Stare long enough and you’ll see all sorts of things in crypto price charts.

Trade volume patterns and fractal candles that seem to predict major pumps. Inverted cup-and-handles hover over your positions like a bad omen.

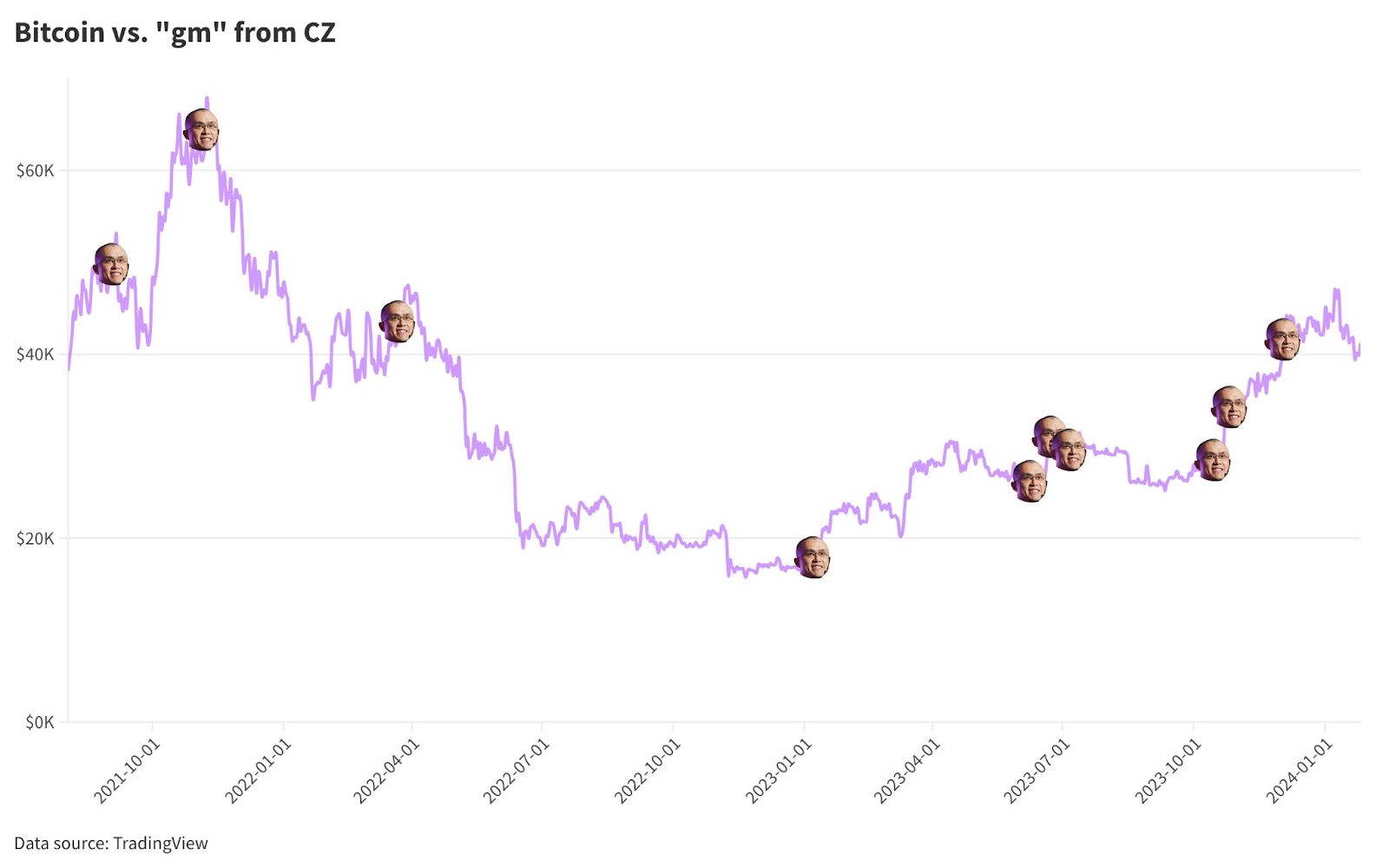

There’s then the odd correlation between X posts from Binance co-founder Changpeng Zhao and bitcoin’s price.

