Amid reports that silver is quietly outpacing gold in 2024, having increased its value by over 20% since the year’s turn and settling at $28.7 per troy ounce after hitting $30 an ounce for the first time since May 2021, there are two tokenized silver cryptocurrencies that can offer exposure to it.

As it happens, silver has recently hit its highest price in the last eleven years (albeit still well below its all-time high of $47.9 from April 2011), increasing not only the demand for the precious metal but also digital assets backed by physical silver, although there aren’t many of them out there.

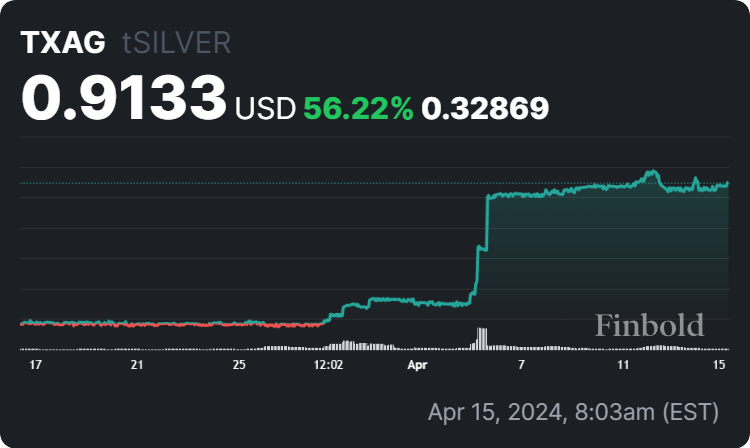

#1 tSILVER (TXAG)

Specifically, one of the most notable silver-backed crypto assets is Aurus’ tSILVER (TXAG), a silver-backed stablecoin on the Ethereum (ETH) blockchain minted by a network of traders from the traditional precious metals market and 1:1 collateralized by 1 gram of 99.99% LBMA-accredited silver.

#2 Kinesis Silver (KAG)

Meanwhile, Kinesis Silver (KAG), which launched for trading on the Dubai-based Emirex exchange one year ago alongside Kinesis Gold (KAU), is the virtual asset product by the crypto trading and payment service platform Kinesis Money, backed by fine silver “stored in fully insured and audited vaults.”

Conclusion

All things considered, the tokenized versions of this precious metal, as is the case with gold-backed cryptocurrencies, inadvertently entail significant risks, so detailed analysis and weighing one’s risk tolerance is necessary before investing a significant amount of money in them.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com