key psychological levels. Finbold illustrated these sell-off events in the $XRP price chart year-to-date.

Arbitrum ($ARB)

On April 16, the Arbitrum protocol unlocked 92.65 million $ARB distributed to the team and investors.

The total value of this month’s unlock exceeded $100 million, making it even more relevant than Ripple’s monthly unlocks. Essentially, $ARB has a $3 billion market cap, nearly 10 times lower than $XRP’s $28 billion capitalization.

So far, the price has not seen any meaningful changes since the unlock three days ago. This suggests the benefited entities have not yet made significant sales, keeping the alert live for the following weeks. Therefore, avoiding trading $ARB is a solid risk management strategy as team members and investors sell off their tokens.

A previous unlock on March 16 dragged Abritrum’s price nearly 40% down.

$BONK

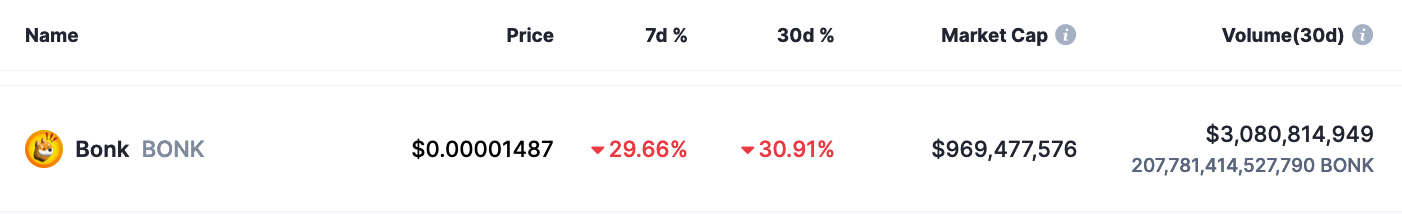

Finally, $BONK is the third cryptocurrency to avoid trading next week, considering no long-term economic fundamentals and a loss of interest from meme coin traders. The Solana‘s first popular meme coin lost over 30% of its value in the past 30 days, dropping below the $1 billion market cap.

Meme coins are usually compared to economic bubbles driven by greed and unsustainable price speculation, described by finance experts as “the greater fool theory:”

“The Greater Fool Theory is the idea that, during a market bubble, one can make money by buying overvalued assets and selling them for a profit later, because it will always be possible to find someone who is willing to pay a higher price. An investor who subscribes to the Greater Fool Theory will buy potentially overvalued assets without any regard for their fundamental value. This speculative approach is predicated on the belief that you can make money by gambling on future asset prices and that you will always be able to find a “greater fool” who will be willing to pay more than you did. Unfortunately, when the bubble eventually bursts (which it always does), there is a large sell-off that causes a rapid decline in the asset values. During the sell-off, you can lose a great deal of money if you are the one left holding the asset and cannot find a buyer.”

– Harford Funds blog post: “The Greater Fool Theory: What Is It?”

However, despite the above economic analysis, these cryptocurrencies could still display positive price performance in the next few days. The cryptocurrency market can surprise the most experienced traders with unexplained actions favoring assets under theoretical negative developments.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com