In the dynamic world of cryptocurrency trading, navigating all the different digital assets can be a challenging task, particularly as thousands of altcoins are vying for attention and it is difficult to ignore the noise to focus on those that represent the most promising investments.

With this in mind, seasoned crypto expert Michaël van de Poppe has offered a couple of strong examples of what an optimal beginner’s $1,000 altcoin portfolio should comprise, uncovering valuable lessons and potential opportunities for both novice and experienced investors in the crypto sector.

Choosing top altcoins to buy

As van de Poppe explained, crafting an ideal altcoin portfolio includes deciding on two crypto segments at maximum and choosing between eight and ten altcoins, or ideally, a maximum of four altcoins per segment. Out of those four, two should be big allocations and two small allocations.

Specifically, the two big allocations should come from the top five altcoins in the particular segment, whereas the two small allocations should be altcoins from outside the top five – that would mean four big allocations and four small allocations. According to the crypto trading expert:

“For a portfolio, my suggestion would be the big allocations between 15% and 20% per allocation and the small allocations between 5% and 10%, which means you’re going to get to 100%, and if you want to keep like 1% to 3% into micro-gems, you can do it – those are sub-$100 million, and should be the micro caps.”

Best altcoins to buy now

For example, van de Poppe has offered two scenarios and picked out the specific categories and altcoins he would choose if he were making his first $1,000 altcoin portfolio, with different allocations for those assets depending on the particular scenario.

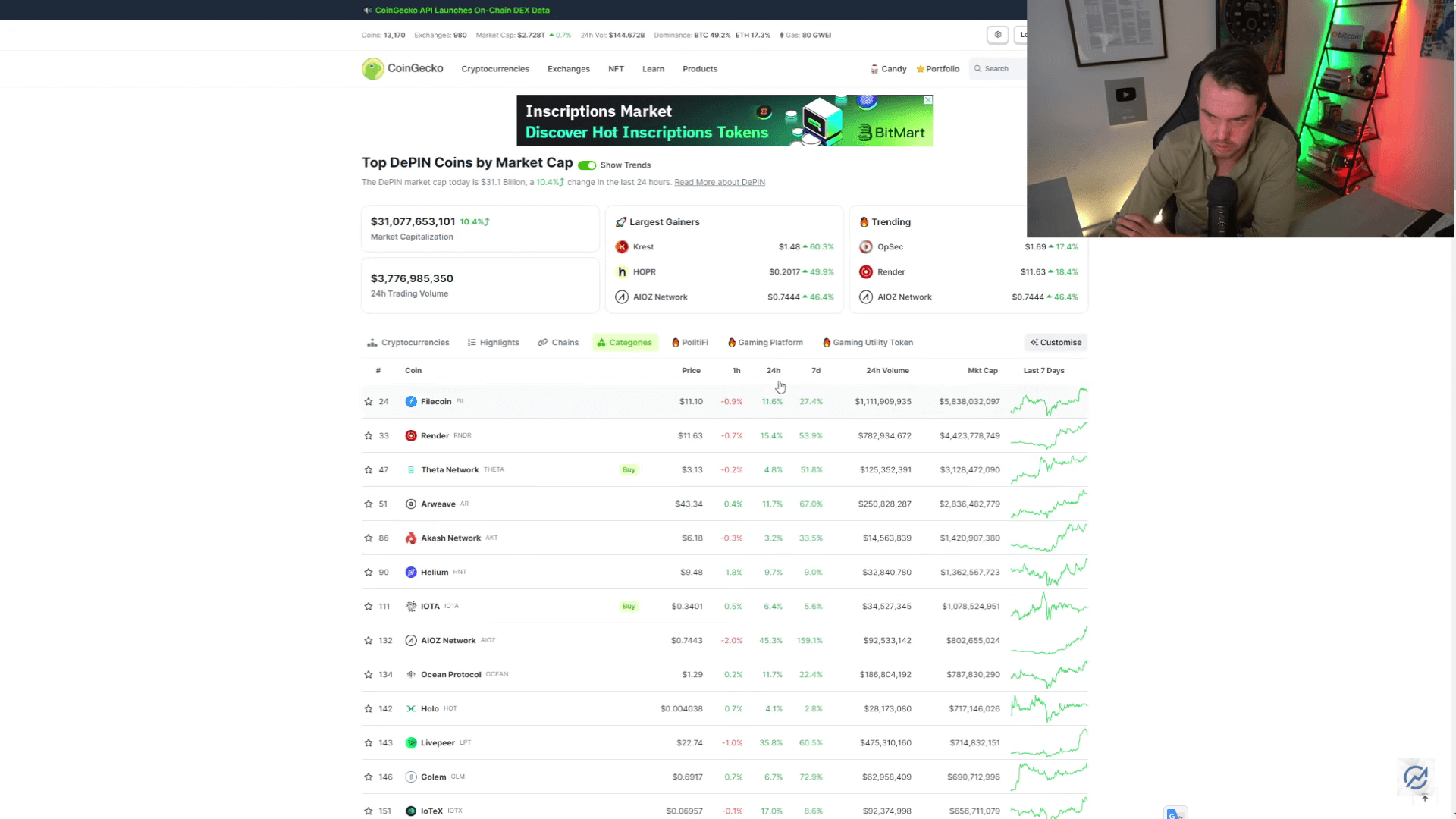

In the first scenario, he picked the DePIN (decentralized physical infrastructure networks) for the primary and Layer 2 altcoins for the second category.

