A 3% jump in crypto’s total market cap signaled broad market gains, with Bitcoin weathering reduced sell pressure from Grayscale GBTC ETF outflows.

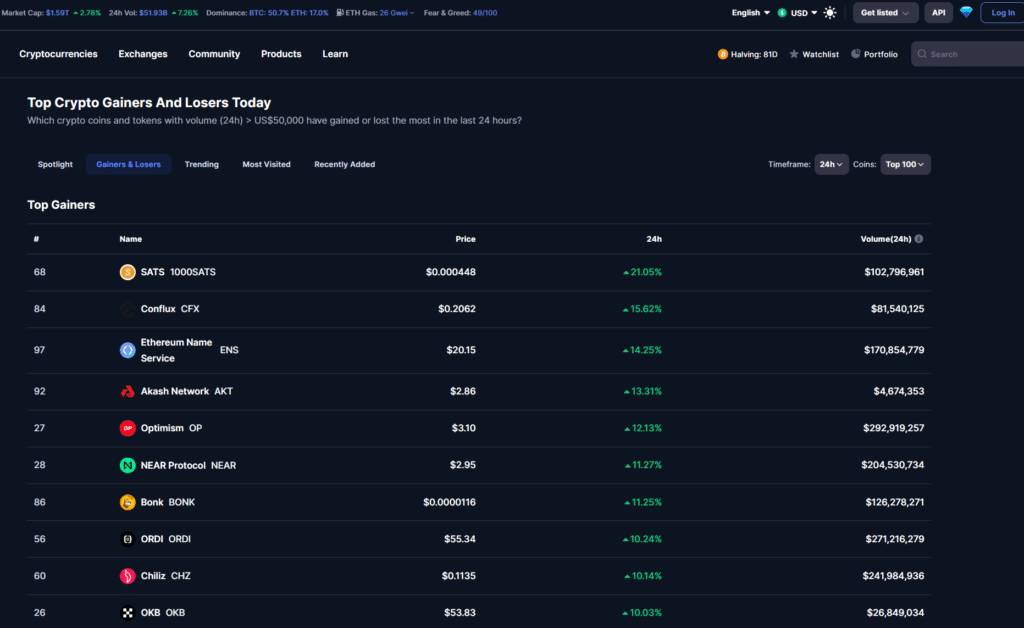

Bitcoin’s (BTC) charge above $41,000 on Jan. 26 bolstered market sentiment, triggering price appreciations for hundreds of cryptocurrencies. According to CoinMarketCap, some 10 tokens saw double-digit price increases in the last 24 hours.

Tokens include Bitcoin BRC-20 token 1000SATS (SATS) with a 21% jump. Conflux (CFX), the so-called ‘China’s Ethereum’ gained over 15% in second, while Ethereum Name Service (ENS) followed closely, increasing by 14%.

Conflux announced a Bitcoin L2 expected by mid-year. ENS received plaudits from Ethereum co-creator Vitalik Buterin in early January.

Akash Network (AKT), Optimism (OP), Near Protocol (NEAR), Bonk (BONK), ORDI, Chiliz (CHZ), and OKB also featured among the day’s top gainers.

Bitcoin sell-off over?

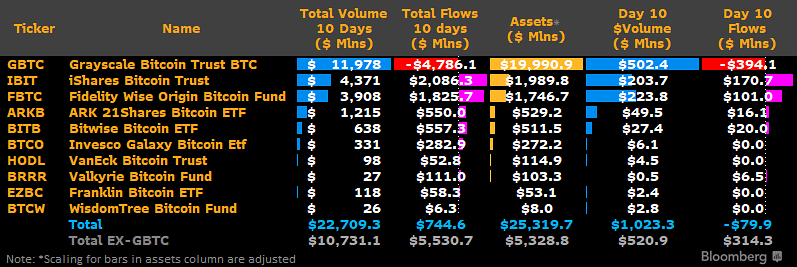

Consecutive negative net flows for Grayscale’s GBTC exchange-traded fund may be slowing down crypto.news reported, citing analysts at JPMorgan. The data suggests that profit-taking, most likely from arbitrageurs trading GBTC’s net asset value discount, has already occurred around $3 billion in outflows.

The FTX estate under CEO John J. Ray III also offloaded $1 billion or so in Grayscale converted Bitcoin ETF, accounting for over $4 billion shed by GBTC in just over two weeks. Bloomberg expert Eric Balchunas predicted a 25% drop in Grayscale’s BTC ETF market cap. GBTC holds over $20 billion in value and Bitcoin.

Rotation into ETFs with lower fees may have occurred as well. Grayscale charges an industry-high 1.5% fee; the competition offers much lower fees, around 0.21% to 0.35% after fee waivers.

FWIW @JSeyff and I are both in the 25% range but this is not something i'd be a sushi lunch over, too many unknowns

— Eric Balchunas (@EricBalchunas) January 23, 2024

Read more: JPMorgan reports GBTC sell declining, highlights ETF record outflows