One of the most widely read financial blogs, named XRP, is on the list of most important cryptocurrencies other than Bitcoin.

In the past year, XRP has slipped from among the top five cryptocurrencies by market capitalization. However, this has not stopped the popular financial blog Investopedia from naming the crypto asset as one of the most important ones for investors to know, aside from Bitcoin.

The Investopedia blog notes that its ranking was based on cryptocurrencies that have “held on throughout steep price climbs and nosedives.” It names Ethereum and Tether’s USDT stablecoin as the most worthy ones, with XRP coming in on third place.

Notably, the article breaks down the primary difference between XRP and other cryptocurrencies like Bitcoin, which runs a Proof-of-Work (PoW) consensus model, and Ethereum with its Proof-of-Stake (PoS) mechanism. Investopedia writes that XRP uses a different approach, as client applications send data to the XRP Ledger servers, where validators confirm and process them.

Beyond being a great education for newcomers to the crypto scene, the latest mention by Investopedia underlines XRP’s already established position among other altcoins. The XRP Ledger has been live since 2012, making it one of the oldest blockchain networks.

Meanwhile, a comparison of XRP of price action since the Investopedia article was published shows that investors may have realized some profit if they purchased XRP based on the recommendation.

XRP Topped $0.70 Since Investopedia Piece

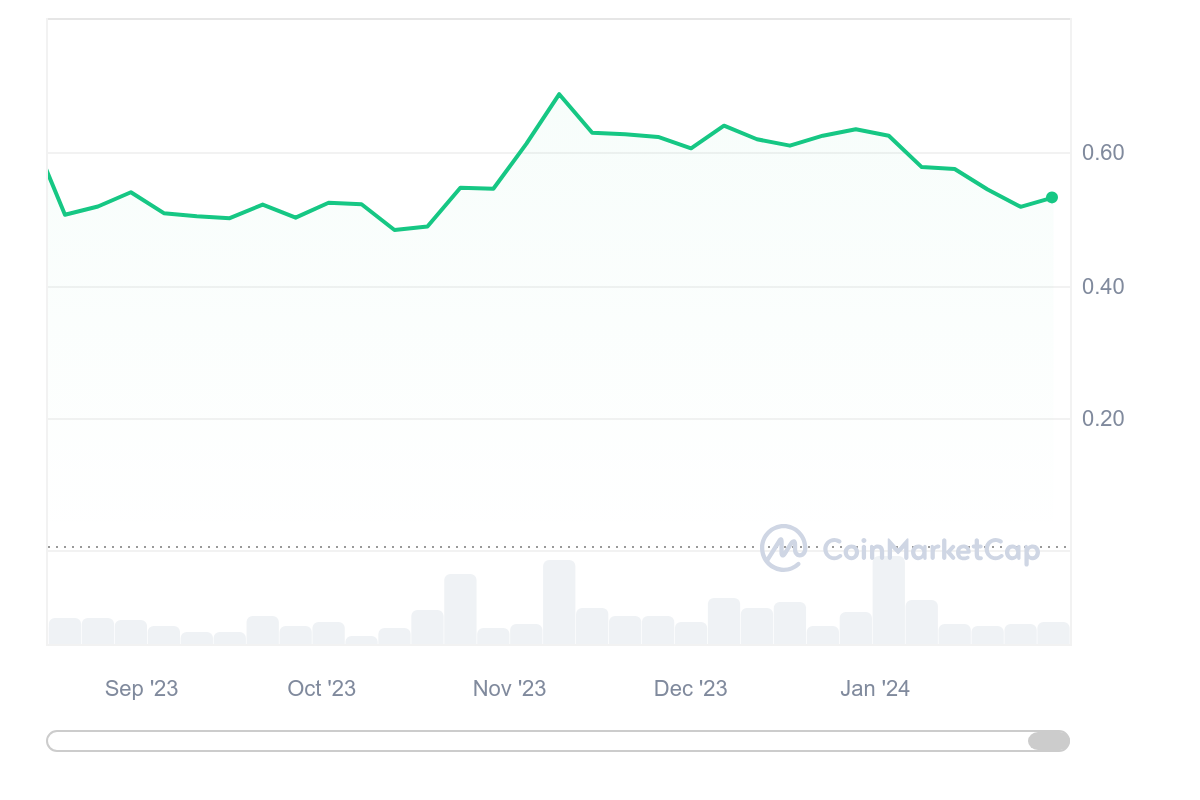

The price of XRP traded at an average of $0.51 on August 25, 2023, the same day Investopedia published the ranking of top cryptocurrencies other than Bitcoin. Since then, the cryptocurrency has seen a significant jump, soaring as high as $0.7 in the first week of November.

Although the cryptocurrency has since declined alongside the broader market, its press time price of $0.53 means an investor would still be in profit if they made an entry on the earlier date. Either way, positive mentions of XRP, especially in widely read publications, will likely continue to shape the public narrative around the cryptocurrency and pave the way for wider adoption.

thecryptobasic.com

thecryptobasic.com