The recent market behavior of Bitcoin Cash (BCH) provides a textbook case study of investor sentiment and whale activity dictating the short-to-mid-term price directions. A stark increase in large transaction volumes and a significant downturn in weighted sentiment present a bearish outlook for BCH.

BCH surged 73.53% in the past month. However, whales’ movement and market sentiment could indicate imminent correction.

Surge in Bitcoin Cash Large Transactions: A Red Flag?

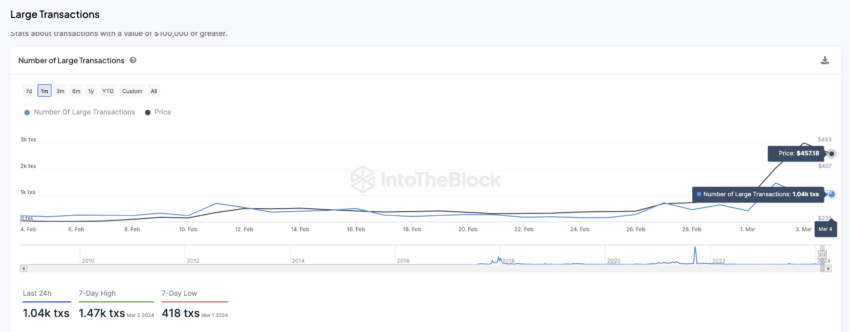

The recent data on Bitcoin Cash (BCH) has highlighted a striking rise in large transactions, those exceeding $100,000, jumping from 418 to 1,004 between March 1 and March 3. This uptrend continued with a notable peak on March 2, when BCH saw 1,470 large transactions, the highest since late December 2023.

Traditionally, an increase in large transactions is viewed by seasoned investors as a bullish sign. It suggests a growing confidence among large-scale traders and investors, which can enhance market liquidity and facilitate better order execution.

However, the current surge in BCH large transactions invites a more nuanced interpretation. Despite the typical bullish outlook, there’s a historical context to consider that might hint at an upcoming market correction.

For instance, the last two spikes in large transactions have led to downturns. A notable example occurred between December 30 and January 5; following a similar increase in Large Transactions, BCH’s price fell by 13%, from $270 to $235.

This pattern suggests that large transaction surges indicate high activity but can also precede volatility or corrections. Investors might see this as a cautionary signal, advising a more guarded approach to market participation.

Bitcoin Cash Has Been Attracting Negative Comments Recently

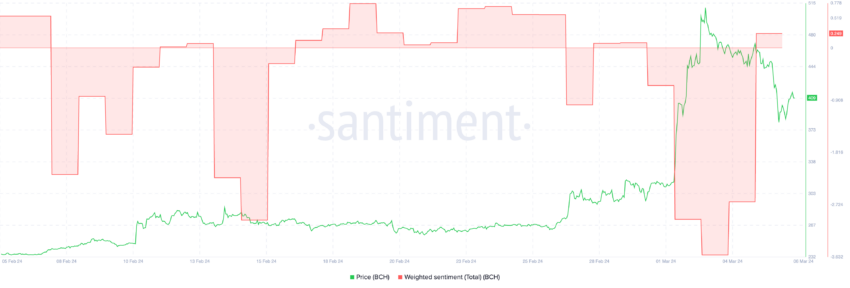

Between February 29 and March 4, the sentiment towards BCH on various social media platforms has predominantly been negative, culminating in its most significant negative sentiment value of -3.59 on March 4. This marks the lowest sentiment level observed since January 12.

What makes this particularly noteworthy is that this period of negativity coincides with a significant price surge for Bitcoin Cash. Specifically, from February 29 to March 4, the price of Bitcoin Cash escalated from $292 to $518, registering an impressive growth rate of 77.4%. This rise occurred despite the overarching negative trend highlighted by the Weighted Sentiment metric.

The Weighted Sentiment metric is designed to meticulously evaluate the current mood and general sentiment prevailing within a particular cryptocurrency ecosystem. This is accomplished by comparing the number of positive comments about Bitcoin Cash and the aggregate number of negative mentions it receives.

Despite observing a shift towards a positive sentiment value in the recent period, this alone may not suffice to sustain or support the price of BCH. This observation becomes particularly pertinent considering the significant surge in BCH’s price over the last few days. Remarkably, this price increase occurred despite the predominantly negative sentiment that had been characterizing the ecosystem.

BCH Price Prediction: Will the $400 Support be Enough?

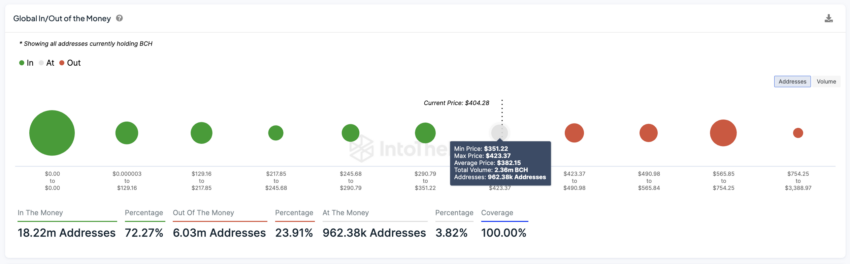

The Global In/Out of the Money (GIOM) metric for Bitcoin Cash shows us that many addresses, specifically 962,380, are “At The Money,” meaning they purchased BCH around the current price range.

This often indicates that there is a potential resistance level; if the price starts to rise, these holders might look to sell to break even on their investment, which could increase selling pressure and cap any upward movement.

The BCH price has support between $290 and $350. If current holders cannot keep Bitcoin Cash above $400, this could potentially drop to at least $350, which would mean a 13.5% drop from its current price of $405.

On the other hand, Bitcoin Cash price resistance is at $420, with addresses holding between $420 to $490. If holders can keep the support and break the resistance, this could mean a new price surge for BCH.

Additionally, new positive market information or broader bullish sentiment could encourage more buying, increasing the price. If the price were to move above the $420 resistance level and maintain its position, this could shift the sentiment and potentially invalidate the bearish thesis, as those who are “Out of the Money” may hold on for recovery, reducing selling pressure.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

beincrypto.com

beincrypto.com