Anyone who works on web2 will know that the real KPIs of social media engagement lie in engagement, user-generated content, link clicks, and sales conversions. Likes and followers are primarily good for little more than self-serving egotism. In Web3, the on-chain metrics that networks should be concerned with are being augmented with ‘fake’ memecoin traffic, which will fall off the moment the novelty of the shitcoin casino fades away.

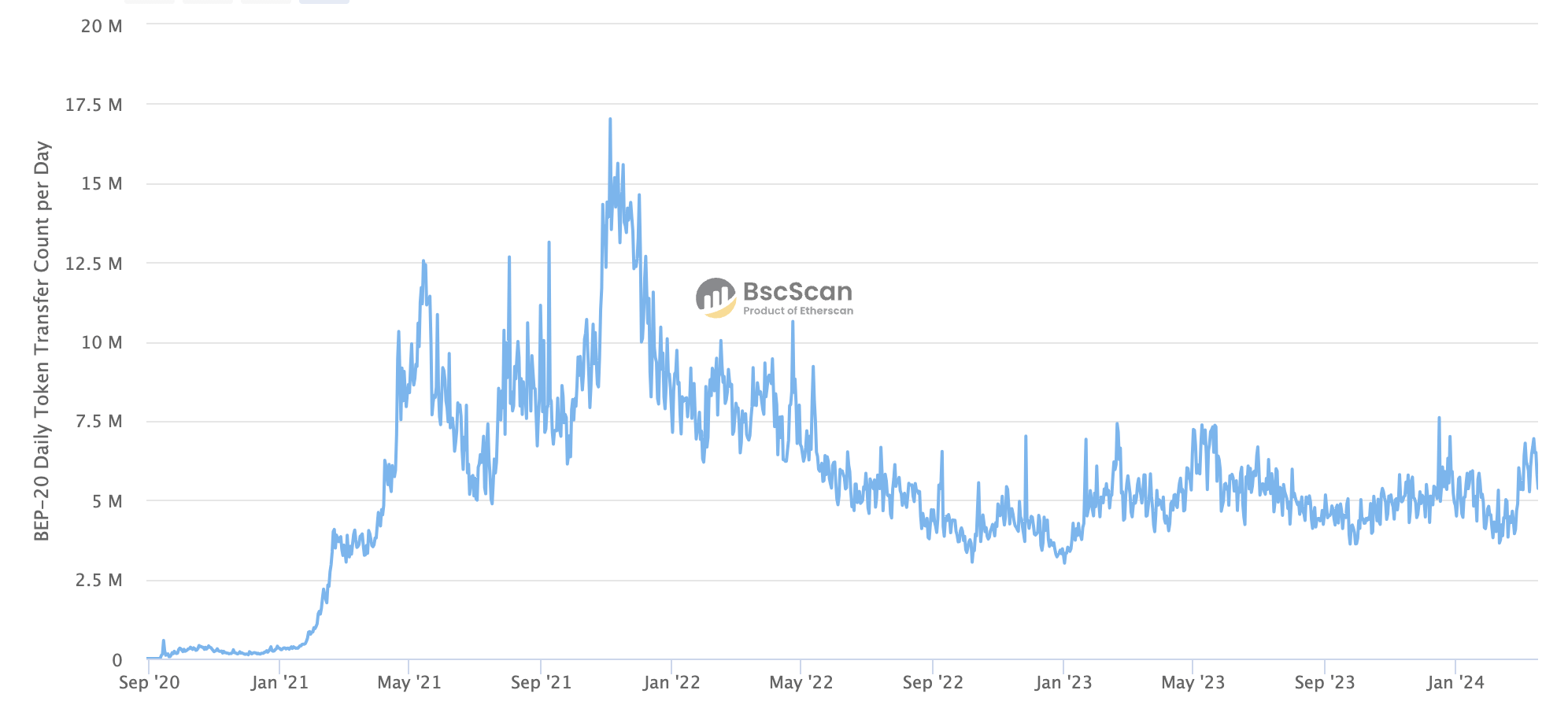

Look at the OG memecoin network, $BNB Chain, which saw a massive surge in usage in 2021 due to memecoin trading on PancakeSwap. It reached around 17 million token transactions per day in 2021 but has since called to around 5 million. Still, 5 million token transfers a day sounds like a healthy metric, right?

