Venture capitalist Chris Burniske says one blockchain project’s recent movement is reminiscent of Solana’s (SOL) back in 2020.

Burniske, former crypto analyst at ARK Invest and current partner at Placeholder, says Celestia (TIA) bulls who are disappointed in TIA’s big correction may want to look at Solana’s chart from 2020, when SOL was also a fairly new token on the scene.

The investor points out that after a massive dip, SOL suddenly rallied 10,000% the next year.

“Seeing lots of TIA complainers after the token went ~10x in the public market in ~4 months. Most of these complainers have no clue SOL also went ~10x in 2020, then sold off 80%, then went 100x+ in 2021. If you can’t handle downside volatility, you don’t deserve the upside.”

At time of writing, TIA is trading at $8.27, 59% down from its all-time high.

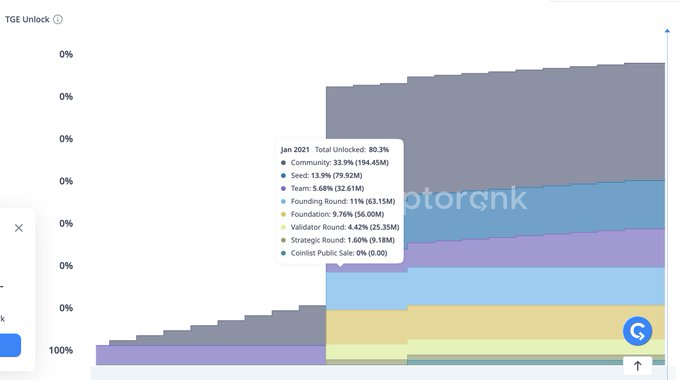

Celestia also has a large token unlock scheduled for October 31 of this year, where 17.57% of the supply will be unlocked onto the open market, which is sometimes interpreted as bearish given that more of the asset can be sold.

However, Burniske points out that Solana also went through a big unlock which ultimately preceded parabolic run-ups.

“Now people complaining that TIA October ’24 unlock is too big at 17.57% of total supply, while SOL unlocked ~80% of its current total supply December 2020. Few here remember much, huh?”

Generated Image: Midjourney

dailyhodl.com

dailyhodl.com