The upcoming Federal Open Market Committee (FOMC) decision might impact the prices of cryptocurrencies. Cryptocurrencies struggled to gather users a few years earlier, but as of writing, they are considered the most used modern payment solutions.

Following the sudden growth of crypto prices, the fear and greed index of the market has crossed the red line in the extreme greed region. However, the index tumbled in the past few hours and reached below 75, termed greed, not extreme greed.

It is crucial to note that the index has reached a level above extreme, and when Bitcoin was trading at $73,500, it was at 90. Fear & Greed index changed every second since Bitcoin hit its all-time high.

As per several market analysts, the upcoming Federal Open Market Committee (FOMC) decision might impact traders and prices. The reason stated is the announcement of interest rates for the second time this year.

The entire market began moving towards bullish territory at the beginning of 2024; in a couple of days, the market cap crossed $2.50 Trillion. Bitcoin is the most prominent cryptocurrency in the market.

Other News

As per a regulatory filing, Fidelity Investments has incorporated a staking feature into their application for an Ethereum (ETH) spot exchange-traded fund (ETF). Although there has been a lot of interest in the industry since the amendment was filed with the US SEC on March 18, observers and market experts have differing opinions.

The SEC has up to ninety days to respond to the modification. The SEC postponed the due date for its decision on the funds over two weeks ago, so May 23 is the formal date for BlackRock and Fidelity to submit their spot Ether ETF applications.

Market Price Update

Bitcoin has established a fresh milestone after it traded at its all-time high; another reason behind the growth is spot ETF approval. When writing, it was trading at $63,150, with a weekly decline of 13.76%.

This week has resulted in market losses of billions. Ethereum, the second most significant and most discussed crypto, fell below $3,200 after trading above $3,900 this month. Despite a massive decline, ETH’s trading has grown 12% in the past 24 hours.

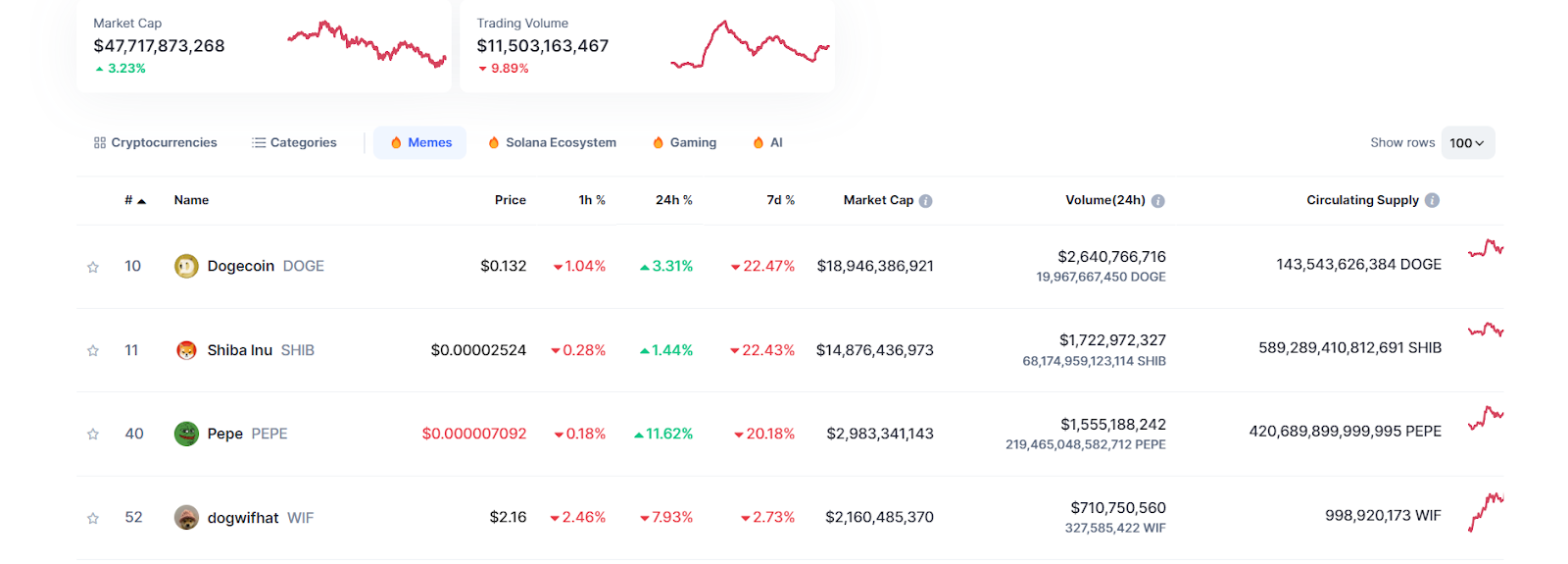

Pepe (PEPE), the most talked about memecoin in the past 365 days, surged 13.75% in the past 24 hours. Optimism (OP) 13.16%, Fetch.ai(FET) 12.23%, Fantom (FTM) 12.11% and Arbitrum (ARB) 11.71%.

The intraday losers list is topped by Avalanche (AVAX) as its price slips 5.77%, Dogwifhat (WIF) 5.38%, OKB (OKB) 3.11%, and Ronin (RON) lost 2.61% of its trading price.

According to CoinMarketCap data, Bonk 2.0 has become the most visited coin in the past seven days, followed by ApeWifHat (APWIFHAT) and OpSec (OPSEC). bitFloki (BFLOKI) is the most recently listed coin, Hectic Turkey (HECT), Imeow (LMEOW), and SLORK (SLORK).

The list of trending cryptocurrencies includes Book of Meme (BOME), Polyhedra Network (ZK), EGO(EGO), Bitcoin(BTC), SingularityDAO(SDAO), Solana(SOL), and Peng (PENG).

Disclaimer

The views and opinions stated by the author or any other person named in this article are for informational purposes only and do not constitute financial, investment, or other advice.

Amanda Shinoy is one of the few women in the space invested knee-deep in crypto. An advocate for increasing the presence of women in crypto, she is known for her accurate technical analysis and price prediction of cryptocurrencies. Readers are often waiting for her opinion about the next rally. She is a finance expert with an MBA in finance. Quitting a corporate job at a leading financial institution, she now engages herself full-time into financial education for the general public.

thecoinrepublic.com

thecoinrepublic.com