By analyzing the data from the $REKT database, a recent study by the company “Smart Betting Guide” has found that in the past year, crypto scams in the gaming and metaverse sectors have reached a record amount of 43.7 million dollars.

The alarm is raised for users of cryptographic spaces, who must increasingly face scam attempts such as phishing, fake smart contracts, exploits, and much more.

However, despite the phenomenon appearing to be on the rise, in 2023 the total number of hacks took away from the crypto market a lower value of assets compared to 2022.

This data marks an important trend reversal, with the exception of the category of cross-chain bridges that amplify the technical vulnerabilities of some operations that occur on blockchains.

All the details below.

Summary

Gaming and metaverse: thefts and crypto scams worth 43.7 million dollars in 2023

The company “Smart Bettin Guide” in a recent study, conducted by analyzing the data present on the $REKT database, highlighted alarming numbers regarding crypto scams operating in the gaming and metaverse sectors.

In 2023, cybercriminals have stolen various decentralized protocols belonging to these market niches for a total value of approximately 43.7 million dollars.

The figure itself represents just 2.5% of all the money lost by users in the crypto world in the past year due to hacks and exploits of various kinds, amounting to 1.64 billion dollars, but it highlights the advancement of increasingly sophisticated fraudulent practices by malicious actors.

Gaming and metaverse represent the sixth most targeted category in 2023, after cross-chain bridges, CeFi platforms, lending protocols on Polygon, Binance’s decentralized network, and DEX on Ethereum.

Especially in the field of cryptographic games and virtual worlds, traps for less experienced users are becoming increasingly clever, sometimes accompanied by AI technology, making it difficult to distinguish them from what is truly legit.

Sometimes scammers try to establish a relationship with the victim, with the intention of creating a “fake friendship” and lowering defensive barriers. Once the goal is reached, scammers use various means to extract valuable data and money from users’ pockets.

Going into specifics, the vulnerabilities reported by $REKT in this context range from theft attempts through phishing, to fake virtual exchanges within the metaverse, NFT scams, up to the use of malicious smart contracts.

Companies like GameStop, Microsoft, and Best Buy are concerned about the increasingly frequent theft of digital assets within gaming platforms because they primarily offer the possibility to pay for games in cryptocurrencies and could be the next target of hackers.

