- Bitcoin Cash (BCH) has failed to keep pace with the broader market. In the past week, it has lost 7.3%. With the halving due in three weeks, analysts predict a bigger dip on the horizon.

- BCH miners have been dumping their holdings; since last April, miners have sold close to three million tokens, worth over $1 billion, as they prepare for the price effects of the halving next month.

Bitcoin Cash was one of the biggest projects in the crypto industry—in 2017, at $31.4 billion in market cap, BCH ended the year as the third largest after Bitcoin and Ethereum. However, it has since dropped out of the top ten, and as its halving draws closer, it could dip further.

BCH trades at $411, gaining slightly on the day despite a drastic dip in its trading volume. It has shed over 7% in the past week, losing some of its gains as it skyrocketed in early March to hit a two-year high at $508.

BCH Halving—What Historical Data Says About Price Action

Bitcoin Cash will undergo halving in 19 days on April 4th, slashing its block reward from 6.25 BCH ($2,577) to 3.125 BCH ($1,288). BCH’s halving comes 19 days before Bitcoin undergoes its halving.

Like any other crypto, the halving is one of the most significant events in the BCH ecosystem and always has a massive bearing on its price.

Historical data shows that BCH holders tend to sell off their coins leading up to the halving. One group that is most active with the sell-off is the miners; in the lead-up to the BCH halving of April 2020, miners dumped millions of tokens.

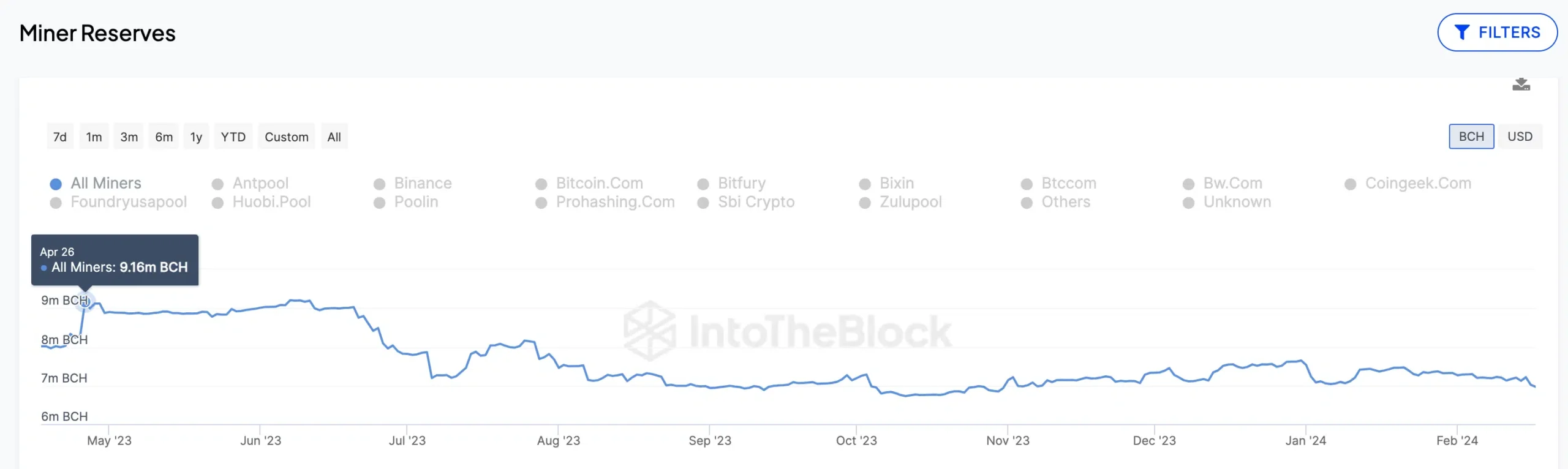

It’s no different this time, as according to data from IntoTheBlock, the major miners and mining pools in the BCH ecosystem have reduced their token holdings from 9.2 million to 6.65 million in the past 11 months. This equates to 30% of their holdings, which is worth $1.1 billion. While some of the sales have been to take profits as Bitcoin Cash hit two-year highs, historical data shows that miners sell their tokens in preparation for the halving.

This trend tends to reverse post-halving. This is because once the reward is slashed, several miners become unprofitable and exit the ecosystem. In response, the network adjusts its mining difficulty to reflect the existing miners, and with the difficulty reduced, the profitability shoots up.

In 2020, miners increased their BCH holdings by 2.7 million tokens between the halving date in April and November. This was reflected in the price, which surged by 480% within six months after the halving.

This trend is expected to recur, and while the dumping could suppress the BCH price severely as we head to the halving, the market is expected to reverse the downtrend in the months following the halving.

The direction of the Bitcoin Cash price will also partly depend on what happens to Bitcoin (BTC) post-halving, as, for years, the two have been directly correlated, as Crypto News Flash has observed in the past.