From the DePIN category, the expert chose two top altcoins – Filecoin (FIL) and Akash Network (AKT) – and allocated 15% of the portfolio to each, as well as took two ‘outsiders’ – Ocean Protocol (OCEAN) or IOTA (MIOTA) and Golem (GLM) or IoTeX (IOTX) with 10% each.

As for the Layer 2 category, van de Poppe picked out Polygon (MATIC) and Arbitrum (ARB) from the top five to assign 15% of the portfolio to each, respectively, as well as deciding on SKALE (SKL) and Cartesi (CTSI) as altcoins outside of the top five to allocate 10% to each of them.

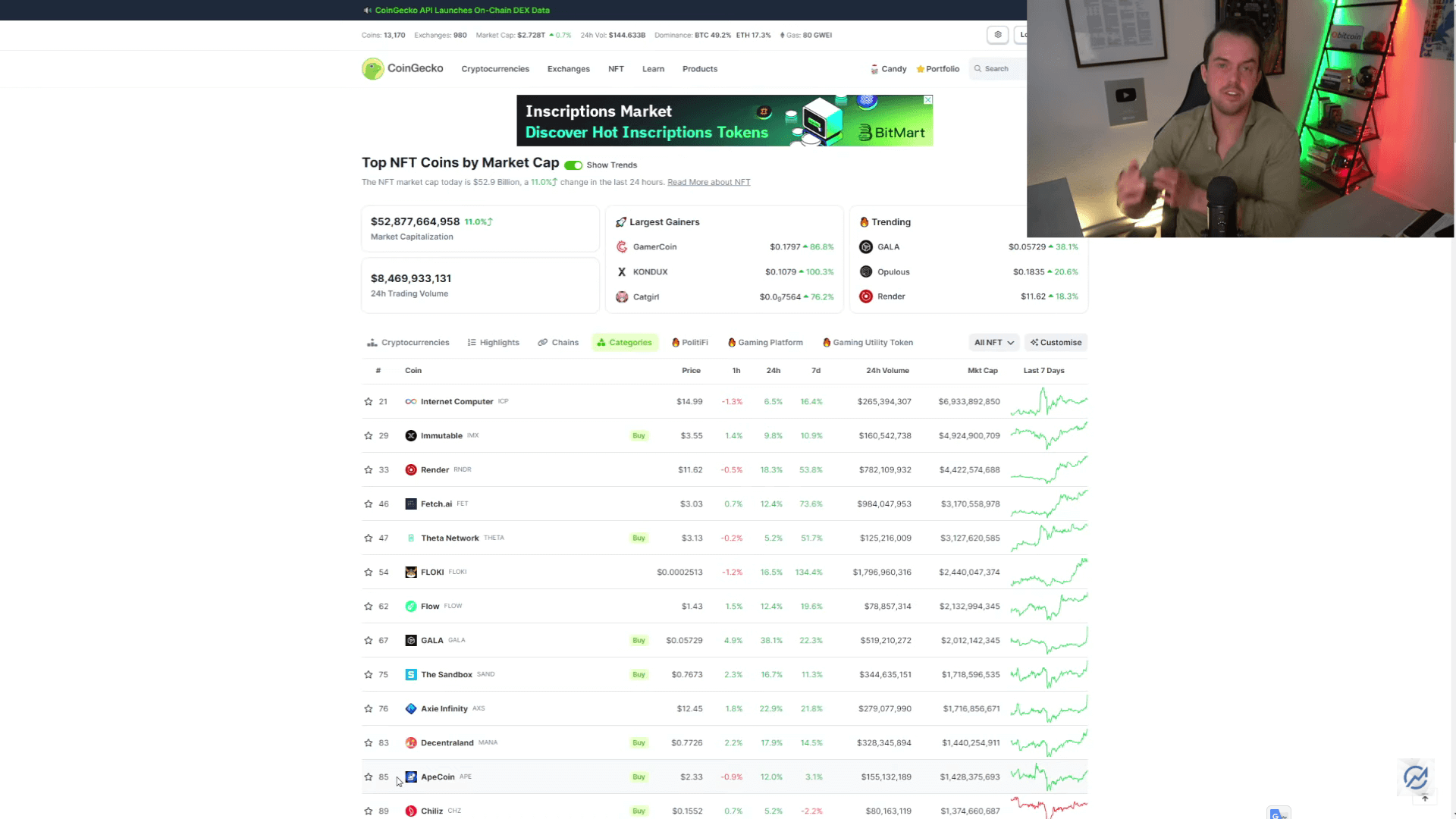

His second scenario focuses on slightly different allocation percentages, this time choosing the metaverse and non-fungible token (NFT) categories.

Specifically, the professional crypto trader chose Sandbox (SAND) and Axie Infinity (AXS) from the metaverse category to receive 20% each, with Vulcan Forged (PYR), the native token of the eponymous game studio, and Magic (MAGIC), the utility token of the Treasure Metaverse, only getting 5% each.

At the same time, the NFT category got 20% each for Internet Computer (ICP) and ImmutableX (IMX), while Decentraland (MANA) and ApeCoin (APE) received an allocation of 5% each, as the best altcoins to buy outside of the top five range.

Conclusion

All things considered, the above-listed investment picks could be excellent purchase choices for a beginner building a $1,000 altcoin portfolio. However, it is important to carry out one’s own research and not rely blindly on anyone’s recommendations, as the situation in this sector can change.

Watch the entire video below:

finbold.com

finbold.com