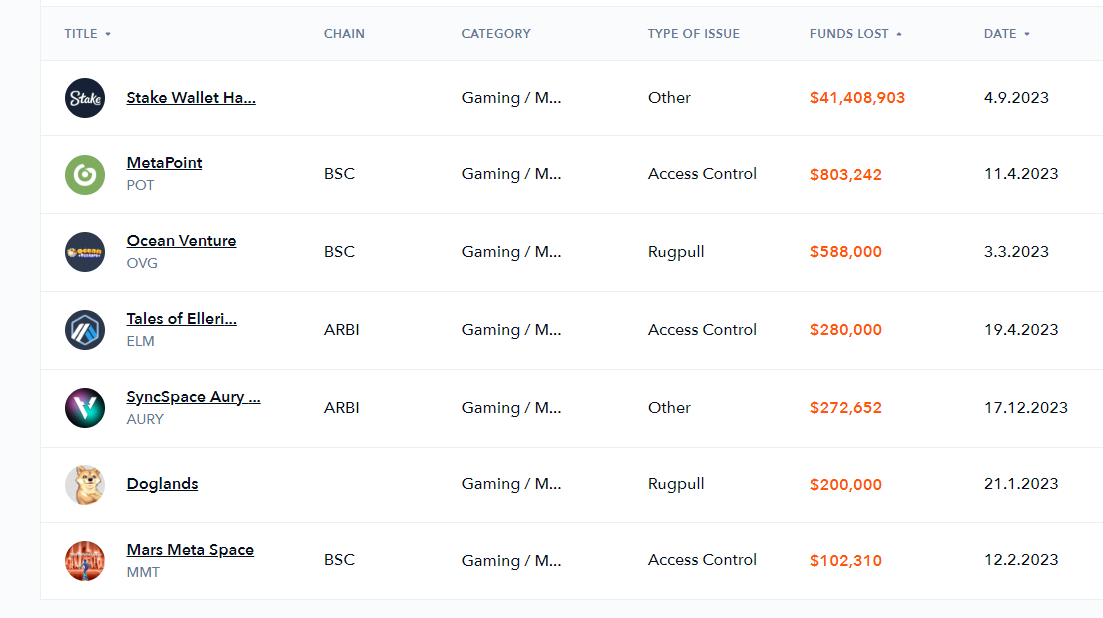

The gaming/metaverse projects most affected in 2023 according to $REKT data are Stake Wallet, MetaPoint, Ocean Venture, Tales of Elleria, Syncspace Aury, Doglands, and Mars Meta Space.

Computer security experts suggest keeping a close eye during this time of year, which historically proves to be one of the most lucrative for hackers in the crypto world.

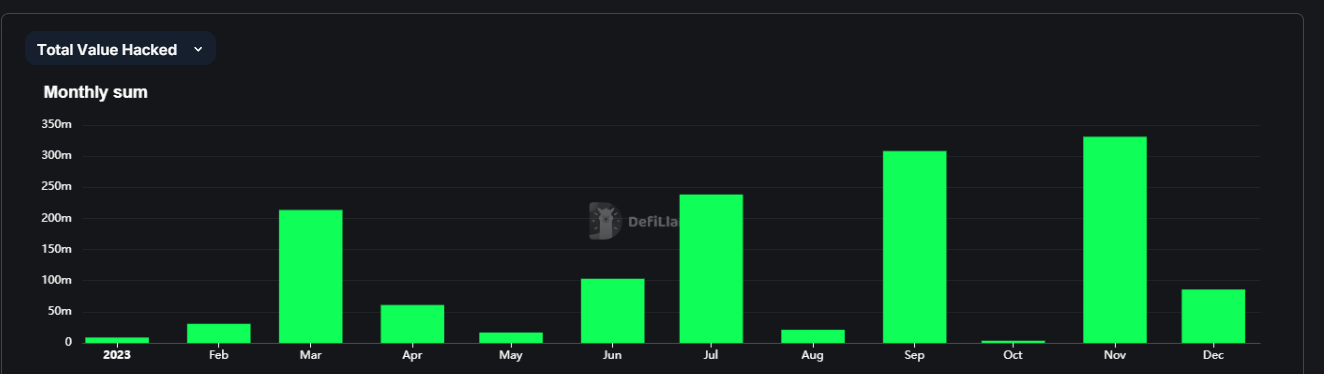

Overall, the probability of being hit by a cryptographic scam is higher in the first half of the year than in the second half, excluding December.

Always check the origin and authenticity of the links we find on the internet, always double check with the verified channels of the project in question, use reporting tools for malicious smart contracts like WalletGuard and never trust anyone when money ethics are involved.

These small precautions could save your wallet.

Here is what igmas Pekarskas, CEO of Smart Betting Guide, reported regarding the proliferation of crypto scams in gaming and metaverse contexts:

“Some platforms, including those in the metaverse and gaming sphere, are more susceptible to cybercrime than others. When making transactions on one of these platforms, make sure to do your research and due diligence. Be wary of prices that seem ‘too good to be true’ or of unverified items for sale, especially if you are purchasing a highly limited or sought-after gaming item, as scammers will try to exploit your interest.”

Hacks and exploits decrease overall in 2023 but incidents on bridges increase

Beyond the frightening numbers in the gaming/metaverse category, in 2023 the trend of crypto scams and hacks in web3 in general has slowed down compared to 2022 when there was a real bloodbath for cryptographic protocols.

According to data from DeFiLlama, in the past year total exploits involved assets worth over 1.4 billion dollars, with a large portion in the months of March, July, September, and November.

The most attacked projects were Euler Finance, Mixing Network, Poloniex, and Atomic Wallet.

