The world of crypto has always held a dual promise for the world – a revolution in how global financial systems operate thanks to the development of blockchain ecosystems and a way to gain significant returns by investing in promising cryptocurrencies and Web3 projects.

The former promise is still in the future as dozens of teams across the globe continuously work to bring it to fruition by improving scalability, security, speed, and cost-effectiveness.

The latter has been continuously fulfilled by numerous projects – even during the troubles of the ‘crypto winter’ as evidenced by the incredible story of the launch of the meme coin Pepe (PEPE).

Now, as the crypto market and community are again abuzz with life with mounting enthusiasm stemming from a string of positive developments for the industry, it is time to look at the four most promising cryptocurrencies to invest in.

Chainlink ($LINK)

Chainlink ($LINK) has established itself as a crucial element of Web3 ecosystems due to providing the services of a decentralized oracle – an important line of communication between smart contracts and data from the outside world.

This positioning as a crucial component of many blockchain projects ensures Chainlink boasts significant staying power in the wider crypto space.

Additionally, there has been significant enthusiasm about the $LINK token in recent weeks as it has been on a nearly continuous rise for almost a full four months by press time – albeit with a period of relative stagnation in January.

In total, $LINK is 160.67% in the green in the last 52 weeks and – highlighting the most recent trend – 35.16% up in the last 30 days. It did, however, decline slightly – by 0.74% – to 18.37% in the last 24 hours of trading.

It also has to cross a significant threshold at $20.03 before it can surge upward, but should it achieve that, the very next price target for $LINK stands significantly higher at $26.87.

Polkadot ($DOT)

While nowhere near a new network, recent months have seen Polkadot ($DOT) increasingly come to life. It is actively working toward boosting its ecosystem to become the platform of choice for non-fungible token ($NFT) projects and Web3 gaming teams and has recently set a new record for $NFT minting speed.

A dedicated team is also currently working on Polkadot’s first meme coin – DED – which could offer a significant boost for $DOT, given that the launch will be free of pre-sales or team allocations. Instead, all holders of the native token will receive the new meme coin via an airdrop.

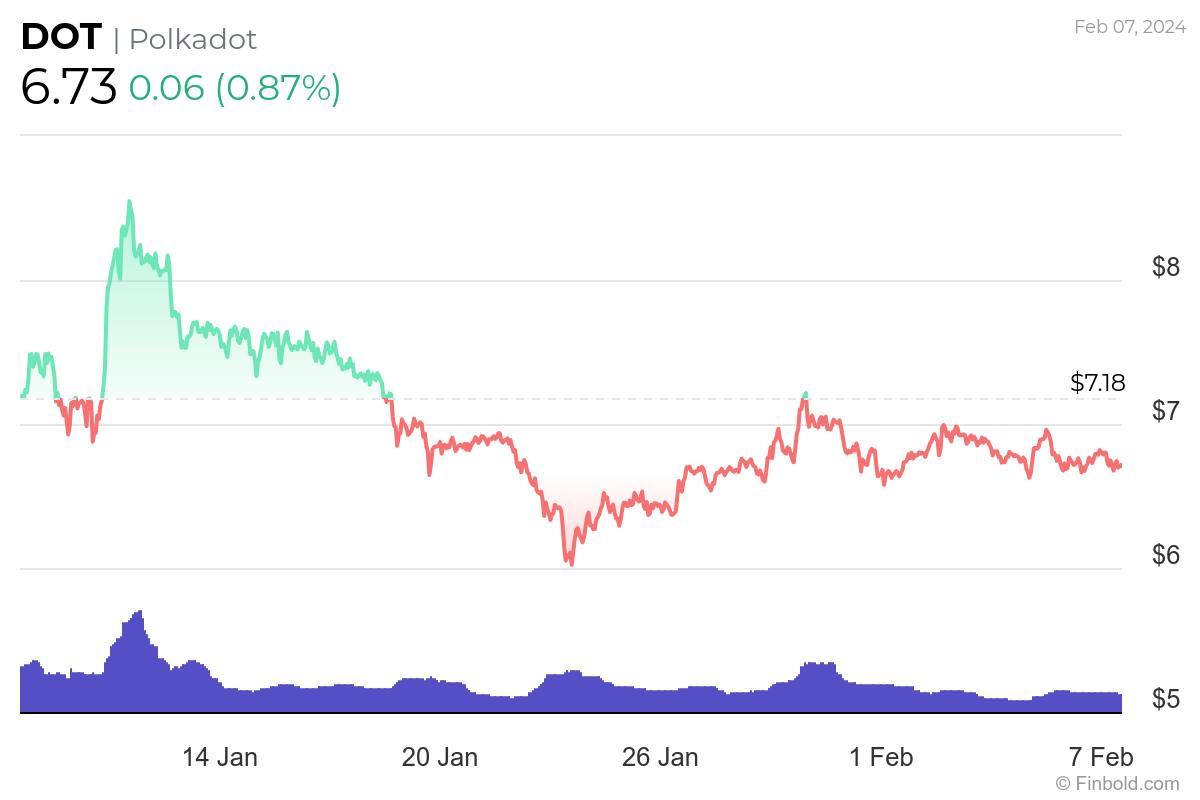

Despite being caught up in the Q4 2023 crypto market rally and rising above $8 in late December, $DOT found itself in a strong downtrend in more recent weeks. It declined 6.66% in the last 30 days but did rise 0.87% in the last 24 hours of trading, landing at $6.73 by press time.

Solana ($SOL)

Solana ($SOL) has been giving crypto investors a lot to talk about of late.

At the start of February, it saw $2 billion in inflows in a single day. In January, its transaction volume crossed the $1 trillion threshold for the first time in years. Finally, in December, the often-touted Ethereum ($ETH)-killer actually overtook $ETH in terms of $NFT sales.

The relatively unique arbitrage opportunity provided by the airdrops linked to Solana’s Saga smartphone also gave it a significant boost last year, and with the first batch being sold out, Solana announced it will soon release a new one.

On the price side, $SOL has also been doing well and despite falling from its yearly high of $121 reached in late December, it still boasts a 52-week rise of 308.49%, a 30-day increase of 0.17%, and is 1.61% in the green in the last 24 hours – despite experiencing a 5-hour outage on February 6.

At press time, $SOL stands at $95.45.

Ethereum ($ETH)

Having talked about an ‘$ETH-killer,’ it would be a shame not to discuss Ethereum itself. The world’s second cryptocurrency has been performing rather well in the last few months, having successfully ridden the Bitcoin-triggered rally in the final trimester of 2023.

In the last 52 weeks, it rose a respectable 41.94% and is – unlike Bitcoin – in the green since January 1 by 0.78%. At press time, Ethereum stands at $2,370.94, having risen 2.17% in the last 24 hours.

Additionally, not only is Ethereum expected to benefit from its own upgrades and the upward momentum likely to be generated by the Bitcoin halving, but a spot $ETH exchange-traded fund (ETF) is expected to be approved in the coming months, giving the cryptocurrency a chance to truly skyrocket.

The optimism is partially driven by the fact that the SEC approved the first batch of spot BTC ETFs less than one month ago after multiple years of waiting and numerous rejected applications, signaling a change in regulatory attitude.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com