Bitcoin tends to go up after Zhao tweets “gm.” Although the subsequent rallies are often short-lived, it happens almost every time.

Good morning (gm) posts spread like wildfire five or six years ago. They were so popular on WhatsApp in India that one-in-three local smartphone users — many of which had only recently gained access to the internet — were running out of space on their devices every day, on account of the fact that each “gm” was usually accompanied by a slapdash image of beaches, roses or sunrises over mountain ranges.

The habit has persisted in crypto as wholesome engagement bait and Zhao has so far shared posts containing “gm” 10 times over the past two years or so.

- Bitcoin rose between 3% and 40% in the days following each gm.

- A post last July about Threads, Meta’s answer to X, which started with “GM” is so far the only exception.

- Bitcoin slipped about 1% shortly after but did reach more than 3% higher in the following two days.

CZ’s first gm. Bitcoin was worth $50,000

The correlation between Zhao’s “gm” and bitcoin’s price has been so strong that it was possible to base a dollar-cost averaging strategy around the former Binance CEO’s Twitter timeline.

Hypothetically, buying $1,000 worth of bitcoin every time Zhao tweeted “gm” would’ve accumulated 0.31 BTC ($13,000) for $10,000 — almost 25% unrealized profit.

Bitcoin has fallen more than 20% over the same period. So, Zhao’s “gms” have outperformed bitcoin by nearly double.

Stacking sats at the end of every month, a pureplay dollar-cost averaging strategy, would’ve made only marginally more than buying alongside Zhao’s “gms,” netting about 0.346 BTC ($14,500).

All this only goes to show that timing the market, whether by superstition, technical analysis or some other prediction, can easily go wrong.