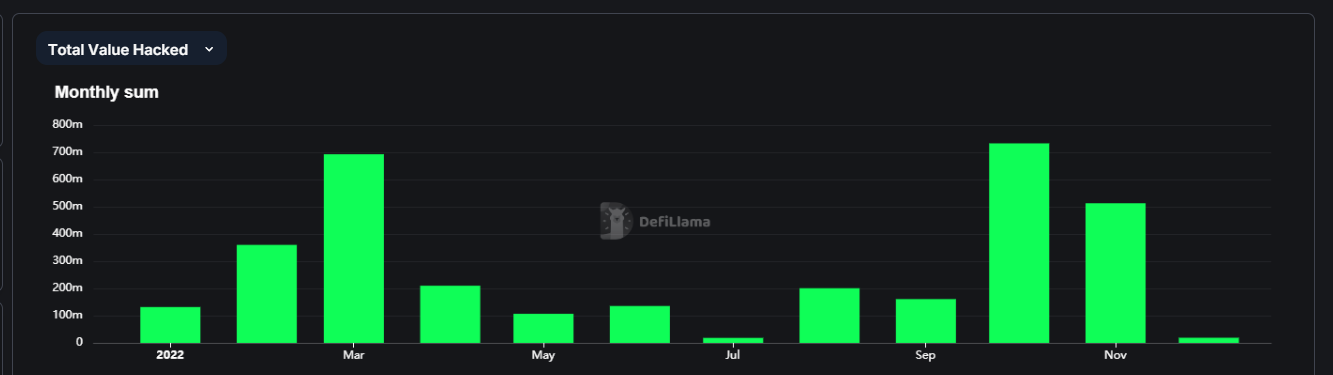

In 2022, the total amount of crypto stolen by hackers reached the staggering figure of 3.2 billion dollars, which is 41.6% of all thefts on blockchain ever recorded.

March, October, and November have been record months for cybercriminals, targeting infrastructures such as the Ronin network, Binance Bridge, and the FTX exchange.

Anyway in 2023 there was a category that stood out along with gaming platforms and metaverse for the large amount of scams and thefts.

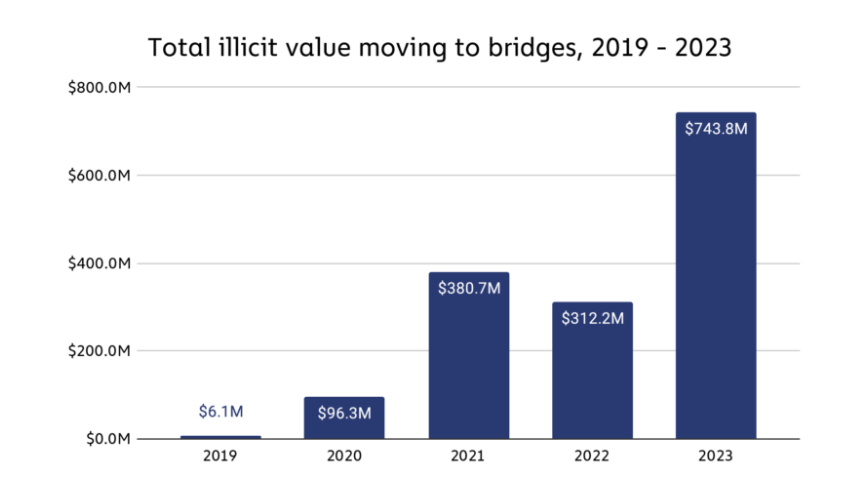

We are talking about cross-chain bridges, the absolute favorite target of hackers who exploit the still immature interoperability technology to obtain large illicit gains.

Since their inception, bridges have lost about 2.83 billion dollars with cases like Ronin, BSC TokenHub, Wormhole, Multichain, Nomad, Horizon, Heco, and Orbit among the most profitable hits.

The growing need for decentralized finance to move assets quickly and economically across multiple blockchains is pushing more and more bridges to seek solutions that are still untested by the community, with a high risk of technical vulnerabilities in the code.

As highlighted by a recent study by Chainalysis, in the last two years these protocols have been of great help to North Korean hackers who have laundered over 1 billion dollars from other illicit transactions carried out on the network.

The wish for the sector at this moment is that the new emerging interoperability solutions like LayerZero and Chainlink CCIP can bridge this gap, making it simple, but at the same time also secure to transfer assets in multichain mode without the risk of encountering crypto scams.

en.cryptonomist.ch

en.cryptonomist.ch