We delved into cryptocurrency AI predictions and analyzed the best crypto prediction apps for accurate price forecasts.

While computer programs predicting asset prices may seem like a far-fetched idea to most, the application of AI in market prediction has been a researched topic for quite some time. For instance, a 2015 paper in the International Journal of Computer Applications discusses an “intelligent stock market forecasting” system that uses the capabilities of neural networks and fuzzy inference systems to unveil patterns in nonlinear and chaotic systems.

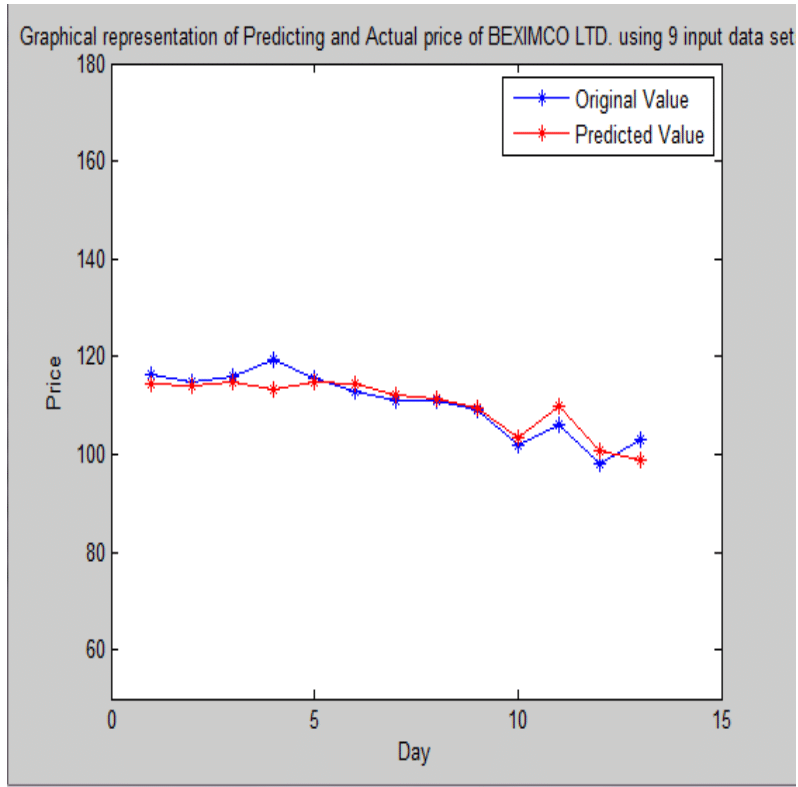

The scientists attempted to predict future stock values for January 2012 using historical data from BEXIMCO Ltd. According to them, the simulation revealed an average error of 1.84 percent.

“If we create a strong knowledge base and train our system with more input data set, it generates more error-free prediction price”, the researchers concluded.

AI to predict cryptocurrency prices

Researchers often use artificial neural networks (ANN) to find patterns in large quantities of data that would be time-consuming to interpret by people. Is there an AI for cryptocurrency?

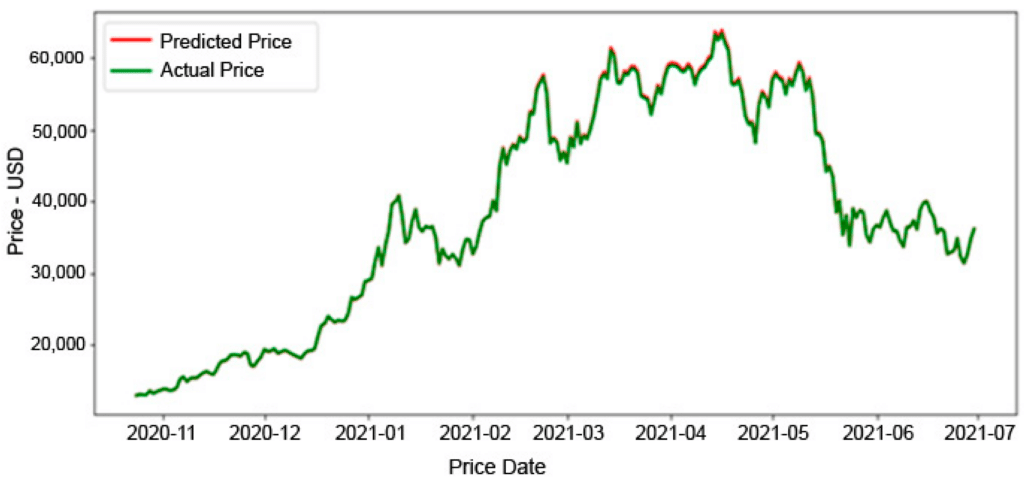

A paper published in 2021 by the Multidisciplinary Digital Publishing Institute describes an AI model for predicting crypto prices.