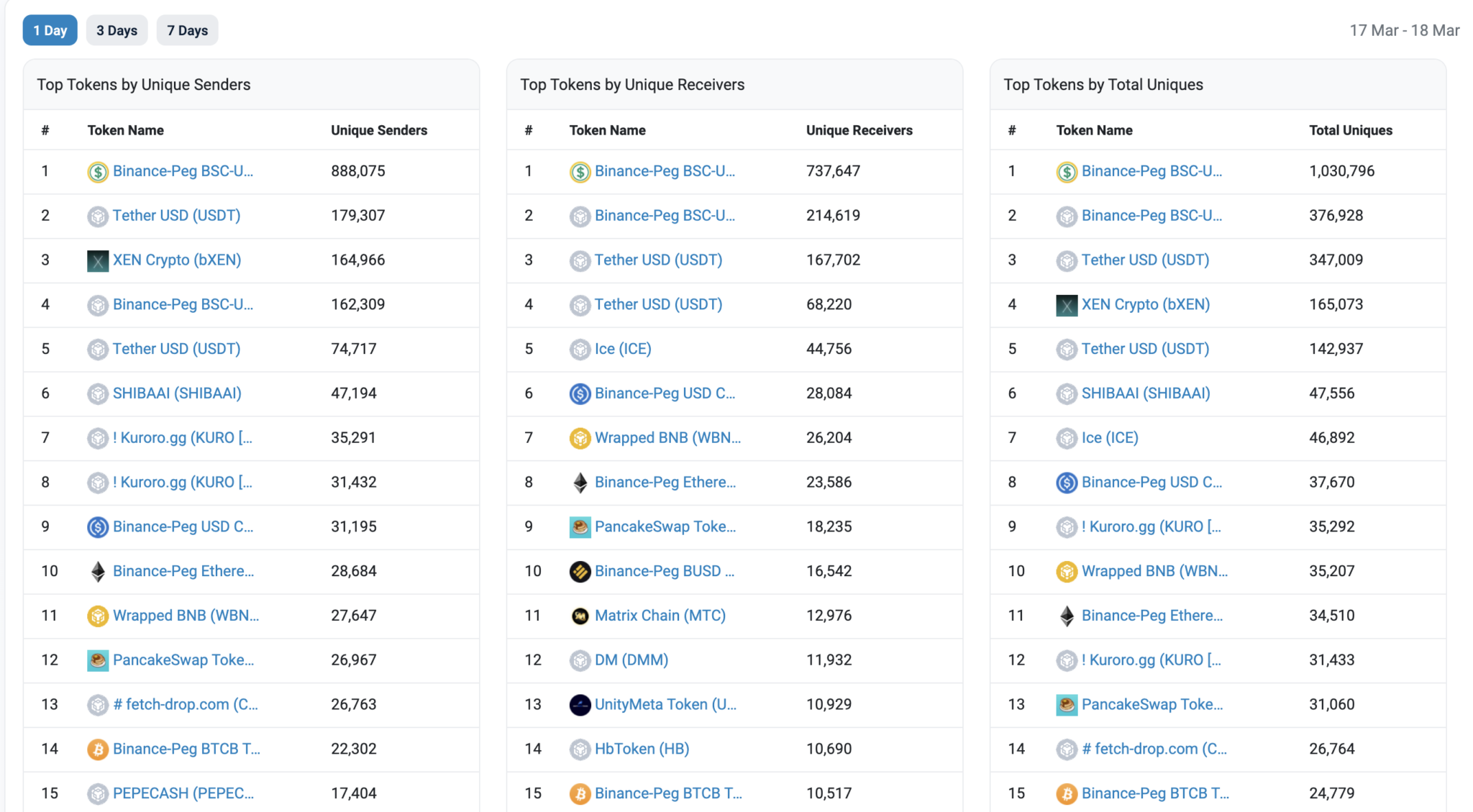

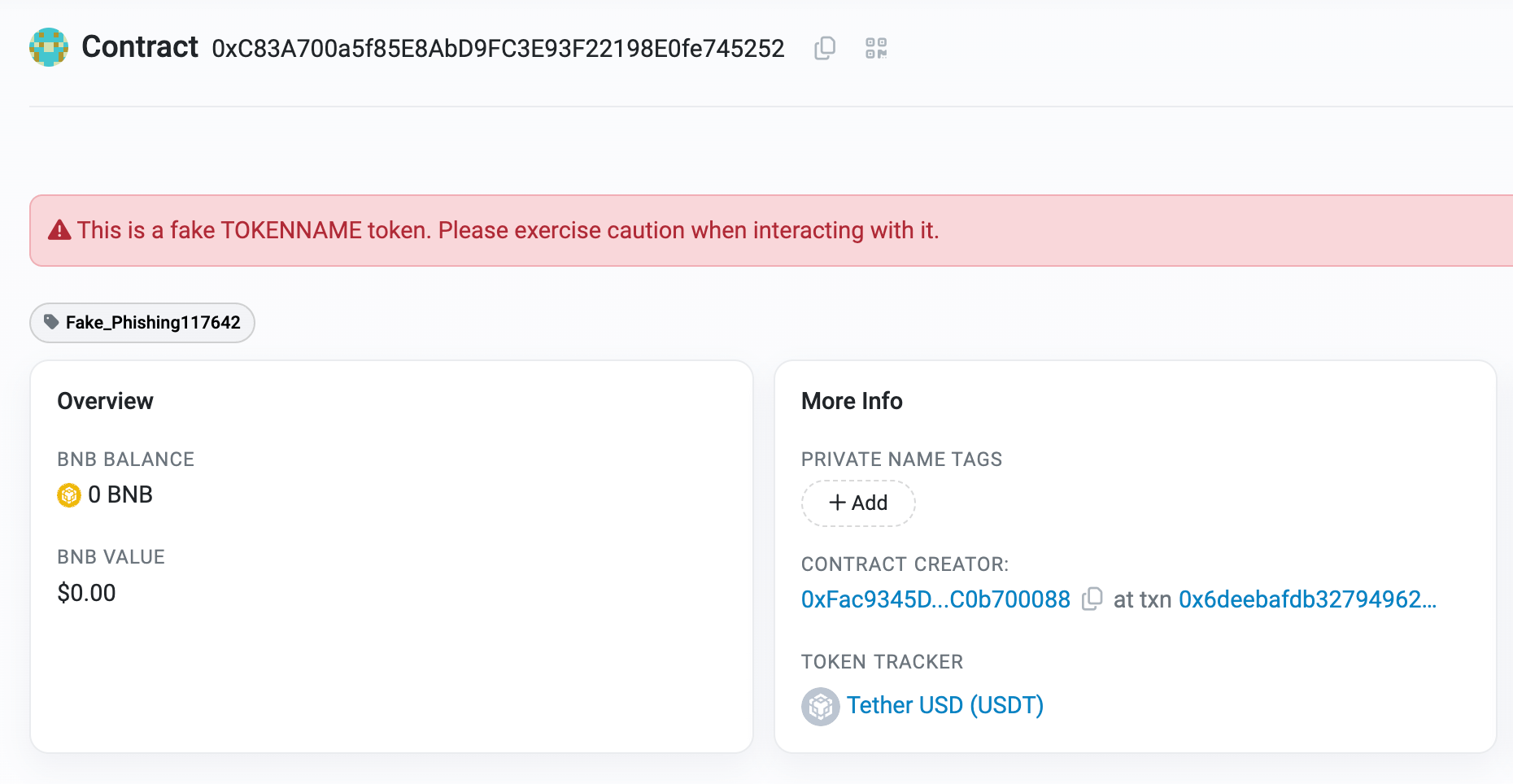

However, when we look at the top tokens being transferred on-chain, we notice that the majority are either memecoins or fake scam tokens, according to BSC Scan.

