The crypto market ignited in the first quarter of 2024, with the total market capitalization exploding by 64.5%. Amid this surge, detailed in CoinGecko’s “2024 Q1 Crypto Industry Report,” certain altcoins dramatically outperformed Bitcoin (BTC).

While Bitcoin set a new all-time high of $73,737 in March, some popular altcoins posted even more impressive gains. This insight and other crypto market developments reveal potential hidden gems for investors seeking dynamic opportunities.

Altcoins Dazzle and Meme Coin Frenzy in Q1 2024

The approval of US spot Bitcoin exchange-traded funds (ETFs) in January ignited the market. By April 2, these ETFs amassed over $55 billion in assets under management (AUM).

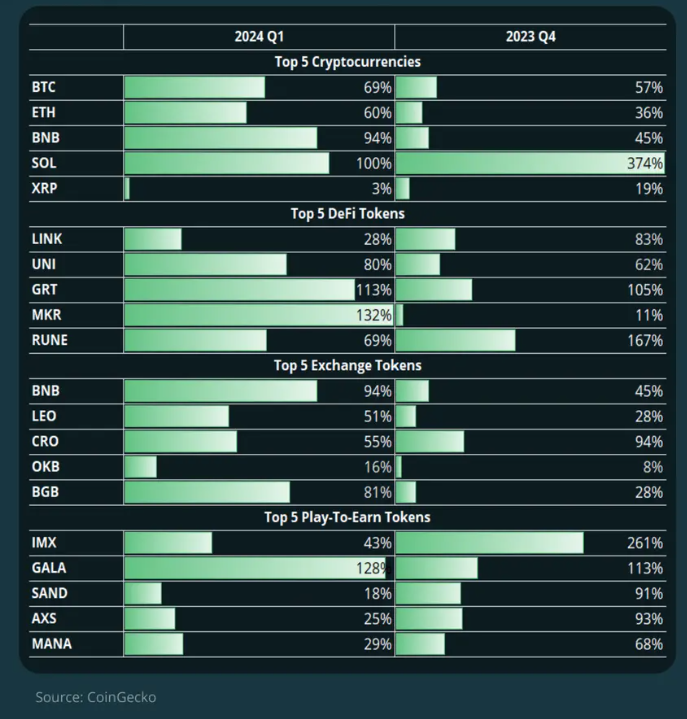

Despite the boost from ETFs, Bitcoin’s price gains were only at 69% during the first quarter. However, Solana (SOL) and Maker (MKR) managed to steal the spotlight, skyrocketing by 100% and 132%, respectively.

Ethereum (ETH), the second largest cryptocurrency, also saw a relatively moderate price increase compared with Solana. In the previous quarter, ETH only managed to record a surge of 60%.

Read more: Which Are the Best Altcoins To Invest in April 2024?

However, its layer-2 (L2) networks flourished thanks to the gas fee reductions implemented by EIP-4844. As a result, these L2s processed over $900 million in transactions during the reporting period.

Besides the L2s boom, Ethereum also recorded amazing achievements from its restaking sector. In Q1 2024, restaking on EigenLayer saw an increase of 36%, with a total of 4.3 million ETH being restaked. The majority of restaked ETH was held by Liquid Restaking Protocols (LRTs), which amounted to 2.28 million ETH.

EtherFi was the most prominent LRT protocol in Q1, with a 21% market share. It experienced a massive growth of 2,616% throughout the quarter and held 910,000 ETH by the end of March.

On the other hand, the surge of meme coins significantly impacted Solana‘s performance. During Q1, the market cap of the top 10 Solana meme coins skyrocketed by over 800%. By the end of March, these assets reached a staggering total market cap of $9.36 billion.

“Of the top 10 Solana memecoins, only Bonk (BONK) and Samoyedcoin (SAMO) existed prior to Q4 2023. BONK, the number one meme coin on Solana since its launch in December 2022, was flipped by dogwifhat (WIF) in early March. WIF was launched in November 2023. Meanwhile, Book Of Memes (BOME) launched on March 14, reaching a $1 billion market cap within two days,” CoinGecko wrote.

In addition to the crypto market, the non-fungible token (NFT) sector recovered in the previous quarter, buoyed by revived attention to Bitcoin and Solana NFTs.

Ethereum recovered its spot as the largest NFT chain, with over $2.2 billion in trade during that period. However, the interest surge within the Bitcoin and Solana ecosystems challenges Ethereum’s dominance.

Previously, BeInCrypto reported that in April 2024, Bitcoin Ordinals, the NFTs in Bitcoin’s blockchain, had outperformed Ethereum NFTs multiple times regarding sales value. Moreover, the upcoming Bitcoin halving and launch of the new Runes token standard could heighten the competition.

Read more: Bitcoin Halving Countdown

Investor enthusiasm was further reflected in centralized exchange (CEX) spot trading volume, which hit $4.29 trillion in Q1 2024. This marks the highest recorded level since late 2021.

However, decentralized exchanges (DEXs) saw Ethereum’s share of trading volume decline, with chains like Arbitrum and Solana gaining attention.

beincrypto.com

beincrypto.com