Some low market-cap cryptocurrencies can present appealing risk-reward potential in the highly competitive and constantly shifting crypto landscape. In this article, Finbold has picked three assets that could reach $1 billion in market value in 2024.

These projects sometimes grow under the radar due to not being featured among the top 100 ranks. However, it is important to understand that low market-cap cryptocurrencies will face different risks than the bigger ones. For example, lower liquidity or underdeveloped ecosystems.

In this selection, Finbold looked to fundamental aspects of these projects, including decentralization, security, utility, and competitive advantages against higher capitalized coins.

Radix (XRD) to reach $1 billion market cap

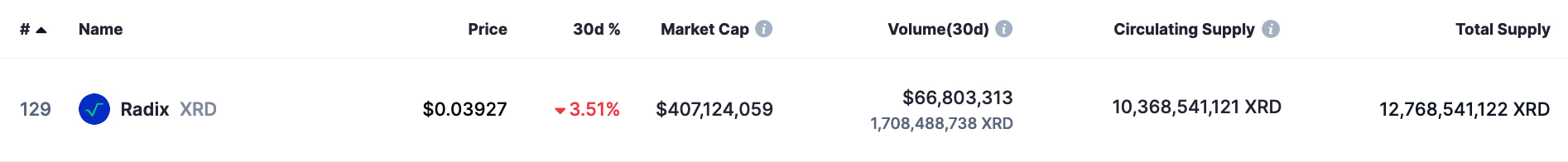

First, Radix (XRD) is a layer-1 blockchain that serves as the infrastructure for decentralized finance (DeFi). Its native token currently has a $407,12 million capitalization, trading at $0.039 per token.

If Radix reaches a $1 billion market cap in 2024, its value will increase by 145%, with a similar effect on price. However, XRD has yearly supply inflation of approximately 2.5%, slightly impacting the price surge.

Interestingly, this is a relatively low supply inflation to Radix’s valuable competitors. For example, Solana (SOL) has over $45 billion in capitalization and an estimated yearly inflation of 17%.

Recent tests by Radix creator Dan Hughes suggest the network can perform around 31,000 swaps per second in decentralized exchanges (DEX).

Its properties are aligned with what Robert Kiyosaki recently explained as his reasons for investing in Bitcoin (BTC) as an alternative to Gold. Offering cheaper value transfer of a scarce commodity. Elon Musk’s AI Grok also named XNO the most suitable cryptocurrency for payments on X.

All things considered, Nano has the potential to reach a $1 billion market cap in 2024 with the proper awareness of its capacities. From a competitive perspective, it offers more efficient transactions than Bitcoin, XRP, Dogecoin (DOGE), Litecoin (LTC), Bitcoin Cash (BCH), and others while keeping decentralization and security.

Nevertheless, the cryptocurrency market is still mostly experimental and uncertain. Radix and Nano would need a meaningful increase in demand for their solutions to meet these expectations, and nothing is guaranteed.

Investors must do their due diligence while maintaining caution and proper risk management strategies, especially when investing in low market-cap cryptocurrencies.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com