The latest Ethereum upgrade – code-named Dencun – was a success.

That in itself is cause for celebration. The Ethereum software is large and complex, and the fact that the developers continue to roll out new code, with minimal downtime and drama, is a major technical victory.

If you try to understand what Dencun actually does, you’ll fall down the rabbit hole of confusing technical terms like “Proto-Danksharding” and “data blobs,” which sound like they escaped from a cyberpunk novel.

As usual, I’ll simplify it for you.

The Ethereum Dencun upgrade will help lower the cost of transaction fees on Ethereum – specifically, on Layer 2s. [Read our investing guide to L2s here.]

This is great for Ethereum investors, but not so great for L2 investors. Here’s why.

Great for ETH Investors

If you’re invested in ETH (as I am), this latest upgrade is part of the long-term roadmap for Ethereum.

As an investor, it is encouraging that Ethereum has a long-term roadmap, and even more encouraging that they are executing against it.

When I think of Warren Buffett’s exhortation to look for “wonderful companies run by capable managers,” I think that Ethereum is the poster child for that kind of “company,” but in crypto.

However, Ethereum is not perfect. One of its biggest fails is the exorbitantly high transaction fees.

Crypto was supposed to free us from fees, but it’s clear to me that’s never gonna happen: in fact, while you might pay $2 to get cash from an ATM, you might pay $3 to make an Ethereum transaction. Or you might pay $30. The more clogged the network, the higher the fees.

Layer-2 solutions like Arbitrum (ARB) and Optimism (OP) have created technology to allow you to transact on Ethereum more cheaply. This has driven the price of their tokens to sky-high valuations, as these L2 solutions catch on.

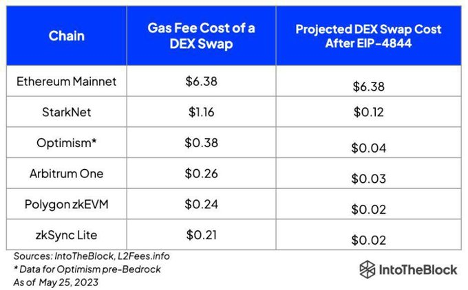

Because the Dencun upgrade lowers the price of transactions on these L2s, the net effect is positive for Ethereum. It means more people will be able to make more transactions on Ethereum, more cheaply:

This means we may soon have more applications and more use cases for Ethereum, since fees are cheaper. More games. More NFTs. More RWAs (Real World Assets) on chain.

Anything that makes Ethereum more accessible and more user-friendly is a good thing for ETH investors. It cements Ethereum’s lead as the primary Layer-1 blockchain.

Take Solana (SOL), another blockchain which primarily competes on lower fees. If Ethereum finds a way to lower its fees, why would new developers choose Solana over Ethereum?

If Ethereum has the most developers, the most dApps, the largest community, the best team, and low fees, then why would people go anywhere else?

Anything that improves the Ethereum experience is not just good for Ethereum, it’s good for long-term ETH investors. Dencun just increases Ethereum’s already massive lead over other L1 blockchains.

Not so Great for Layer-2 Investors

Think of L2s like gas stations.

All gas stations sell the same product: gas. So we all look for who sells it the cheapest. Maybe one gas station has a bigger convenience store, or it’s slightly closer to our house, so we’ll pay a few pennies extra, but generally we just want the cheapest gas.

Layer-2s, because they’re all offering a similar product, are gas stations. (We even call Ethereum transaction fees “gas.”)

Since the Dencun upgrade lowers gas prices across L2s, it makes the gas stations more important, but it does not benefit any specific gas station.

It’s the equivalent of crude oil prices going down, which lowers gas prices for everyone.

This is why I have not invested in any L2 to date: I can’t see why anyone would choose Arbitrum over Optimism for their Ethereum transactions.

In fact, I can see a future where user-friendly applications simply route your Ethereum transaction across the L2 that’s currently offering the lowest gas prices. This will be invisible to the user: you won’t even know which L2 you’re using.

Note: this could change.

L2s could find a way to compete, perhaps by specializing in specific use cases like gaming or finance. They could create better developer tools, or a stronger community. (Some gas stations supposedly offer “cleaner gasoline,” or slightly cleaner restrooms.)

But for most L2s investors, the Dencun upgrade is a “race to zero” for fees. And the lower the fees, the harder it will be for these L2s to make a “profit.” That’s a bad business model.

I’d much rather invest in Apple, with its ridiculously overpriced products and unreasonably high profit margins, than a gas station.

For the most part, gas stations are a race to the bottom. Layer-2 tokens are gas stations.

Investor Takeaway

I don’t mean to say that Layer-2s are bad. We need them!

But we need them as a solution for Ethereum’s fundamental problem: high transaction fees.

Maybe one Layer-2 will become the winner over time, due to network effects. Maybe we’ll have a handful of L2s that will take over most of the market, specializing in various use cases or with different sets of developer tools.

Or maybe Ethereum just continues to improve its technology so we don’t need Layer-2s at all.

It’s way too early to tell. And that makes L2 tokens, in my view, a very bad bet.

But it makes ETH one of the best bets of all.

Health, wealth, and happiness,

John Hargrave

Publisher, Bitcoin Market Journal

bitcoinmarketjournal.com

bitcoinmarketjournal.com