kirilm.eth was involved in a phishing attack that took place on February 15, costing them 180.25 million BEAM, worth about $5.14 million.

kirilm.eth was phishing attacked and lost 180.25M $BEAM($5.14M) 13 hours ago.

— Lookonchain (@lookonchain) February 16, 2024

The scammer quickly sold the 180.25M $BEAM for 1,629 $ETH($4.6M), which caused the price of $BEAM to drop by ~7%.https://t.co/x8epiNx4Qa pic.twitter.com/ytcfYib2Kg

Following the attack, the stolen BEAM was converted into 1,629 Ethereum (ETH), valued at $4.6 million. The move proved destructive to Kirilm.eth, having caused waves in the BEAM market, leading to a 7% price decrease.

Concurrently, BEAM’s market capitalization and 24-hour trading volume dipped by 4.55% and 1.38% to $14,424,788 and $1,003,331, respectively. At press time, BEAM exchanged hands at $0.09765, a 4.31% decline from the intra-day high of $0.109, according to data from CoinStats.

BEAM/USD 24-hour price chart (source: CoinStats)

Sentiment Turns Sour After Phishing Attack

The impact of this phishing scam is already reflected in the market dynamics of BEAM. This situation was reported by the platform LookOnChain, a blockchain analytics platform, and attracted much notice of the rapid fall in the value of BEAM. The market reaction was immediate, and the token became associated with a bearish sentiment.

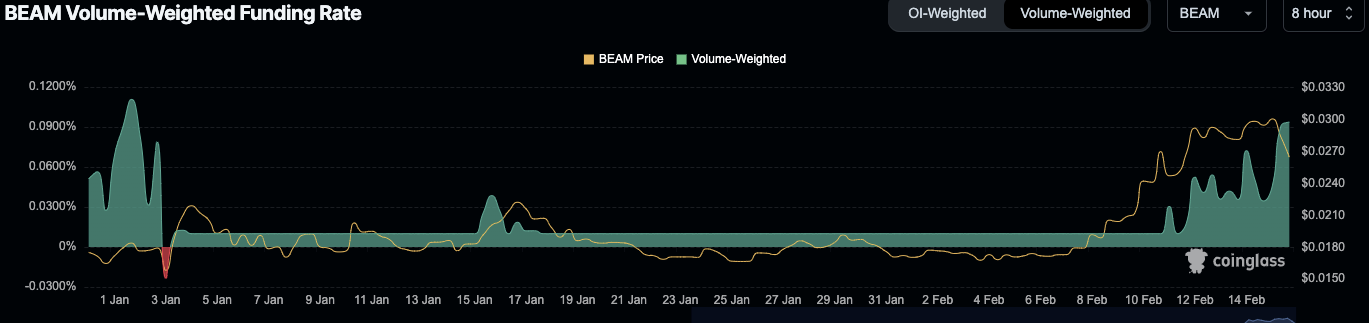

This feeling was also supported by CoinGlass, a derivative data provider, who declared an 11.20% decrease in open interest of this token. The reduction in the open interest and subsequent drop in the price indicates an uncertain period for BEAM that would lead to a potential downtrend.

Although the market saw the initial shockwaves caused by the phishing scam, there are seemingly signs that it may stabilize. Data provided by CoinGlass showed that there was a significant rise in volume after the accident.

BEAM Volume

This increase in the number of transactions might indicate that traders and investors have started using the volatility or the coin is about to enter a consolidation stage. Community and market observers are closely following these developments, with an anticipation of recovery from this unforeseen shock.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com