- XRP price declined slightly on Wednesday, trading sideways below $0.53.

- Ripple CEO Brad Garlinghouse unveiled the payment firm’s plan to expand product offerings to crypto custody.

- Ripple is seeking US regulatory approval to purchase Standard Custody and Trust Co. to acquire a New York trust charter.

XRP price is trading sideways below the $0.53 level. The altcoin is struggling to tackle resistance on its path to its $0.56 target.

The payment remittance firm’s CEO, Brad Garlinghouse, announced Ripple’s plan to foray into crypto custody with its recent acquisition of a New York trust charter firm.

Also read: XRP price could rally towards $0.56 target amidst possibility of settlement in SEC v. Ripple lawsuit

Daily Digest Market Movers: Ripple plans to foray into crypto custody with latest acquisition

- While Ripple is embroiled in a legal battle with the US Securities and Exchange Commission (SEC), the firm has secured nearly 40 US money transmitter licenses, a Monetary Payments Institution license from the Monetary Authority of Singapore (MAS), and a Virtual Asset Service Provider registration with the Central Bank of Ireland.

- Brad Garlinghouse, the CEO of Ripple, shared the news in an official tweet on X.

With @StandardCustody, we’ll be able to improve existing product offerings for our customers, as well as explore new products and use cases, all in a fully compliant way.

— Brad Garlinghouse (@bgarlinghouse) February 13, 2024

To date, @Ripple has secured: ✅ nearly 40 U.S. money transmitter licenses, ✅ MPI license from MAS, and ✅… https://t.co/0BrAWjBmhM

- While the ongoing lawsuit has likely negatively influenced the asset’s price, the developments that are likely to boost XRP adoption, like its growing utility and use cases, could catalyze gains in the altcoin.

- The SEC lawsuit pushed Ripple to look outward and shift its focus overseas and the company is working on boosting its payments infrastructure for firms in the US with the likes of a limited purpose trust charter held by Standard Custody and Trust Co.

- Ripple President Monica Long was quoted as saying: "We want to offer more and more of these infrastructure pieces to these financial institutions. We see this as giving us a lot of flexibility."

Technical Analysis: XRP price struggles below resistance at $0.53

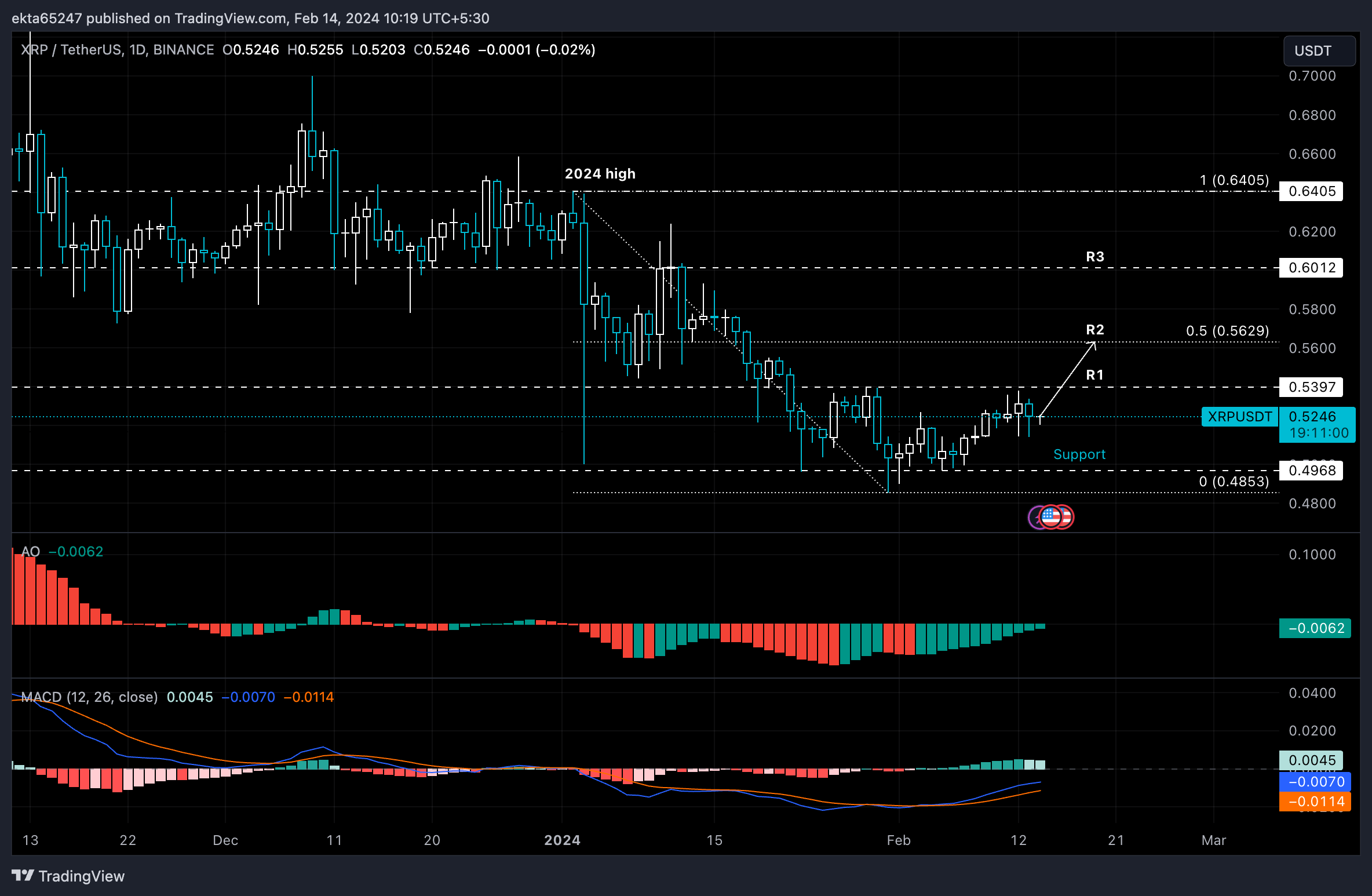

XRP price is trading sideways since its January 31 low of $0.4853. The altcoin is trading between resistance at $0.5397 and support at $0.4968. XRP price declined slightly on Wednesday to $0.5246 on Binance.

The altcoin faces immediate resistance at R1, $0.5397. The next two resistances in XRP’s path to its 2024 high are at the 50% Fibonacci retracement of the altcoin’s decline from its January peak, at $0.5629; and $0.6012, a level that acted as resistance for XRP throughout January.

Two technical indicators, Awesome Oscillator (AO) and Moving Average Convergence/Divergence (MACD) are flashing green bars, implying that the uptrend is intact. However, XRP price continues to struggle at the immediate resistance.

XRP/USDT 1-day chart

A daily candlestick close below support at $0.4968 could invalidate the bullish thesis for XRP price and open the possibility of a sweep of January 31 low of $0.4853, before the altcoin sees meaningful recovery.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

fxstreet.com

fxstreet.com