“The models show excellent predictions depending on the mean absolute percentage error (MAPE)”, the authors of the paper claim. MAPE is a statistical measure used to evaluate the accuracy of a forecasting model. According to the researchers, the algorithm reached MAPE percentages of 0.2454%, 0.8267%, and 0.2116% for Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC), respectively.

The paper explains that 80% of the historical data (Jan. 2018 – Oct. 2020) was used for training and 20% (Oct. 2020 – June 2020) for testing. Still, it is unclear how the model would perform in the longer term, with ever-changing market conditions.

While researchers are working hard to harness the power of AI for precise crypto price predictions, the practical applications are currently quite limited. Yet, for those looking for AI tools for cryptocurrency trading, the market offers some AI-powered market prediction and analysis tools.

You might also like: Why Bitcoin price predictions often miss the mark

How to find the best AI crypto prediction apps

Santiment

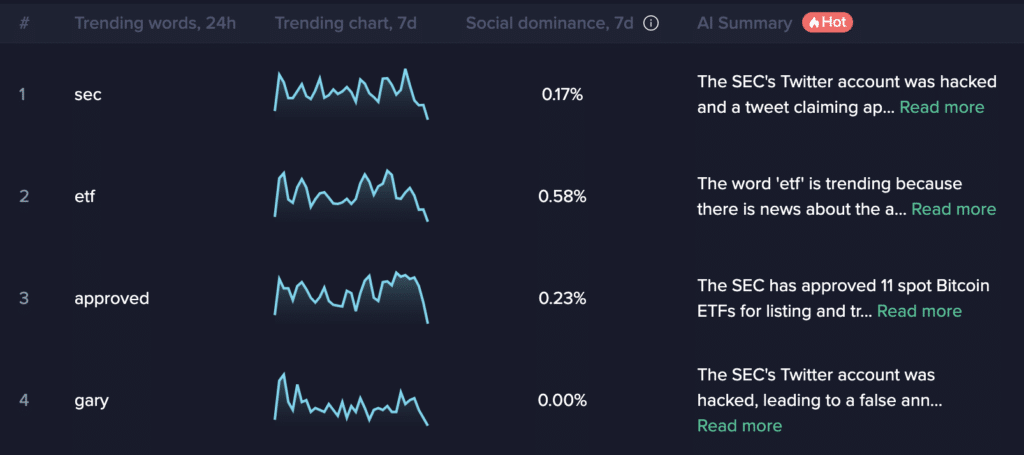

Santiment uses AI to generate a summary of what social-media discourse around assets is currently focused on.

This approach does not directly predict market movement with AI. It uses AI to allow human traders to parse large quantities of data faster to make their own decisions. Some offerings use AI to make trading decisions for you through bots.

ChatGPT Trend Master and Crypto Tactics

Both bots are offered by OctoBot Cloud. The website claims that it uses OpenAI’s ChatGPT to make its predictions. As of press time, ChatGPT Trend Master is 0.812% down over the last month, but also 26.22% over the last six months, while ChatGPT Crypto Tactics is 2.2% down last month and up 26.12% over the last six months.

KepingAI Long Short TF Free

Another bot is KepingAI Long Short TF Free, on 3commas. This app provides limited insight into its operational mechanisms and only explains that it uses artificial intelligence. No past performance data is reported on the website either.

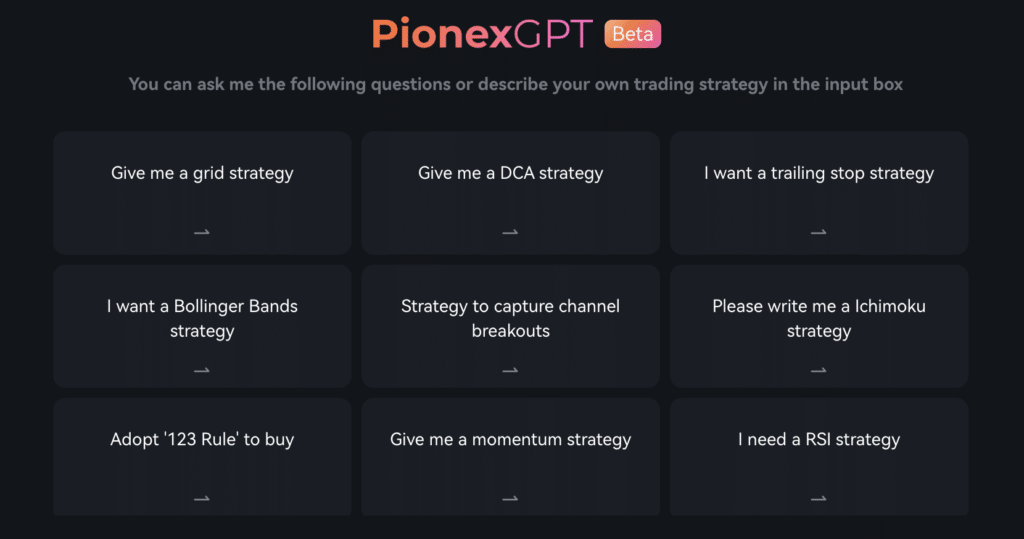

PionexGPT

PionexGPT uses AI to write custom TradingView’s pine scripts to integrate with Pionex bots. In other words, it uses AI to create traditional trading bots.