The majority of tokens in the image above without a logo are scam tokens designed to trick users into trading them to steal funds. For example, the USDT token with 1.2 million unique transfers over the past seven days is not an actual token issued by Tether.

Solana, with its pre-sale memecoin circus saving its failed cellphone launch and Avalanche pumping its ‘community token’ economy by buying tokens for its treasury, may well end up like $BNB Chain with the direction they are going.

I am not against memecoins as a concept, but I do believe they deserve to be treated like the gambling activity they are. In addition, it is likely that Solana and Avalanche will now join $BNB Chain as gambling networks filled with a mix of scam tokens and memes of no material value.

Remember, memecoin trading is essentially Russian roulette, and the goal is not to be the whales’ exit liquidity.

I was an early adopter of Dogecoin back in 2014 when I mined coins using graphics cards from my video production company. At the time, the term ‘memecoin’ wasn’t even a thing, as Doge was the only one in existence. I became a massive fan of the concept as a way to make ‘magic internet money’ that aligned with the online culture of the time. Doge memes were all the rage, and thus, Dogecoin was a fun way to learn about crypto and potentially be a part of a digital medium of exchange for a world still learning how to ‘internet.’

For total transparency, I sold all my Doge for Bitcoin in late 2015 and currently hold a minimal amount for nostalgia’s sake.

However, the current market for memecoins has nothing to do with offering a fun digital currency that could be used to trade online freely. There is no utility to any memecoin other than hoping that the ‘number go up.’ Recently, Bitcoin content creator Layah Heilpern said,

“Meme coins and shitcoins are really out here changing peoples lives. There’s no other industry that lets you go from broke to millionaire over a span of a few weeks or even a few days.”

These are dangerous narratives as they make people think they can change their lives with memecoins. The reality is that most either buy in too late or hold too long. They may be paper millionaires for a moment, but they rarely materialize profits in Bitcoin or fiat terms. Either their conviction in further profits stops them from selling before the market inevitably collapses, or a lack of liquidity hinders their ability to sell.

Cryptoquant founder Ki Young Ju seemingly shares some of my views here commenting today,

“Meme coins harm the crypto industry.

It’s frustrating to see billion-dollar-cap memecoins overshadow hardworking teams building legit products to advance this industry.

Easy money can’t drive industry-wide progress, as shown by the 2018 ICO burst.”

For context, Book of Meme (BOME) reportedly has achieved a $1b market cap, leading to an influx of new traders. However, DEX data showed liquidity of around $64 million when it first reached the milestone. Since then, CEX listings have helped push the trading volume to over $2 billion over the past 24 hours.

Slerf, another Solana pre-sale token, reported that the founder had ‘accidentally’ burned all of the pre-sale tokens along with the LP before it was listed on CEXs and has now had $700 billion in volume today alone and a market cap of $200 million.

The most talked about memecoin of the past month, Dogwifhat ($WIF) categorically states,

“$WIF isn’t just a cryptocurrency; it’s a symbol of progress, for futuristic transactions, a beacon for those who think ahead. It’s clear that the future belongs to those who embrace innovations like $WIF, transcending boundaries & paving a new era in finance and technology.”

However, do not be fooled; unlike Dogecoin 10 years ago, these “symbols” of progress are designed for one thing only, to make someone rich by dumping on retail investors playing the shitcoin casino lottery.

Chains that alter their focus to promote the community aspect of digital assets to foster innovation and engagement bla bla may as well say what they mean, which is

“Web3 has become so noisy that the only way we can get attention is by becoming a casino, but we don’t want to say that so we’ll pretend this is about ‘community.'”

In the words of many a millennial mother, “I’m not mad, I’m just disappointed.” I hold Solana, $BNB Chain, and Avalanche in my portfolio; this is not a short seller report. I simply want to raise awareness about memecoins and peel back the bs about “community.” The only meme community, in my opinion, was Dogecoin, but even the original developers gave up on that.

So let’s just call a spade a spade and admit memecoins are gambling. Then, add the appropriate warnings instead of pretending they represent innovation.

cryptoslate.com

cryptoslate.com