The cryptocurrency market is on a bull rally, and most altcoins are breaking out from mid-term downtrends in their charts.

However, some cryptocurrencies still register a weekly oversold status due to huge losses suffered in the past. This could create a buying opportunity for the next few days if these projects have strong fundamentals to fuel demand.

Notably, Bitcoin’s (BTC) price action evidenced the strong short-term momentum for the crypto landscape.

The leading cryptocurrency has reached multi-year highs at $52,522, facing price resistance that dates from 2021. As of writing, BTC trades at $52,260. This movement could propel oversold cryptocurrencies into a bullish trend moving forward.

Buy signal for an oversold 0x Protocol (ZRX)

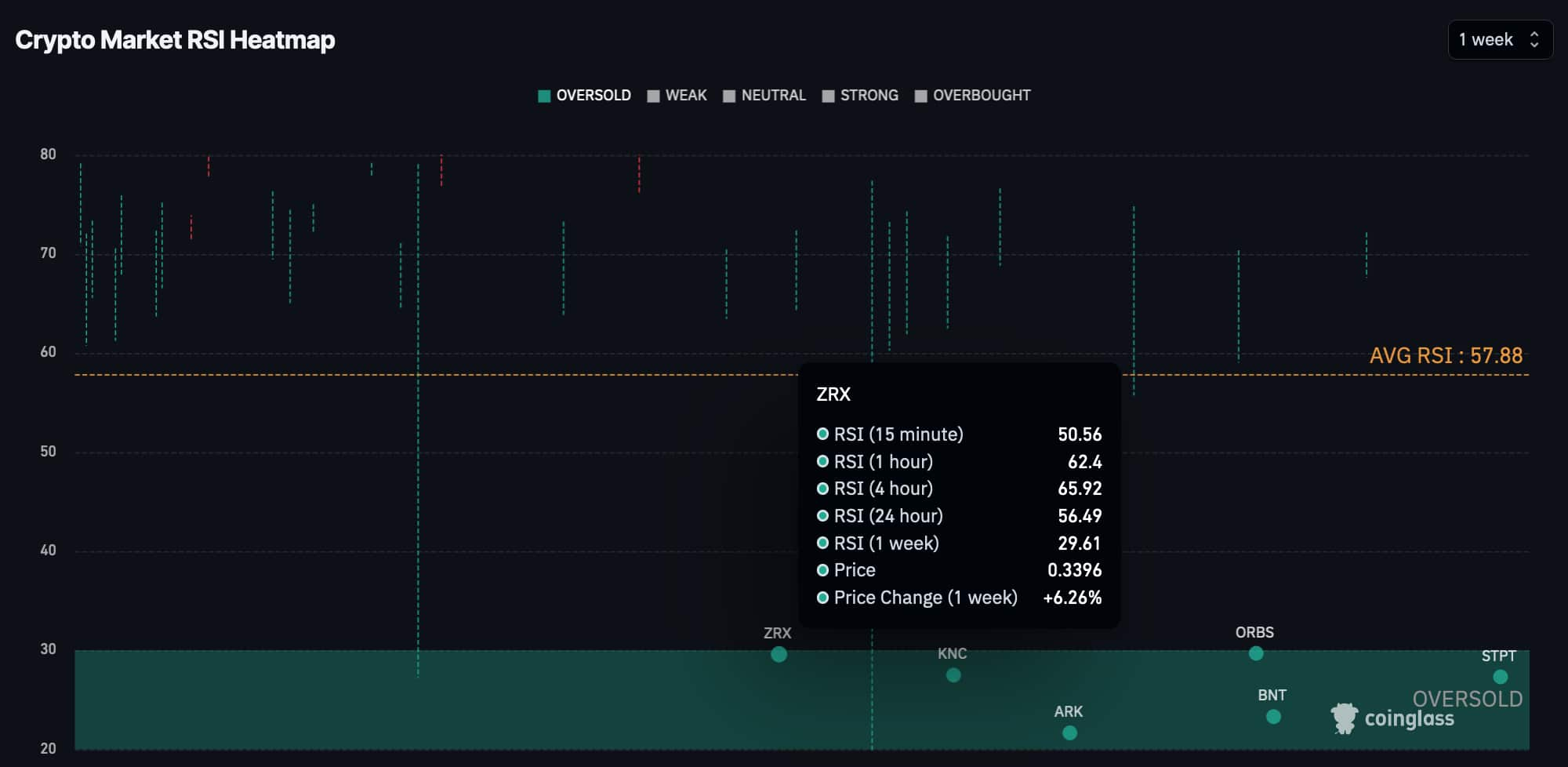

In particular, Finbold spotted an oversold 0x Protocol (ZRX) at CoinGlass’s weekly Relative Strength Index (RSI) heatmap on February 15.

The decentralized exchange infrastructure protocol trades at $0.339 by press time, up 6.26% in seven days. Interestingly, its weekly RSI remains oversold at 29.61, while lower time frames position ZRX in a surging momentum.

