A leading crypto analytics firm says the largest whales in the industry are busy loading up on dollar-pegged digital assets.

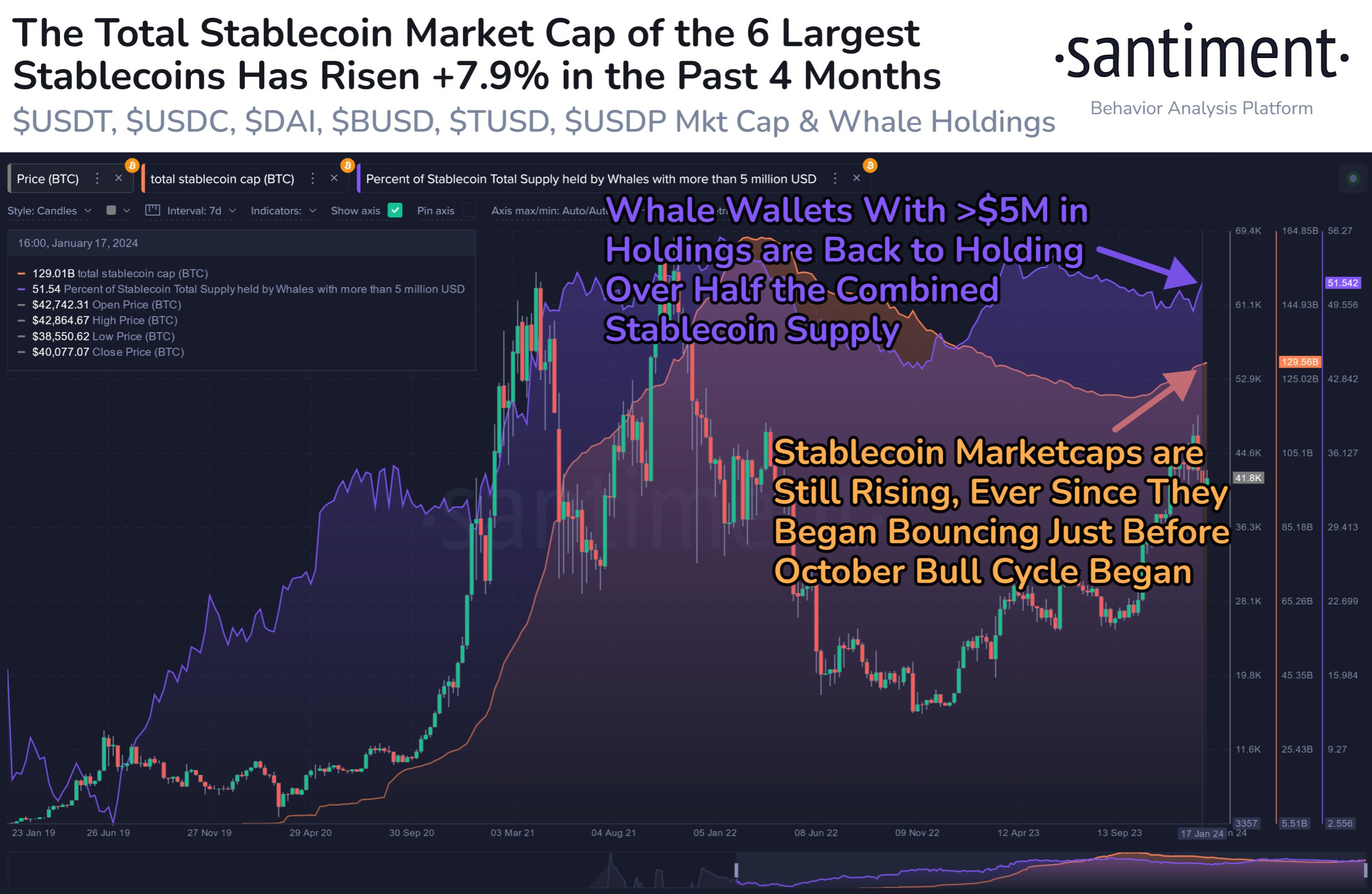

Santiment says on the social media platform X that the combined market capitalization of the six largest stablecoins including Tether (USDT), UDSC, Dai (DAI), BUSD, TrueUSD (TUSD) and Pax Dollar (PUSD) has risen by $9.42 billion in just four months.

The analytics firm also notes that the increase in the market caps of the dollar-pegged crypto comes as whales holding more than $5 million worth of digital assets gobble up massive amounts of stablecoins.

According to Santiment, the whales now hold more than half the combined stablecoin supply.

The analytics firm highlights that the rise in stablecoin market caps has bullish implications for crypto, calling it a “necessary ingredient” for the markets to witness more rallies.

Taking a closer look at the activities of USDT owners, Santiment says holders of the third-largest crypto by market cap are sending their dollar-pegged digital assets to exchanges. According to Santiment, the USDT inflows to exchanges suggest that the crypto markets are gearing up for more rallies.

“As Bitcoin’s and Ethereum’s respective supplies have continued moving off exchanges after the ETF (exchange-traded fund) approvals, an interesting development has been Tether seeing nearly 4% of its available supply come back to exchanges in five weeks.

The increase in buying power implies that the mid-term three+ month bull cycle (starting back in October) could still have some legs, particularly with just 79 days until the Bitcoin halving, estimated to occur on April 18th.”

The Bitcoin halving is a highly anticipated event as it is a time when the issuance of new BTC to miners gets cut in half.

At time of writing, BTC is worth $43,439, up nearly 3% in the past day.

Generated Image: DALLE3

dailyhodl.com

dailyhodl.com