- Aptos network will unleash 24.84 million tokens to the market on March 13.

- The unlock represents 6.7% of Aptos’ circulating supply worth $334.13 million.

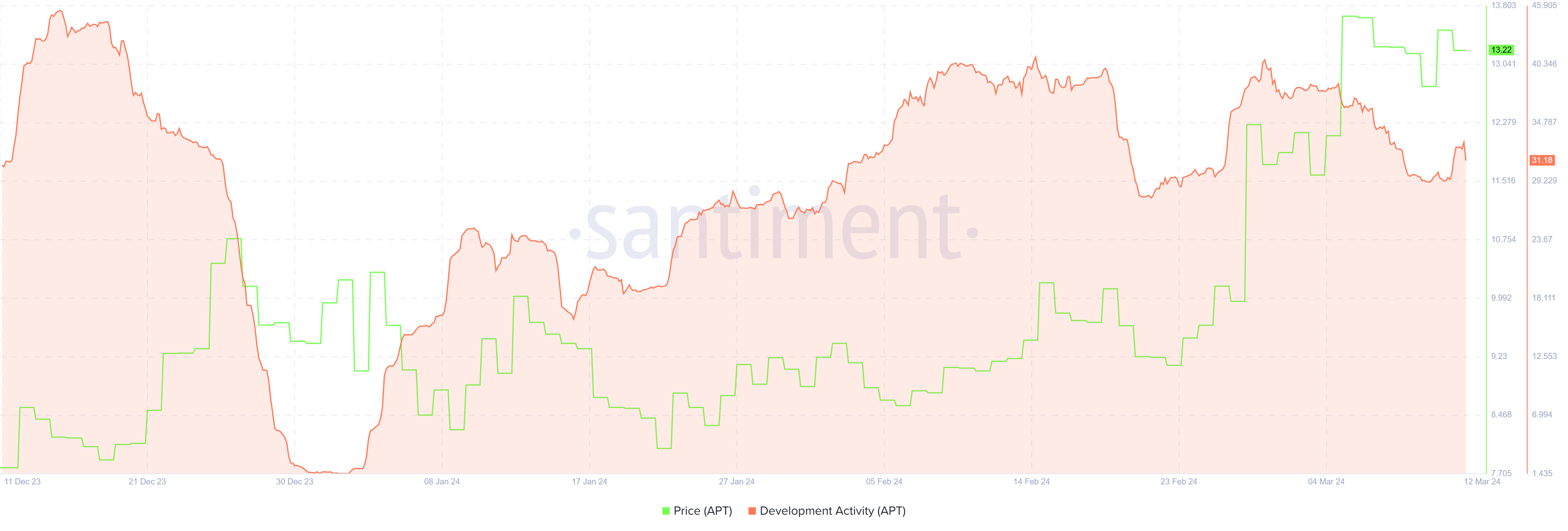

- Divergence seen in the development activity metric against price suggests a bearish outlook for the L2 token.

Aptos (APT) price suffered rejection from the peak of the market range at $14.55 on March 6, what came on the back of a broader market dump could become worse as the network readies for massive unlocks event.

Aptos to unlock 24.84 million tokens

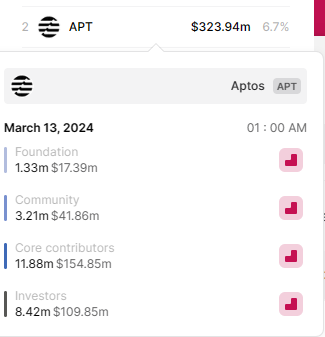

The Aptos ecosystem will offload 24.84 million APT tokens on March 13. Worth $334.13 million at current rates, the tokens will constitute 6.73% of the Aptos ecosystem’s circulating supply. Token allocations will go to core contributors, investors, the foundation and the community.

Most of these recipients are likely to cash in for early profit. Core contributors will receive the lion’s share of the allocations, followed by investors, at 11.88 million and 8.42 million APT tokens respectively.

APT Unlocks

Meanwhile, Aptos price is sitting on support due to the 78.6% Fibonacci retracement level at $12.79 in a market range measured from $6.32 to $14.55. Technical indicators suggest a further downside, as momentum. This is shown with the nose-diving Relative Strength Index (RSI). The histogram bars of the Awesome Oscillator (AO) and the volume indicators are also flashing red, to show the bears are gaining ground.

If they have their way, Aptos price could drop, slipping below the immediate support at $12.79 before testing the most crucial Fibonacci retracement level of 61.8% at $11.41. In a dire case, the slump could extrapolate to the midpoint of the market range at $10.44. A break and close below this level would invalidate the big-picture bullish outlook.

APT/USDT 1-day chart

Onchain metrics supporting bearish outlook for Aptos price

Multiple on-chain metrics accentuate the bearish thesis for Aptos price, presented by the bearish divergences between development activity and price, as well as volume and price.

A drop in development activity relative to Aptos price between March 5 and 12 tilts the odds in favor of the downside, with the same outlook displayed by the volume indicator

APT Santiment: Price, development activity

On the flipside, if traders leverage the $12.79 level as a buying area, Aptos price could push north, potentially going as high as to fill the market range.

fxstreet.com

fxstreet.com