- PEPE continues to dip, and at press time, three-quarters of its holders were in losses, and while the whales continue to accumulate, the overall market is turning against the meme coin.

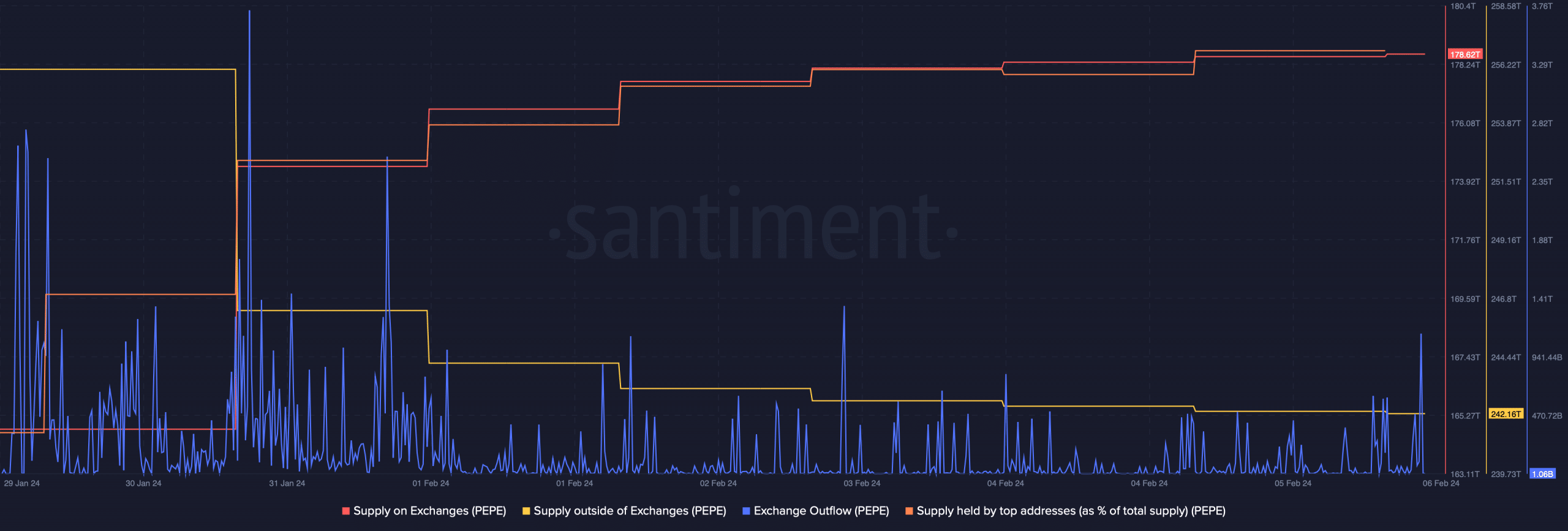

- Data shows that investors have continued to transfer the token into exchanges to dump, with the supply outside exchanges dipping consistently over the past week.

Once one of the hottest cryptocurrencies, Pepe’s best days seem to be behind it as its price continues to tank and investors continue to dump it. At press time, over 70% of investors holding PEPE were in the red and deposits on exchanges continue to rise as investors dump the meme coin.

In mid-last year, Pepe was all the rage; after Binance listed the frog-themed meme coin, it shot to a record high at $0.00000431 on May 5th. Since then, it has been going downhill, and while it has recorded some uptrends in that run, it has been unable to maintain the momentum.

This trend continues—in the last 24 hours, PEPE lost 2.77% to trade at $0.0000009041. It has lost 14% in the past week and 23% in the past month, and since it hit its all-time high in May last year, it has shed 79%. This leaves the meme coin with a market cap of $380 million, which places it 131st in the world—it once burst into the top 100, but those days seem long gone now.

The continued dip has pushed more investors into losses, with data from IntoTheBlock showing that 72% of PEPE holders are in losses at press time. 94% of its owners have held the token between one and twelve months and most likely jumped in during its glory days last year with the expectation that it would continue pumping.

What’s Next for PEPE?

Technical factors indicate that it could get worse for Pepe. According to Santiment, the market remains bearish, with most holders most likely to sell their holdings, which would exert downward pressure on the token’s price and, in a vicious cycle, force even more investors to dump.

Exchange inflow for the token continues to rise, indicating that investors are sending their tokens to exchanges to sell. Santiment data also shows that the concentration of PEPE outside of centralized exchanges has continued to dip.

However, the whales have bucked the trend. Santiment shows that the concentration of tokens held by whales has continued to rise despite the price dip. In the past week, the whales were especially active, scooping around two trillion tokens. According to IntoTheBlock, whales hold around three-quarters of the total PEPE supply, and as such, they can sway the price the most.

The other positive sign for the token is its relative strength index, which has dipped significantly in recent weeks to indicate that the token has been oversold. This shows that there’s a significant upside for an asset.