A widely followed crypto analyst is giving traders an update on crypto king Bitcoin ($BTC) and taking a look at Polkadot ($DOT).

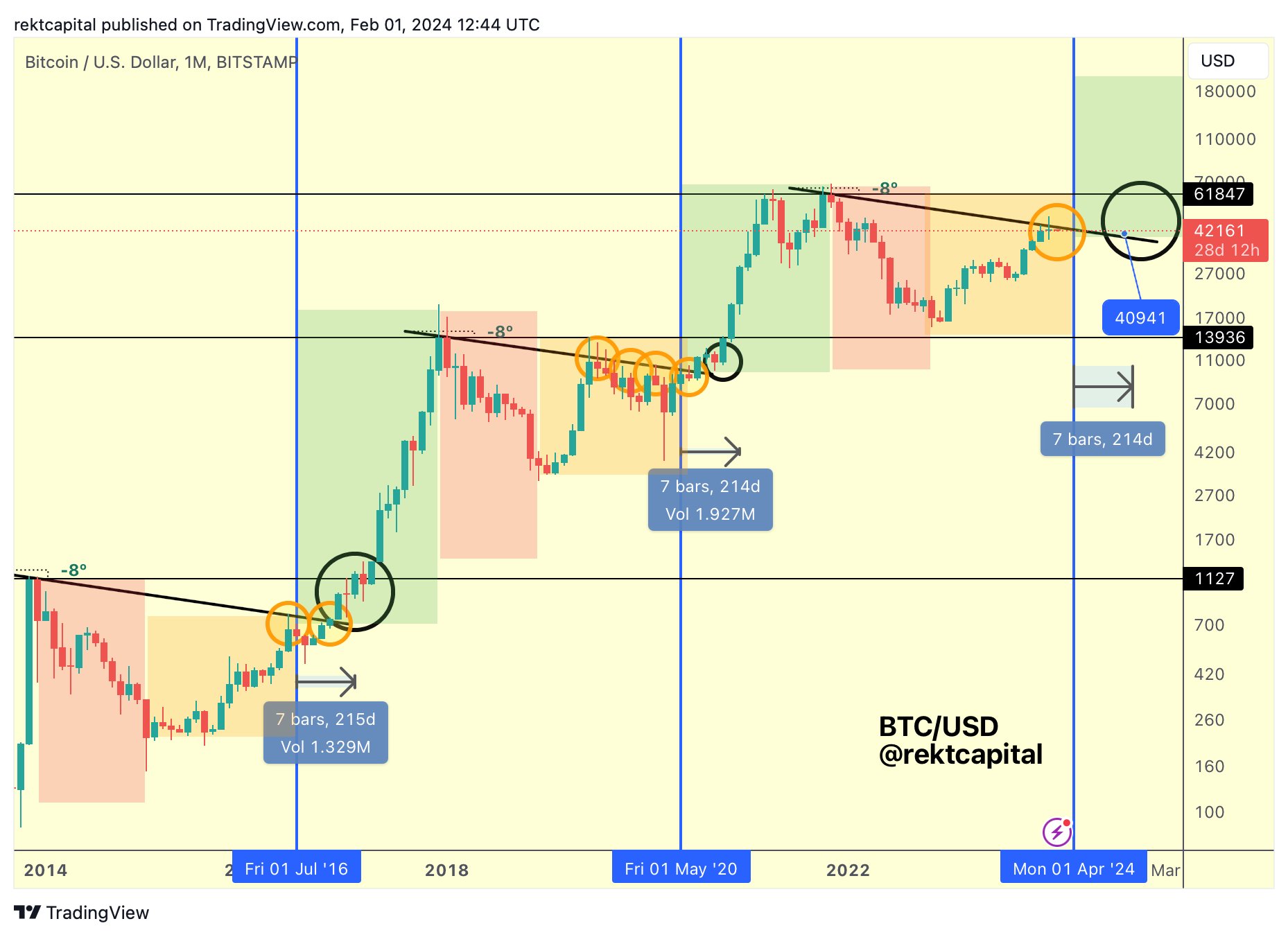

Pseudonymous crypto trader Rekt Capital tells his 394,700 followers on the social media platform X that February has brought $BTC a new rejection from resistance.

“New month

New rejection from the macro diagonal resistance.”

The macro diagonal resistance is represented as a line on the graph, indicating a value zone that $BTC is struggling to pass.

Next, Rekt Capital looks at $BTC’s relative strength index (RSI), a momentum oscillator measuring the speed and change of asset price movements.

“Bitcoin was able to revisit its red range high resistance (~$43,800) but has since rejected to form a lower high (black)

In the meantime, the RSI is still at its downtrend resistance

The RSI needs to break this downtrend if price is to move higher.”

