- Litecoin’s price faces downward pressure due to a persistent trend of lower highs, indicating potential correction.

- Bitcoin’s market outlook heavily influences Litecoin’s trajectory, with a possible downturn looming if Bitcoin undergoes correction.

Litecoin ($LTC) has been grappling with a downtrend characterized by a series of lower highs since its 69% crash between November 2021 and February 2022. Despite a slowdown in selling pressure, $LTC has failed to break free from the grip of this descending trend line. The current retest has cleared the $100 hurdle but has yet to breach the overarching trend line resistance.

The course of the Bitcoin market appears to be influencing the future of Litecoin’s pricing. $LTC’s attempt to retest the declining trend line may cause a similar negative movement if Bitcoin transitions from a sideways to a corrective movement. A breakdown of the key $100 level, which may trigger a fall into the $90 support level and represent a nearly 13% decline, is what investors are bracing for.

Despite the looming correction, investors eye a silver lining. In particular, if Bitcoin’s outlook improves, a $90 support level recovery may offer a favorable time to purchase. $LTC might reach $119 in such a situation due to Litecoin’s comeback rally. Litecoin’s recovery rally might propel $LTC toward $119 in such a scenario. In a more bullish scenario, $LTC could aim for a retest of the $150 or even the $200 levels, albeit with a potentially prolonged timeline.

While the short-term outlook for Litecoin remains cautiously optimistic for long-term holders, the pivotal role of Bitcoin cannot be overlooked. A steeper correction in Bitcoin’s price could spell trouble for Litecoin, potentially causing it to breach the $90 support level and plummet further to the next key support level at $75, marking a 16% decline.

Miners Drive Momentum with Accumulation

Litecoin ($LTC) has seen a remarkable surge in its price, reaching an eight-month peak of $106.2 on March 29th. This surge comes amidst significant activity observed among miners and speculative traders, hinting at further gains shortly.

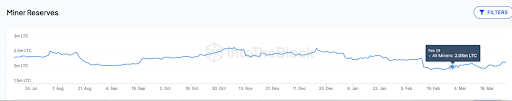

In March 2024, Litecoin miners played a pivotal role in driving the ongoing rally. According to on-chain data trends, miners have accumulated approximately 150,000 $LTC coins, increasing their balances from just over 2 million $LTC in February to 2.2 million $LTC by the end of March. This accumulation, valued at around $16 million at current prices, has significantly reduced the supply of $LTC entering the market. With miners showing confidence in $LTC’s near-term prospects, the trend indicates a bullish sentiment among key stakeholders.

Litecoin ($LTC) price vs. Miners reserves | March 2024 | Source: IntoTheBlock

Speculative Traders Fuel Optimism

In addition to miners, speculative traders have contributed to the positive momentum surrounding Litecoin. Coinalayze’s open interest chart reveals a surge in derivatives contracts, with open interest growing from $337 million to $481 million on March 29th. This substantial increase of $144 million in fresh capital inflows indicates growing optimism among traders. Notably, the growth in open interest has outpaced the 12% price surge witnessed on the same day, suggesting a strong belief among market participants in the sustainability of the upward trend.

While the recent surge in $LTC prices is promising, there are potential challenges ahead. A looming sell-wall at the $130 range, as indicated by IntoTheBlock’s global in/out of money around price data, presents a hurdle for further price advancement. Additionally, bears could regain control if the $LTC price reverses below $90. However, with speculative traders continuing to pour in fresh capital, the likelihood of a significant downturn in the near term seems minimal.