Cryptocurrency traders often navigate price trends, launching into short positions during bearish phases and long positions amid bull rallies. This behavior sets the stage for profitable long or short squeezes, masterminded by whales and market makers.

When initiating short positions, traders essentially bet on the cryptocurrency‘s value dropping through a collateral deposit and a liquidation price above the current exchange rate.

However, if the asset’s price surges, reaching this liquidation point, it can forcibly close the traders’ positions. This event, known as a short squeeze, involves a cascade of closures, pushing the price higher and clearing the liquidity pools.

Short squeeze alert for Solana (SOL)

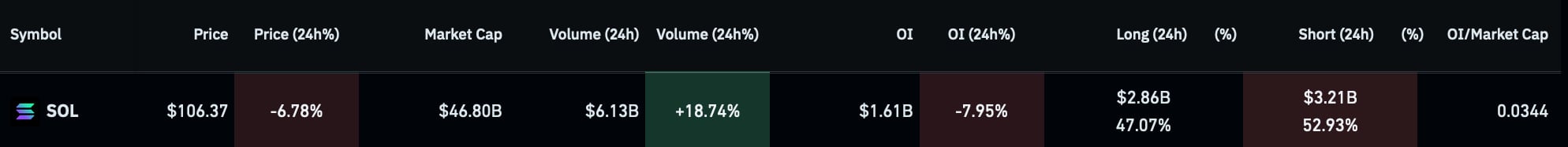

Notably, Solana (SOL) has seen an increase in short positions in the last 24 hours, creating upward liquidity pools. Finbold retrieved this data from CoinGlass’ derivatives market on February 20. From the $6.13 billion 24-hour volume, 52.92% is made by short sellers, for $3.21 billion.

The most likely target is $119.47 per SOL, with over $820,000 of liquidations at this price. Solana is trading at $106.37, down 6.78% in the day following a general drop in the crypto market.

Sui Network (SUI) could pump with a short squeeze

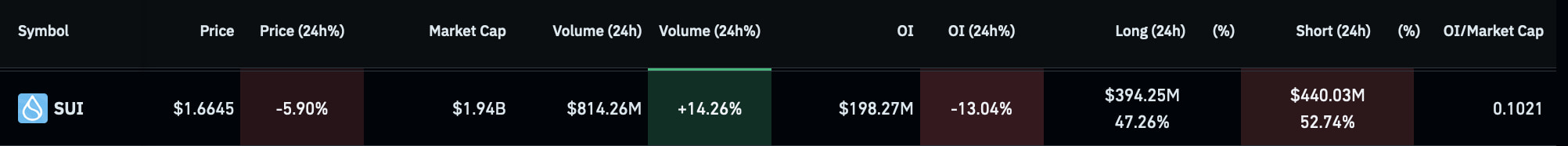

Another coin with a potential imminent short squeeze is Sui Network (SUI), which has had a growing volume of short positions. In particular, $440 million of a $814.26 million 24-hour volume is made of shorts.

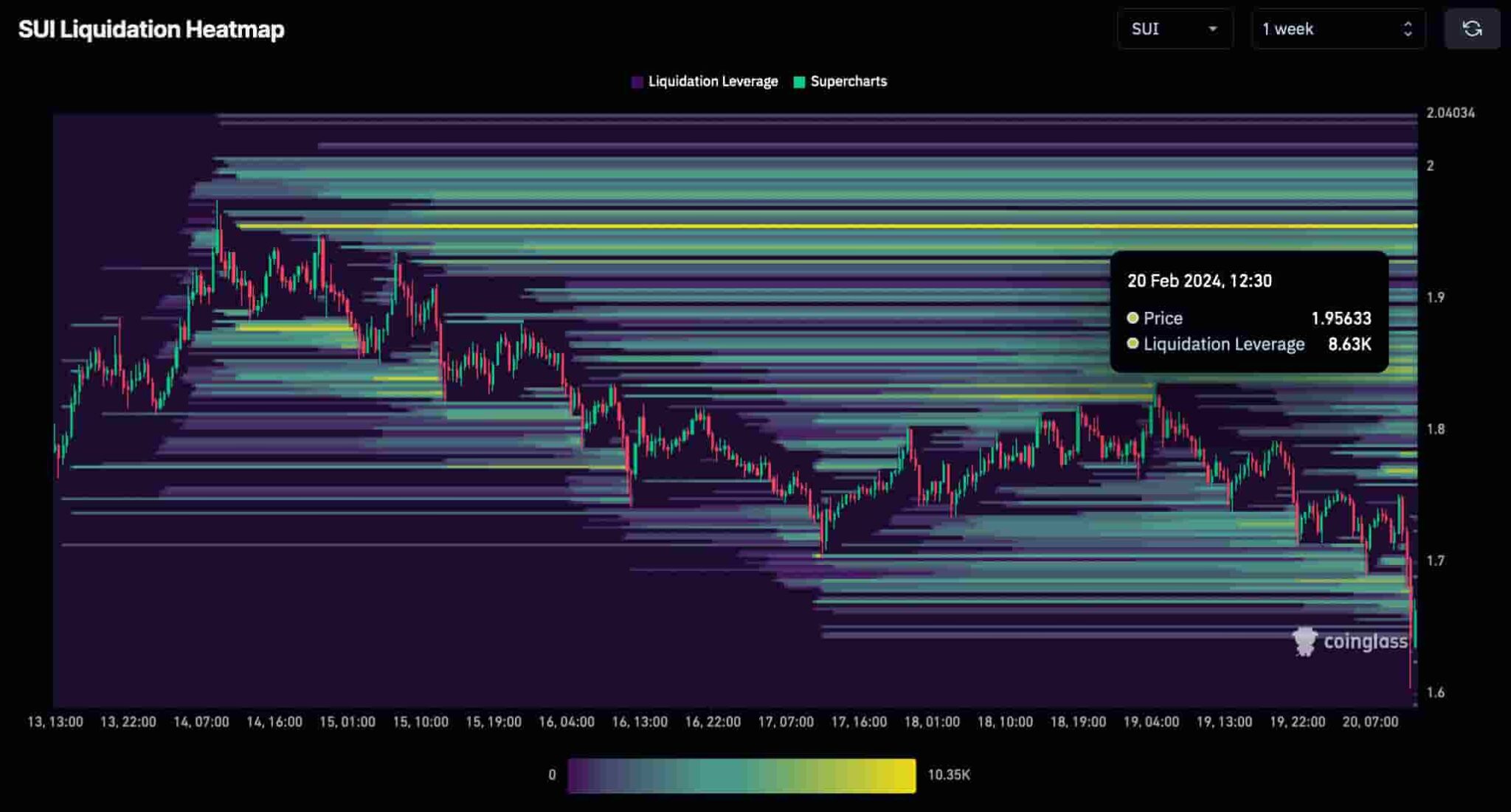

SUI’s liquidation heatmap has even more short-squeeze potential than Solana’s in comparison to historic liquidations in the weekly time frame. On that, there are relevant liquidity pools close to the current price of $1.66 per token.

Furthermore, reaching these pools could fuel a pump, seeking more liquidations above the $1.95 zone.

Nevertheless, short sellers can avoid liquidation by either adding more collateral to the already opened contracts or closing their positions. Thus, liquidity pools can quickly change over time as the market adjusts to recent developments.

In closing, Solana and Sui Network could suffer a short squeeze this week due to increased short positions and liquidations upwards. But cryptocurrencies are volatile and unpredictable, changing every minute. Investors must remain cautious and properly manage risk while speculating on this market.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com