After a sudden decline earlier in the week, the cryptocurrency market has witnessed a modest revival, spearheaded by Bitcoin (BTC). The maiden cryptocurrency is striving to reclaim the $70,000 threshold and aim for a new all-time high.

This resurgence ensued following Federal Reserve Chair Jerome Powell’s confirmation of anticipated rate reductions “at some point” before the conclusion of 2024. This announcement served as a relief signal for the market participants.

Apart from Bitcoin, several other cryptocurrencies deserving attention exhibit prominent fundamentals that distinguish them within the market. Amidst the current short-term bullish sentiment, Finbold has identified three digital assets worth monitoring in the upcoming week.

Ethena (ENA)

Ethena (ENA), a synthetic dollar protocol supported by notable figures such as Arthur Hayes, co-founder of the BitMEX crypto exchange, has experienced significant growth following the distribution of its governance token through an airdrop to users. The token has subsequently been listed on major cryptocurrency exchanges like Binance.

The cryptocurrency gained market attention by surpassing the $1 mark within a week, propelling its market capitalization to over $1 billion and ranking it among the top 100 cryptocurrencies. It’s worth noting that Ethena aims to disrupt the decentralized finance (DeFi) segment by introducing an innovative synthetic dollar protocol, offering users a stablecoin alternative to mitigate the volatility common in other cryptocurrencies.

While the token is currently experiencing hype, it’s important to note the potential risks amid the uncertain environment, hence the need to watch out in the coming week. Investors may not fully understand Ethena’s model and limitations, posing considerable risks.

Additionally, the crypto community is concerned about the risks of Ethena’s approach, particularly following the collapse of the Terra ecosystem. Some market players fear Ethena might follow a similar path and face a meltdown.

For instance, Andre Cronje, the creator of Fantom, has expressed concerns about the incentives driving Ethena Labs and is warning of potential parallels with Terra’s past collapse.

Bitcoin Cash (BCH)

Bitcoin Cash (BCH) warrants attention in the upcoming week due to recent price surges, uncertainties following its halving, and conflicting technical signals. BCH has experienced a nearly 15% surge in the past week, surpassing the performance of the broader crypto market, with the potential for this momentum to persist.

The recent halving on April 4th, reducing miner rewards, has divided the market on its impact. While some anticipate a surge in price due to reduced supply, others fear a sell-off. The market’s response to the halving remains uncertain, marked by heightened volatility as stakeholders speculate on its future direction.

BCH’s halving occurred 16 days before Bitcoin’s, significantly increasing the asset’s open interest, indicating heightened investor interest.

The technical analysis presents mixed signals, indicating a potential pullback after a strong rally alongside signals hinting at a bullish continuation. With the potential for increased volatility in the coming week, BCH emerges as an intriguing asset to monitor closely.

BCH was valued at $690 by press time, reflecting daily gains of 0.66%.

Pendle (PENDLE)

Pendle Finance (PENDLE) is drawing attention for the upcoming week due to its remarkable surge in value and substantial market capitalization growth in recent days. The token stands out as one of the hottest cryptocurrencies in the market, having appreciated by 55% over the last seven days.

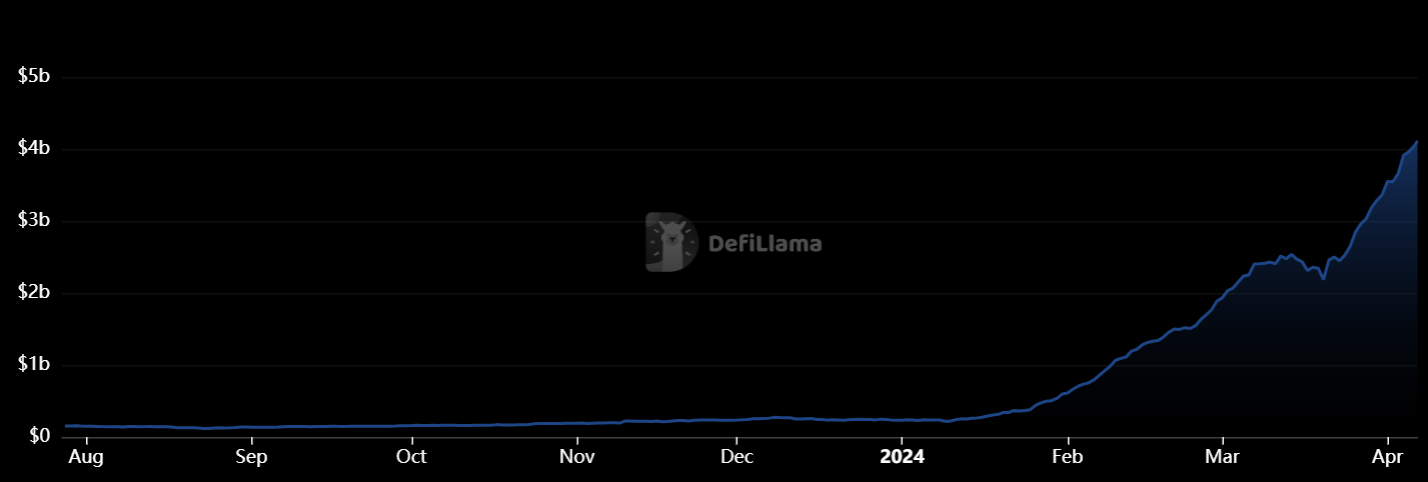

This surge aligns with notable growth in other key metrics on the platform. Specifically, data from DeFiLlama revealed that Pendle’s total value locked has reached $4.116 billion, representing an impressive growth of over 1,600% in 2024 alone, solidifying its position as one of the largest DeFi yield protocols in the crypto market.

This surge in value can be attributed to several factors, including the restaking boom in Ethereum (ETH) and increased trading of yield tokens related to Ethena’s synthetic Dollar, USDe.

The price growth has also earned the token praise from influential industry figures, with Arthur Hayes expressing admiration for the project and dubbing it the “future of decentralized finance.”

As of the time of writing, PENDLE was trading at $7.18, marking a surge of almost 30% in the last 24 hours.

In essence, it’s essential to recognize that the cryptocurrencies above are still subject to external market forces that extend beyond their mentioned fundamentals.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com