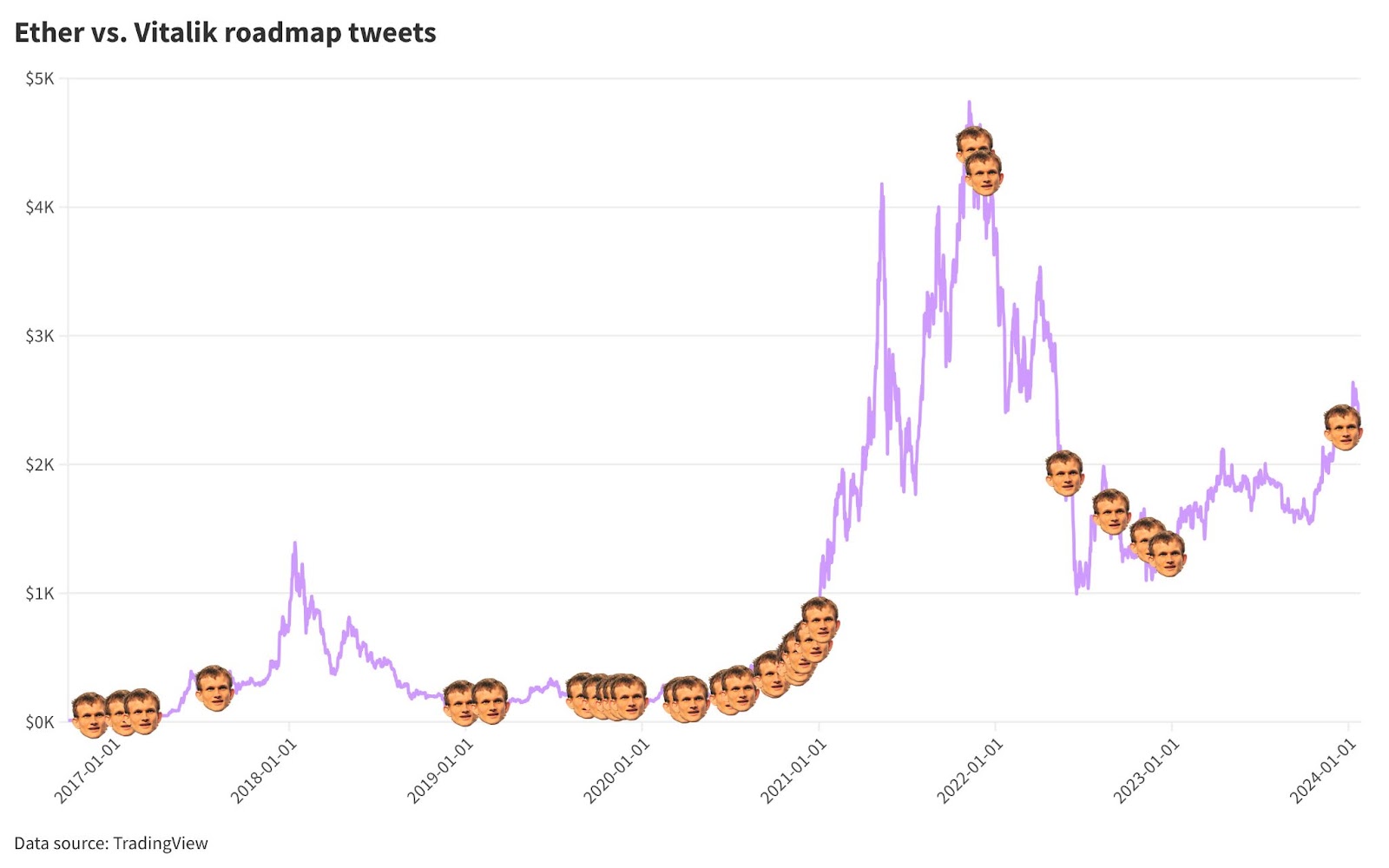

Vitalik tweets a lot about Ethereum’s roadmap

One way it would’ve easily gone right would’ve been to snap up $10,000 worth of ether (ETH) shortly after Vitalik Buterin ever tweeted about Ethereum’s roadmap.

Ethereum’s roadmap is something of a meme, mostly due to the years of delays surrounding the blockchain’s switch to proof-of-stake and the sprawling nature of the diagrams shared by Buterin.

Buterin has tweeted about Ethereum’s roadmap 29 times since 2016 (not counting any posts that may have been deleted over time).

Buying $10,000 worth of ether shortly after his first roadmap post would’ve got you about 888 ETH — now worth $2 million with unrealized gains of 20,000%.

Although that probably had more to do with time in the market than timing the market, albeit with some degree of luck.

Dollar-cost averaging the same amount into ETH each time Buterin tweeted about the roadmap would have otherwise returned 2,500%.

Doing the same at the end of every month since 2016 would get about two-thirds of those gains.

For what it’s worth, Buterin has tweeted “gm” only once, in March 2021 with an attached image of a “beautiful field full of flowers.”

Any still-held positions taken alongside Buterin’s gm would be down 16%, on account the post was made in the midst of an aggressive bull run which ETH is yet to run back.

All these scenarios are purely fun ways to express that correlation does not always mean causation.

Basing investment decisions on spurious signals like the wording of social media posts is not a legitimate strategy and any implication otherwise is only for entertainment. Sometimes dumb strategies pay off — a dart-throwing chimpanzee, a camel and other primates have previously beaten swathes of US funds for returns.

We know social media and news headlines (real or fake) can impact crypto markets, but the likelihood of real connection between Zhao’s gm posts and the prices of bitcoin are basically zero.

Buterin’s roadmap posts may contribute to the transparency of Ethereum development — boosting value proposition in some tangential way — but any effect is practically unmeasurable.

As for the debate between dollar-cost averaging and lump-sum investments, check out these academic studies or even these reports from major investment banks.

blockworks.co

blockworks.co