The overall mid-term sentiment remains bullish for the cryptocurrency market, despite the short-term bearish pivot, following a market retracement. In this context, a buy signal might surge for cryptocurrencies with strong fundamentals and technical indicators.

A massive liquidation event wiped over $230 million of crypto’s total market cap in one day this week. Thus, short-term cryptocurrency trading suddenly saw a dominating fear taking over while cryptocurrencies tested support levels.

In the meantime, some projects accumulated smaller losses than others, maintaining a strong position and holding their previous gains.

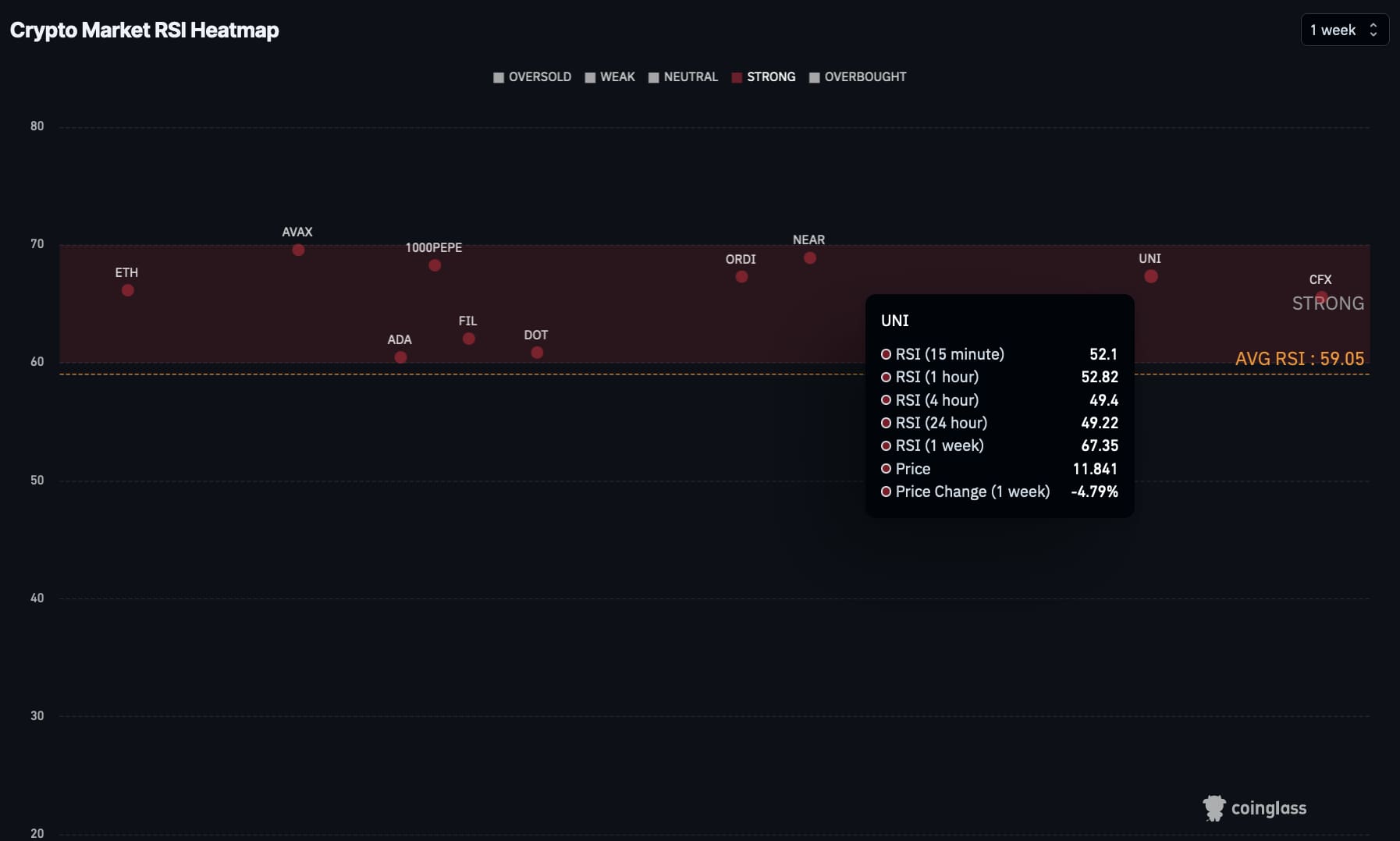

Particularly, Finbold recurred to CoinGlass’s Relative Strength Index (RSI) weekly heatmap and CoinMarketCap’s ranking for potential buy signals to April.

Strong buy signal for Uniswap ($UNI)

First, Uniswap ($UNI) holds a strong weekly RSI of 67.35, significantly above the market’s average of 59.05. $UNI lost 4.79% of its exchange rate in the past seven days, now trading at $11.84. This drove its daily RSI to neutral, registering 49.22 points in this time frame, which could act as support.

Uniswap is the leading decentralized exchange natively built on Ethereum (ETH) but supports multiple EVM chains. An increased demand for its ecosystem could potentially fuel the token’s performance. For example, BlackRock’s recently announced endeavor to create a tokenization fund with a seed investment of $100 million.

Interestingly, $UNI jumped in its market cap ranking with over $7 billion, joining the top 20 most valuable cryptocurrencies.

Near Protocol ($NEAR) shows strength

Meanwhile, Near Protocol ($NEAR) also climbed CoinMarketCap’s ranks, currently at the 19th position with a $7 billion capitalization.

$NEAR is one of the strongest cryptocurrencies in the weekly RSI, with 68.91 index points. Remarkably, this strong position was kept even with 19% losses in the week, trading at $6.67 by press time.

The Near Protocol is a competing layer-1 blockchain for Web3 and DeFi, focused on scalability and a friendly development environment.

However, cryptocurrencies are highly volatile assets and buy signals could find invalidation if circumstances change, despite the strong indicators. Investors must remain cautious and understand the underlying fundamentals of the projects they are investing in.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk

finbold.com

finbold.com