According to the analyst, $BTC’s current cycle has been a “story of re-accumulation ranges” as the flagship digital asset approaches its next halving.

Bitcoin’s halving is a scheduled event that occurs every four years when the rewards for mining and verifying new blocks is reduced by half. The next one is slated for April.

$BTC is worth $42,560 at time of writing, up 6.5% in the last week.

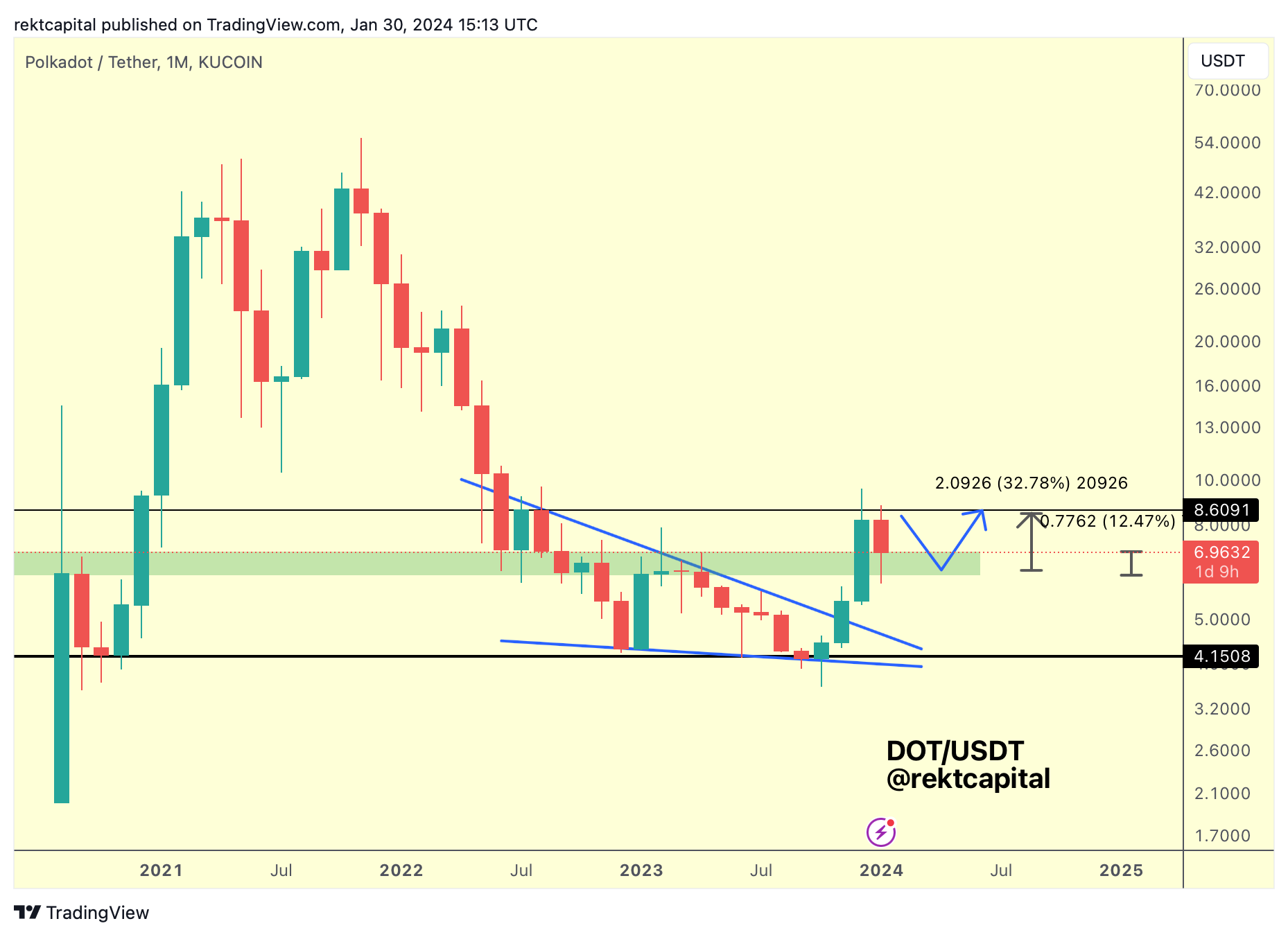

In a new edition of the trader’s Altcoin Newsletter, Rekt Capital also says that interoperability blockchain Polkadot has successfully rebounded to kick off the new year.

“$DOT has rebounded +12% to the upside and looks set to monthly close above the top of the green support area.

A monthly close above the top of the green area would enable $DOT to continue to follow the blue path so as to revisit the black highs above.”

$DOT is worth $6.75 at time of writing, up 6% in the last seven days.

Generated Image: Midjourney

dailyhodl.com

dailyhodl.com