Essentially, with a daily and hourly RSI of 56.49 and 62.4, the short-term price action could trigger a reversal from the weekly zone moving forward.

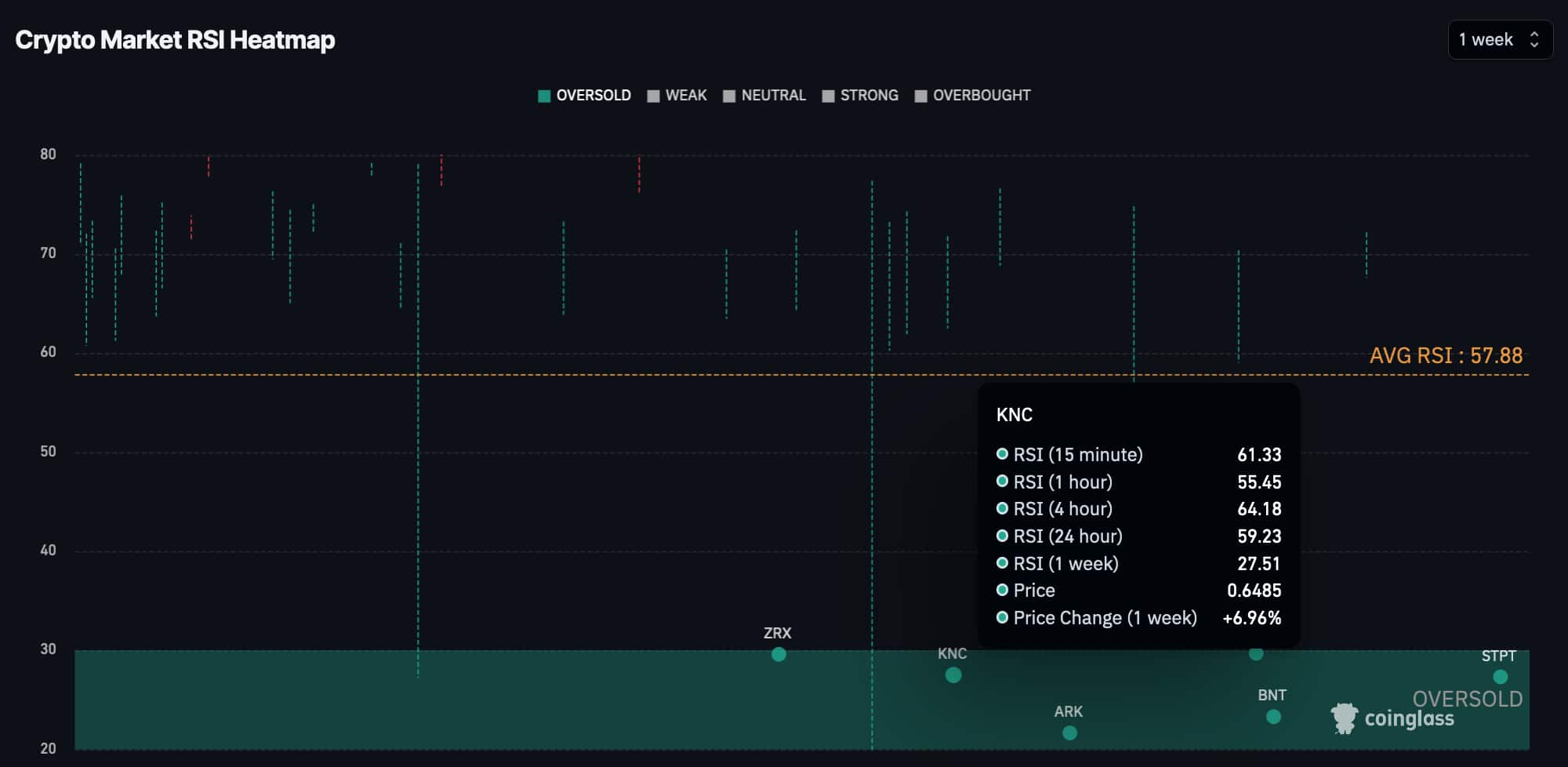

Kyber Network Crystal v2 (KNC)

Another potentially oversold cryptocurrency is Kyber Network Crystal v2 (KNC). The token has a 27.51 weekly RSI, trading at $0.648 and up 6.96% as of writing. Like ZRX, KNC signals a trend reversal with its low time frame RSIs.

Interestingly, the average weekly RSI for the crypto market is 57.88, increasing the relevancy of projects above that line.

Nevertheless, having an oversold RSI status does not guarantee price recovery. Understanding this extreme-weakness indicator is vital for investors looking to buy signals. The cryptocurrency market is highly volatile, and everything can change in the blink of an eye.

In this context, projects that are going through problems, discontinuation, or massive dumps can also present an oversold status and continue in a bearish trend. Therefore, investors must be cautious and understand what they are buying.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com