CryptoHopper

CryptoHopper employs an AI that “analyses all the strategies you feed it and can decide on its own which one it should use.” The system backtests multiple strategies simultaneously. The AI then ranks and rates all the strategies for all the active markets that the user is on — and allegedly picks the best option for the current market.

Do AI crypto trading bots really work?

There is a good reason to be wary of AI bots. The Commodity Futures Trading Commission (CFTC) explained in a Jan. 24, 2024 press release that AI crypto trading bots are popularly a cover-up story for scams.

“When it comes to AI, this advisory is telling investors, ‘Be wary of the hype.’ Unfortunately, AI has become another avenue for bad actors to defraud unsuspecting investors.”

CFTC Office of Customer Education and Outreach Director Melanie Devoe

The opinion of certain AI experts is not significantly more optimistic. Laurence Moroney, AI Lead at Google, told crypto.news in an interview in October 2023 that the potential of this AI application would still be limited.

“If you were to train a model exclusively on data from reputable exchanges and only on successful transactions, you might have a better chance of getting reliable output. But you can never predict the future. Analytics have been attempting this for years, both with AI and with traditional data science. There’s nobody out there who can predict prices correctly.”

Laurence Moroney, AI Lead at Google

Moroney explained that if many people were to use the model simultaneously, “its verifiability and accuracy will go out the window” since the model would influence the market direction.

“I don’t believe in the future of trading bots in that way. And I worry that if you have a million bots all doing the same thing, they can potentially move the market.”

Laurence Moroney, AI Lead at Google

Moroney suggested that rather than replacing human financial advisors, AI will enhance their efficiency by assisting in extracting meaningful information from vast datasets. He compared it to how the introduction of spreadsheets didn’t make accountants obsolete but instead augmented their capabilities.

Metrics to identify the best AI trading models

As Moroney noted, AI cannot predict the future, However, for a good trading bot, it doesn’t need to do that. Successful traders just need to make more money than they lose. This is done by managing risks, minimizing losses on unsuccessful trades, and maximizing gains on successful ones. Some traders stay profitable even if most of their trades are not successful, thanks to effective strategies.

So, if an AI is mostly right or has a good chance of making very profitable trades occasionally, that’s considered good. However, since this kind of software allows its owner to make a profit without sharing it with others, there’s little motivation to bring it to the market.

Back in 2019, hedge funds were already incorporating AI into their operations. According to a BNY Mellon article, “a number of hedge funds are using AI to analyze masses of data, predict corrections in supply and demand imbalances, and forecast market movements for tactical asset allocation.”

As Moroney suggested, these tools mainly help humans rather than replace them. They assist the Chief Investment Officer and their team, but there are also more innovative approaches being explored.

“Indeed, a class of AI pure play hedge funds has emerged in recent years that are based entirely on machine learning and AI algorithms. Examples include Aidiyia Holdings, Cerebellum Capital, Taaffeite Capital Management and Numerai. Numerai, a recognized AI hedge fund, is pushing the boundaries of the hedge fund business model.

The firm uncovers investment strategies by hosting competitions among external AI experts, mathematicians and data scientists. Recently, Numerai expanded its business model by making elements of its platform available to the rest of financial community with its product Erasure, which is a decentralized prediction marketplace using blockchain technology.”

BNY Mellon

On Numerai’s website, there’s a leaderboard showcasing the performance of data scientists and their models, revealing an average one-year return of 40.18%. As of the latest update, the top spot is claimed by data scientist Houdini, boasting a three-month increase of 15%, a yearly boost of 67.8%, and an impressive all-time gain of 516.7%.

The evaluation of AI models involves two metrics: Meta Model Contribution (MMC) and benchmark model contribution (BMC). MMC gauges a predictive model’s unique impact on the overall performance of a combined meta model. On the other hand, BMC assesses a model’s unique contribution but in relation to specific benchmark models rather than a composite meta model.

To put it simply, these scores measure how much the models contribute to the overall results of the entire meta model. Currently leading the one-year average MMC leaderboard is Koerrie304, with a 0.71% gain over the last 24 hours and a 4.8% increase over the last month. There are also models like JOS_XB_SMART showcasing a remarkable 504.9% yearly gain.

Read more: What are Telegram bots, and why are they popular in crypto community?