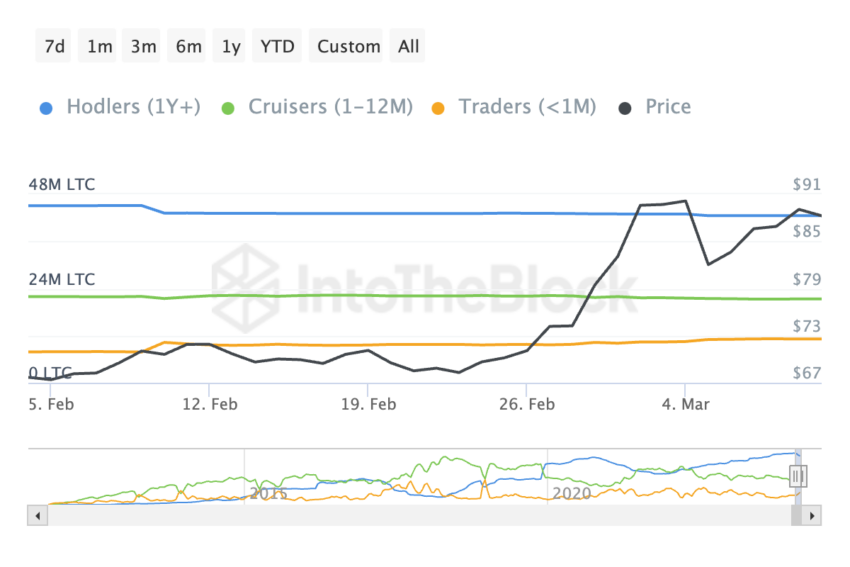

The landscape of Litecoin has witnessed a notable shift since early February, with the trader demographic (those holding for less than a month) expanding their presence from 7.84 million $LTC to an impressive 11.13 million $LTC.

However, long-term $LTC holding decreased during that period. $LTC price recently jumped 40% in one day. Analyzing the metrics is important to know if this uptrend can continue.

Litecoin Traders Are on the Rise

Analyzing how long users are holding $LTC reveals a surge in short-term traders. These are users who hold $LTC for less than a month. The number of coins they hold jumped from 7.84 million $LTC to a whopping 11.13 million $LTC. That’s a significant increase of 41.96% in just one month.

However, this rise in short-term holders comes at a cost. The number of long-term holders, also known as Hodlers (those holding for more than a month), is going down. Their $LTC stash went from 45 million all the way down to 42.5 million.

This trend of more short-term traders and fewer long-term holders could have two consequences for $LTC’s price. First, it might lead to more volatility. Short-term traders tend to buy and sell more frequently, which can cause price swings.

Second, the decrease in Hodlers could be a sign that long-term users are losing confidence in $LTC. This could put downward pressure on the price.

$LTC RSI Just Reached Overbought State

For $LTC, a notable movement in RSI over a 7-day period from 48 to 71 reveals much about its market dynamics and potential future price movements.

The Relative Strength Index (RSI) measures whether an asset is overbought or oversold. It measures the momentum of price movements by comparing the size of recent gains to recent losses. The RSI is displayed as a value between 0 and 100. Generally, an RSI above 70 indicates an overbought condition, suggesting the price may be due for a decline. Conversely, an RSI below 30 suggests may be oversold and primed for a potential upswing.

Such a shift in the RSI signals a robust increase in buying pressure for Litecoin, underscoring a significant uptick in investor interest and market activity. This jump past the overbought threshold of 70 suggests some critical implications for $LTC’s short-term price trajectory.

The asset may be entering an overvalued phase, hinting at a possible impending price correction. This scenario often unfolds as investors begin to take profits, leading to a sell-off that might temper $LTC price ascent.

$LTC Price Prediction: EMA Lines Are Sending Important Signals

A review of the Litecoin ($LTC) price chart before the recent 40% price increase reveals an interesting scenario. The 200-day Exponential Moving Average (EMA) line was positioned demonstrably lower than the short-term EMA lines and the current price. This specific technical configuration, often interpreted as a bullish signal, coincided with a rapid price appreciation of $LTC from $86 to $105 within a single trading day.

That configuration remains true in the more recent timeframe. The long-term 200-day EMA line is still below the shorter-term EMA lines and the current price. This technical indicator, historically interpreted as a bullish signal, suggests a potential uptrend for $LTC in the near future.

Given the number of short-term traders and the EMA lines, we could see $LTC nearing $105 soon, although the RSI above 71 should always bring caution. However, if the trend changes and $LTC can’t keep building its momentum, it could go as down as $72, its next strong support zone.

If the $LTC price fails to find support at the established levels of $93 and $87, a further decline toward $70 could be anticipated. Conversely, a decisive break above the $100 resistance level could lead to a renewed price increase, potentially reaching $105 again in the short term.

beincrypto.com

beincrypto.com