Fetch.ai ($FET) price has been moving sideways and consolidating for over a month.

While signs of a change in price action direction seem apparent, the question is, will it be bullish or bearish?

Fetch.ai Investors Take a Step Back

Fetch.ai’s price is set to continue witnessing the consolidation it is stuck in. At times, the investors tend to shift the waves of price action, but this may not happen with $FET right now. The reason is that investors are pulling back.

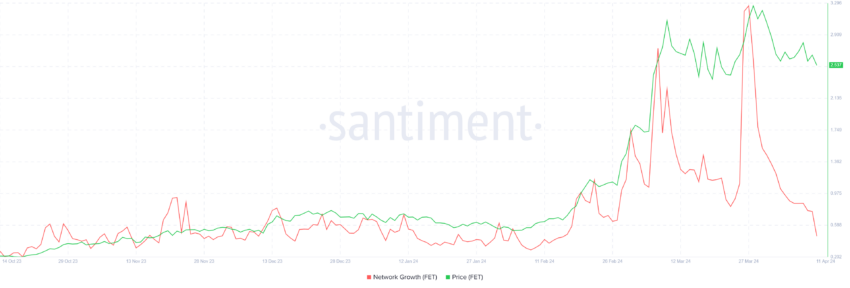

As visible in the network growth, a downtick indicates the project is noting a decline in the traction observed in the market. This is measured by the rate at which new addresses are formed on the network, which is at a two-month low presently.

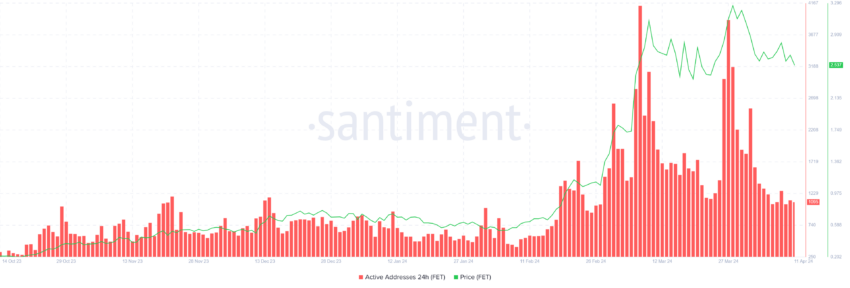

Additionally, the active investors are refraining from participating in the network. The ones conducting transactions on the network are declining with every passing day. This means that the market’s pessimism is overshadowing the optimism.

As active addresses decline, the volatility drops, too, leaving Fetch.ai’s price vulnerable to either consolidation or a decline.

$FET Price Prediction: Consolidation Continues

Fetch.ai’s price, trading at $2.54 at the time of writing, failed to breach the resistance marked at $2.85. This level has only been broken through once in the last 90 days. Given the declining support of investors, the situation will likely remain the same in the future.

The Relative Strength Index (RSI) is also currently below the neutral line at 50.0. RSI is a momentum oscillator that measures the speed and change of price movements. It indicates whether a security is overbought or oversold, aiding in identifying potential trend reversals.

The presence of the indicator in the bearish zone is a sign that Fetch.ai’s price is finding difficulty in noting a recovery, leaving it vulnerable to consolidation.

However, if $FET falls through the $2.40 support level or breaks out above $2.85, it would potentially invalidate the neutral thesis, resulting in either a rally or a correction.

beincrypto.com

beincrypto.com