Today’s market session saw bears take total control of the markets, as evidenced by the lack of gainers. The global market cap dropped 6% over the last 24 hours to $2.45T as of press time, while the global trading volume jumped by 77% to $140.03B as of the same period.

Bitcoin Price Review

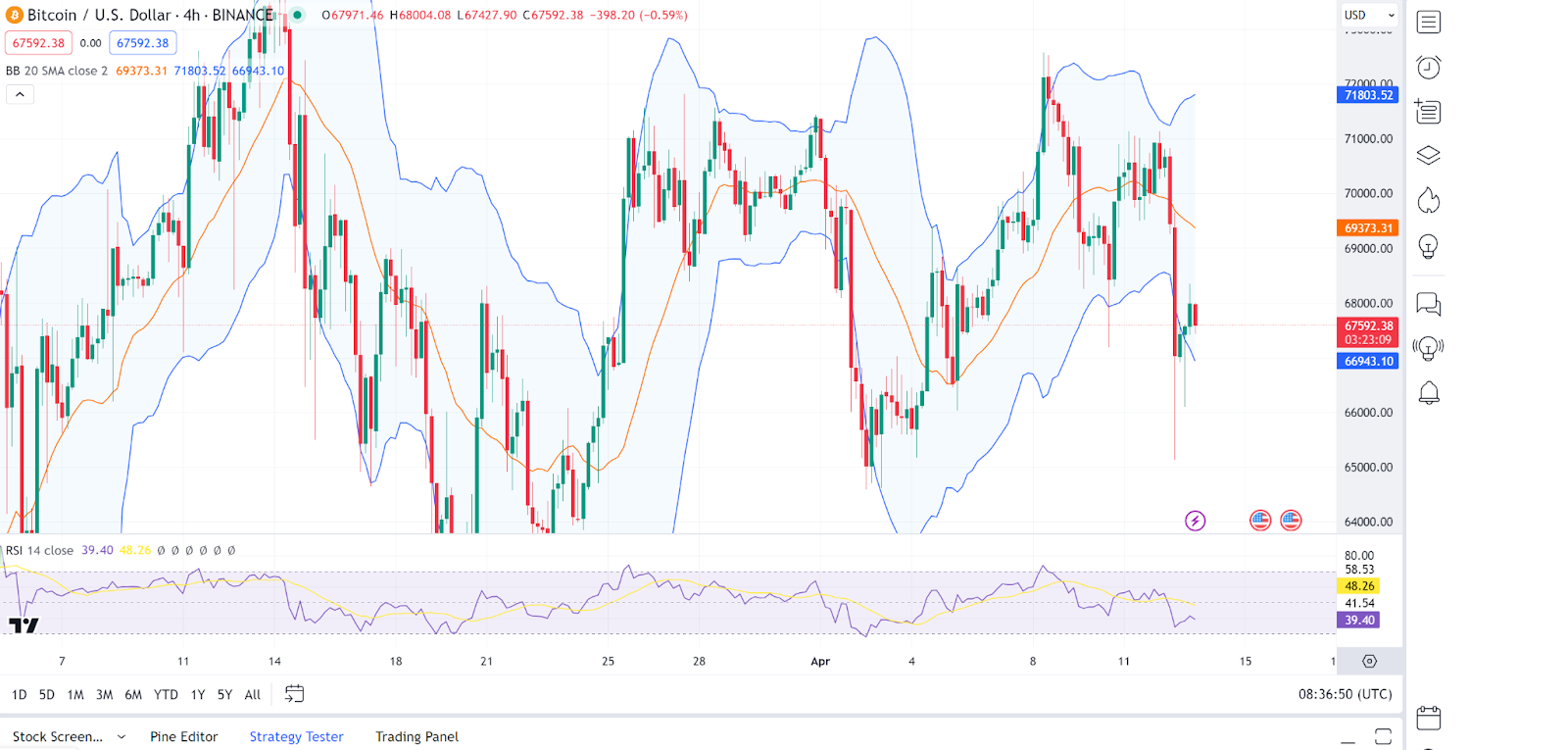

Bitcoin (BTC) is also facing massive corrections today as the crypto king dropped back to $67K. The Bitcoin price is currently fluctuating within the Bollinger Bands, having recently moved down from the upper band, indicating potential overbought conditions that have corrected. The 20-period SMA (orange line) is above the current price, which suggests a short-term downtrend.

On the other hand, the RSI (Relative Strength Index) is around 48, which is near the midpoint, showing neither overbought nor oversold conditions. As of press time, the Bitcoin price stood at $67,132, representing a 5.1% dump from its previous 24-hour price.

Ethereum Price Review

Ethereum (ETH) is also having a rough day as the altcoin king failed to post corrections in today’s session. The Ethereum price has broken below the cloud in the Ichimoku Kinko Hyo indicator, which is typically considered a bearish signal. The Supertrend indicator has turned red and is above the current price, further confirming bearish sentiment.

On the other hand, the ADX (Average Directional Index) is above 25, indicating a strong trend, which is currently downwards. As of press time, the Ethereum price stood at $3,251, representing a 7.7% dump from its previous 24-hour price.

Core Price Review

Core DAO (CORE) is the top loser in today’s session as the altcoin now faces massive corrections from this week’s pump. After a sharp uptrend, the price has significantly declined, crossing below all three moving averages of the Alligator indicator, which could signify a trend reversal or a corrective phase.

On the other hand, the MFI (Money Flow Index) is very low, under 20, suggesting that the asset is oversold. If buyers step back in, this could lead to a bounce. As of press time, the Core DAO price stood at $1.62, representing a 25% dump from its previous 24-hour price.

Conflux Price Review

Conflux (CFX) is today’s second top loser as the altcoin also pulls back from the week’s upswing. Analysing CFX charts, we notice the Conflux price is in a strong downtrend as it is below the Ichimoku cloud. Recently, there was a sharp decline breaking past previous support levels.

On the other hand, the Woodies CCI is showing strong downward momentum, which aligns with the overall bearish trend. As of press time, the Conflux price stood at $0.2686, representing a 23% dump from its previous 24-hour price.

THORChain Price Review

THORChain (RUNE) is also posting massive corrections in today’s session ahead of today’s bear market. The THORChain price has broken below a descending channel, continuing the bearish trend. Long red candles indicate a sharp downward move, suggesting strong selling pressure.

On the other hand, the Volume Oscillator is negative, indicating lower trading volumes on down moves, which might show a lack of buyer interest at the current levels. As of press time, the THORChain price stood at $5.63, representing a 21% dump from its previous 24-hour price.