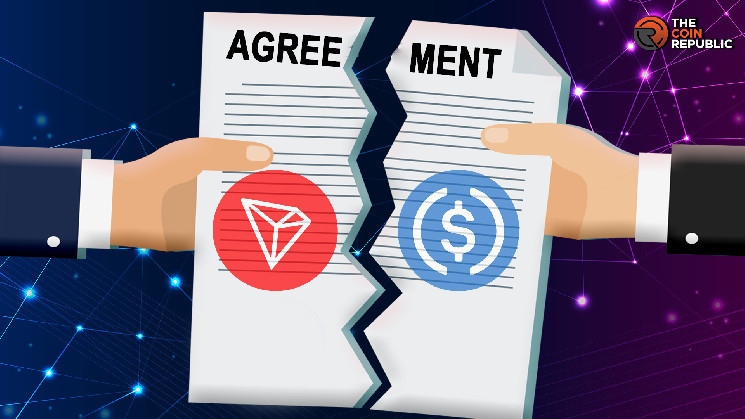

- 1 USDC issuer Circle has stated that it will no longer offer its service for the Tron blockchain.

- 2 “Through February 2025, Circle Mint customers may transfer USDC to other blockchains or redeem USDC on TRON for fiat currency directly with Circle,” said Circle.

- 3 The cryptocurrency market capitalization was above $2 Trillion on February 20, 2024.

Circle, the firm that issues USDC stablecoins, has revealed its plan not to serve Tron blockchain and has seized its exclusion services for the platform. According to the firm, the move is appreciated to maintain the commitment to uphold the integrity and safety of the stablecoin.

The documents from Circle state that the seizure will be effective with immediate effect. The move to halt service over the Tron blockchain came after regulatory trouble over the Tron ecosystem.

1/ We are discontinuing USDC on the TRON blockchain in a phased transition. Effective immediately, we will no longer mint USDC on TRON. Transfers and redemptions of USDC on TRON will continue to operate normally through February 2025. Read the details: https://t.co/kw9A3ZUpWH

— Circle (@circle) February 21, 2024

Circle clarified in its blog post that the minting of USDC will no longer be done on the Tron blockchain. It adds, “Through February 2025, Circle Mint customers may transfer USDC to other blockchains or redeem USDC on TRON for fiat currency directly with Circle.”

“As part of our risk management framework, Circle continually assesses the suitability of all blockchains where USDC is supported. Our decision to discontinue support for USDC on TRON is the result of an enterprise-wide approach that involved the business organization, compliance and other functions across our company.”

The Tron Network is owned by Justin Sun, a famous crypto mogul. The available data on Crunchbase states that Sun has invested in many companies; his significant investments include Animoca Brands and Valkyrie Investments.

Market Price Updates

The cryptocurrency market capitalization was above $2 Trillion on February 20, 2024. However, the market cap has declined since the beginning of the February 21 trading session. When writing, the market cap was $1.95 Trillion posting a 1.52% decline. The hype surrounding BTC halving is largely causing the volatility in the crypto market as per analysts.

Bitcoin, the leader of all cryptocurrencies, has fallen more than 2% in the past 24 hours and is trading at $51,227. Despite the decline in the trading price, BTC trading volume grew more than 45%.

After the decline in the market capitalization of the crypto market affected some other coins/tokens, as per the losers list powered by CoinMarketCap, Starknet topped the list, which lost over 17% of its price, followed by SATS, BONK, Arweave, Beam, WOO and others.

Notably, the gainers and losers daily are majorly led by the coins & tokens below $20. For the past few days, Siacoin (SC) has been among the top gainers, and when writing, it was trading at $0.0168 with a growth of 16.23%.

There are over 150 stablecoins in the market; some are dollar-pegged, and others are gold-pegged or pegged by some other digital currency and asset. The constant boost in the entire crypto adoption indicates the efficiency of blockchain technology and other digital assets.

Industry experts claim that by 2025, cryptocurrency adoption will double, and significant developments are expected within the sector.

Steefan George is a crypto and blockchain enthusiast, with a remarkable grasp on market and technology. Having a graduate degree in computer science and an MBA in BFSI, he is an excellent technology writer at The Coin Republic. He is passionate about getting a billion of the human population onto Web3. His principle is to write like “explaining to a 6-year old”, so that a layman can learn the potential of, and get benefitted from this revolutionary technology.

thecoinrepublic.com

thecoinrepublic.com