Bitcoin’s price recently hit a new all-time high of $73,737. However, it dropped and is now selling for around $62-63K. Altcoin prices have also moved mostly in sync with Bitcoin, so the market for those coins has also slowed down. Even though the market is nervous, big buyers still invest much money into crypto funds.

CoinShares, a European fund manager, says that $2.9 billion came into crypto funds last week, which is a new high. Most of this money goes into Bitcoin ETFs, especially BlackRock’s iShares Bitcoin Trust, which got $2.4 billion in new money.

📈 Crypto investment products maintained their momentum last week, drawing in a substantial $2.9 billion.

— CoinShares (@CoinSharesCo) March 18, 2024

Get the latest insights in our brand new video format, available every Monday, and find all the details in our full report: https://t.co/jaWv5NNvVv pic.twitter.com/f7WnBkfGCv

But Why Is Crypto Crashing?

The approval of 11 spot Bitcoin ETFs by the U.S. Securities and Exchange Commission in January sped up this wave of institutional investment. But not every crypto fund is doing as well as others. $14 million was taken out of funds that had exposure to Ethereum. Money also left funds that had exposure to Solana and Polygon.

As the market deals with doubt, something recently happened on the BitMEX bitcoin futures platform, making things even less stable. Someone unknown sold over 400 BTC quickly on the BitMEX BTC/USDT spot market. This caused Bitcoin’s price to drop quickly to around $8,900 on the exchange.

BitMEX is looking into what happened on its own and has temporarily stopped payments for a few accounts while they do this. Users were informed by the exchange that its trade site was working properly and that all funds were safe.

That’s not all, Farside’s data show that the Grayscale recently withdrew around $642.5 million. Around the same time, money going into Fidelity, the second-largest Bitcoin ETF, dropped to $5.9 million, its lowest day ever.

These events have raised worries about how large-scale Bitcoin ETFs might affect the cryptocurrency network. Arthur Hayes, who used to be CEO of BitMEX, has said that spot Bitcoin ETFs that do too well could “destroy” Bitcoin.

Hayes says that if ETF makers hold a big chunk of all the available Bitcoin, it could lower the number of transactions on the network and make miners less likely to verify transactions. In the worst case, miners might shut down their computers, which could shut down the network.

Other Factors Influencing The Market Downturn

Risking off before the FOMC

The US Federal Reserve is set to announce its long-awaited benchmark interest rates on Wednesday. This comes after two months of Consumer Price Index (CPI) data showing that inflation was still high. Economists think the Fed will keep the interest rate at 5.50 percent and not lower it.

Still, there are a lot of unknowns because Fed members aren’t sure if they should raise interest rates. Because of this, cryptocurrency traders have been lowering the risk of their positions to avoid having to sell their holdings quickly.

Healthy Market Before Cutting

Since spot Bitcoin exchange-traded funds (ETFs) were approved in the US a few months ago, Bitcoin and the cryptocurrency market have made much money. A cooling time was predicted to ensure the market would healthily fix itself.

A well-known crypto expert, Ali Martinez says Bitcoin will probably find strong support at around $61,100 in the next few weeks. The crypto expert thinks the support range between $51,530 and $56,685 will hold during a long-term sell-off.

Additionally, the altcoin market and the joke coin business have recently seen big gains. With the big rise of new joke coins, people had to take their profits, which made the cryptocurrency sell-off even worse.

Who Bled Most?

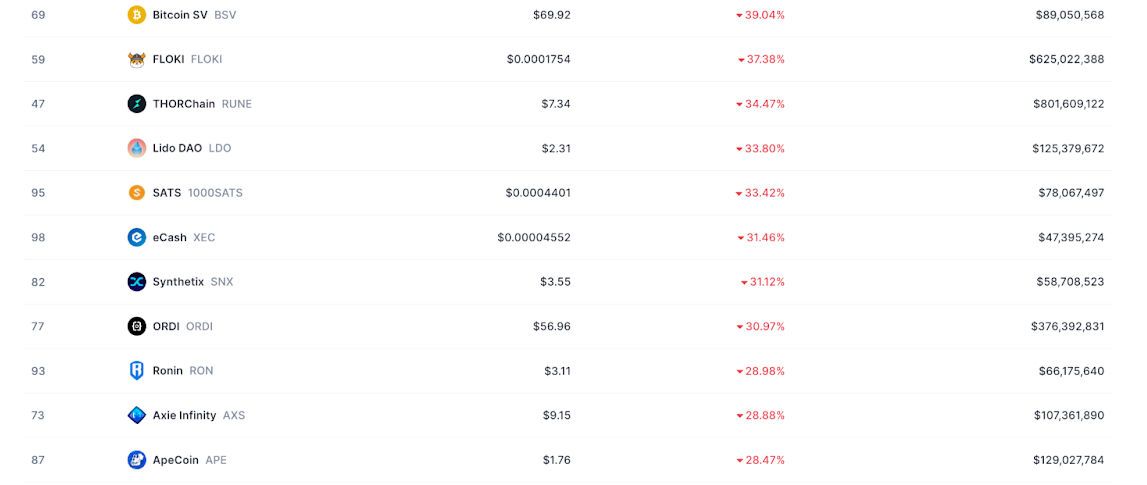

Due to the mentioned events, markets are now experiencing a widespread downturn. Many digital currencies have seen significant price drops over the past seven days. Bitcoin SV (BSV) bled the most as it declined to $69.92, reflecting a 39.04% fall. Similarly, THORChain (RUNE) and Lido DAO (LDO) are trading at $7.34 and $2.31, respectively, with losses of over 30%. Smaller units like FLOKI and 1000SATs also saw a 37.38% reduction and a 33.42% decline respectively.

The market cap of these cryptocurrencies also reveals substantial variance, with THORChain’s reaching approximately $801 million, ranking highest among the listed assets. Meanwhile, Lido DAO’s market cap stands at around $125 million.

The impact of the market dip is further underscored by the downturns in other cryptocurrencies such as eCash (XEC) and Synthetix (SNX), with the former dropping by 31.46% to a value of $0.00004552, and the latter decreasing by 31.12% to $3.55. The market caps for these two are significantly lower, with eCash at nearly $47 million and Synthetix at about $58 million. Other cryptocurrencies like ORDI, Ronin (RON), Axie Infinity (AXS), and ApeCoin (APE) are also facing declines, with their values standing at $56.96, $3.11, $9.15, and $1.76, respectively.

cryptonews.net

cryptonews.net