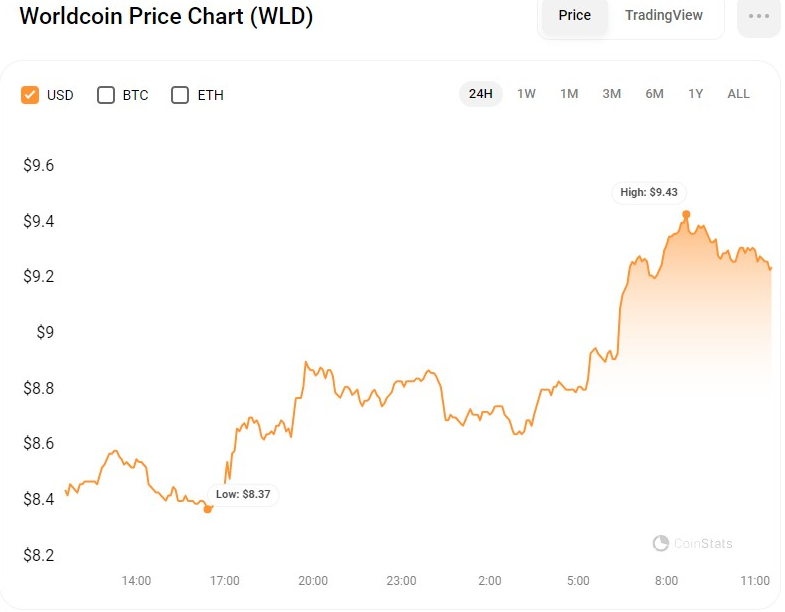

With the launch of its Personal Custody feature, Worldcoin ($WLD) has seen a notable increase in value, surging to a seven-day high in the last 24 hours. During the rally, $WLD’s price swayed between an intra-day high and low of $8.35 and $9.45, respectively. At press time, the bullish momentum was still in control of the market, with $WLD exchanging hands at $9.24, a 9.57% surge from the intra-day low.

This development comes amidst growing privacy concerns and regulatory scrutiny in various countries, including a notable ban in Kenya. The new feature represents a strategic pivot for the cryptocurrency project, focusing on enhancing user control over personal data and addressing the privacy issues that have shadowed its operations.

Worldcoin’s Shift to Personal Custody

Worldcoin’s introduction of Personal Custody marks a significant transition in its approach to user data management. The feature allows users to retain their personal data, including images and metadata used for World ID iris code generation, on their devices.

This move is in response to the increasing demand for privacy and security in the digital age, where data breaches and unauthorized access have become prevalent concerns. By empowering users with full control over their data, Worldcoin aims to foster a more secure and trust-based relationship with its user base.

worldcoin is doubling down on self custody:

— tiago sada (@tiagosada) March 25, 2024

wallet & world id private keys already live locally on people's personal device, and now so will orb data

this gives everyone even more control over how to use it, and of course even to delete it pic.twitter.com/HYDgLR3BxF

The implementation of Personal Custody also enables advanced features like Face Authentication. This feature enhances the security framework of Worldcoin by allowing users to verify their identities through a local, on-device process. This development is not only a step forward in securing user data but also in building a user-centric technology ecosystem that prioritizes individual privacy and autonomy.

Addressing Privacy Concerns

Worldcoin’s decision to cease storing personal data on its servers comes in the wake of various privacy concerns and regulatory challenges across the globe. Notably, the project faced a setback in Kenya, where the government imposed a ban on Worldcoin operations due to safety and data privacy issues. The ban highlighted the critical need for projects like Worldcoin to adopt more stringent data protection measures and ensure compliance with local regulations.

KENYA MAINTAINS WORLDCOIN SUSPENSION – UNSWAYED BY US PRESSURE

— BSCN (@BSCNews) March 22, 2024

– According to local media, Kenyan minister Kithure Kindiki told the nation’s parliament that its ongoing suspension of @Worldcoin $WLD operations would not be lifted.

– This is despite reported pressure from the… https://t.co/EnMP6Ex7eo pic.twitter.com/GIiJHrpgx4

In response to these challenges, Worldcoin has taken a proactive approach by implementing Personal Custody and discontinuing optional Data Custody at orb visits. This move is aimed at reinforcing the project’s commitment to privacy and security, ensuring that users’ personal information remains in their control.

$WLD/USD Technical Analysis

On the WLDUSD 24-hour price chart, the Vortex Indicator, which monitors trend direction, is indicating a strong bullish rally, with the uptrend line (blue) attempting to break above the downtrend line (red). This points to a probable positive turnaround in the near future as buying pressure rises and sellers lose control. This pattern shows that the positive momentum in the $WLD market is gaining traction and may persist in the short run.

The Stochastic RSI has moved from the oversold level to 34.91, supporting the concept of a bullish reversal as momentum turns towards the purchasing side. This pattern is also consistent with the increased volume observed in recent trading sessions, showing more investor interest and engagement in driving the price upward.

Furthermore, $WLD’s trading volume and market capitalization have increased by 10% and 56.31%, to $1,468,358,030 and $434,080,770, respectively, during the rise.

The Relative Volatility Index (RVI), which measures a security’s volatility, has also increased, suggesting that prices would move higher. With the RVI rising above its signal line and a rating of 57.68, an upward breakthrough might be approaching. This might draw more traders eager to profit from the rising trend, driving prices further higher in the short term.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com