The cryptocurrency market has dropped to a correction, with most digital assets trading at lower prices than earlier this week. However, some possibly overbought cryptocurrencies have lagged and are yet to retrace, which could indicate a sell signal.

Despite the short-term bearish scenario, some projects have maintained strong momentum, leading to an overbought status. This could create a selling opportunity for traders who expect these projects to follow the macro trend this week.

Notably, the Crypto Total Market Cap Index evidences the recent retracement. The index added $367.677 billion from January 23 to February 13, peaking at $1.839 trillion. Then, it lost $55.872 billion in less than 24 hours, currently at a $1.784 trillion capitalization.

Chromia (CHR) is overbought in multiple time frames

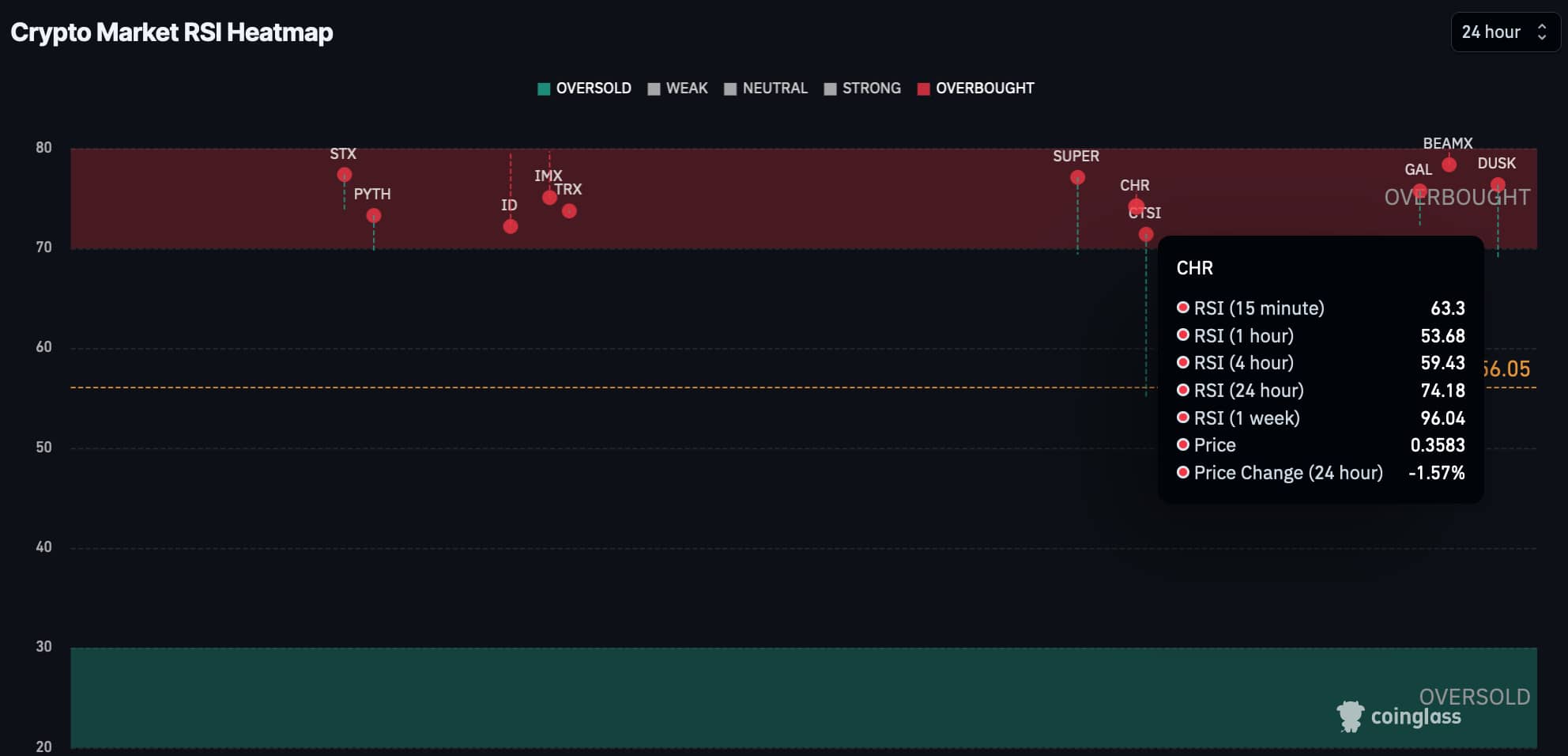

In particular, Finbold spotted an overbought Chromia (CHR) at CoinGlass’s weekly Relative Strength Index (RSI) heatmap on February 13.

The CHR token currently has the highest weekly RSI in the market, creating a relevant sell signal at these prices. Chromia is currently trading at $0.358, down 1.57% in 24 hours but with a 96.04 overbought weekly RSI.

Moreover, it shows an overbought status in the daily RSI, with 74.18 points, while suggesting strength or a momentum reversal in shorter time frames.

Sell signal for Stacks ($STX)

Another potentially overbought cryptocurrency is Stacks ($STX). The token has an 87.34 weekly RSI, trading at $2.11 and up 3.48% by press time.

Interestingly, $STX has the same Relative Strength Index of 77.38 in the daily and 4-hour time frames. The hourly chart also suggests an overbought Stacks at 70.64 RSI, while the 15-minute frame indicates weakness.

Therefore, these data could be interpreted as a relevant sell signal to $STX.

Understanding this momentum indicator is vital for investors looking to sell signals.

On the other hand, having an overbought RSI does not guarantee a price crash or trend reversals. The cryptocurrency market is highly volatile, and projects can continue growing with the proper conditions and demand increase.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com