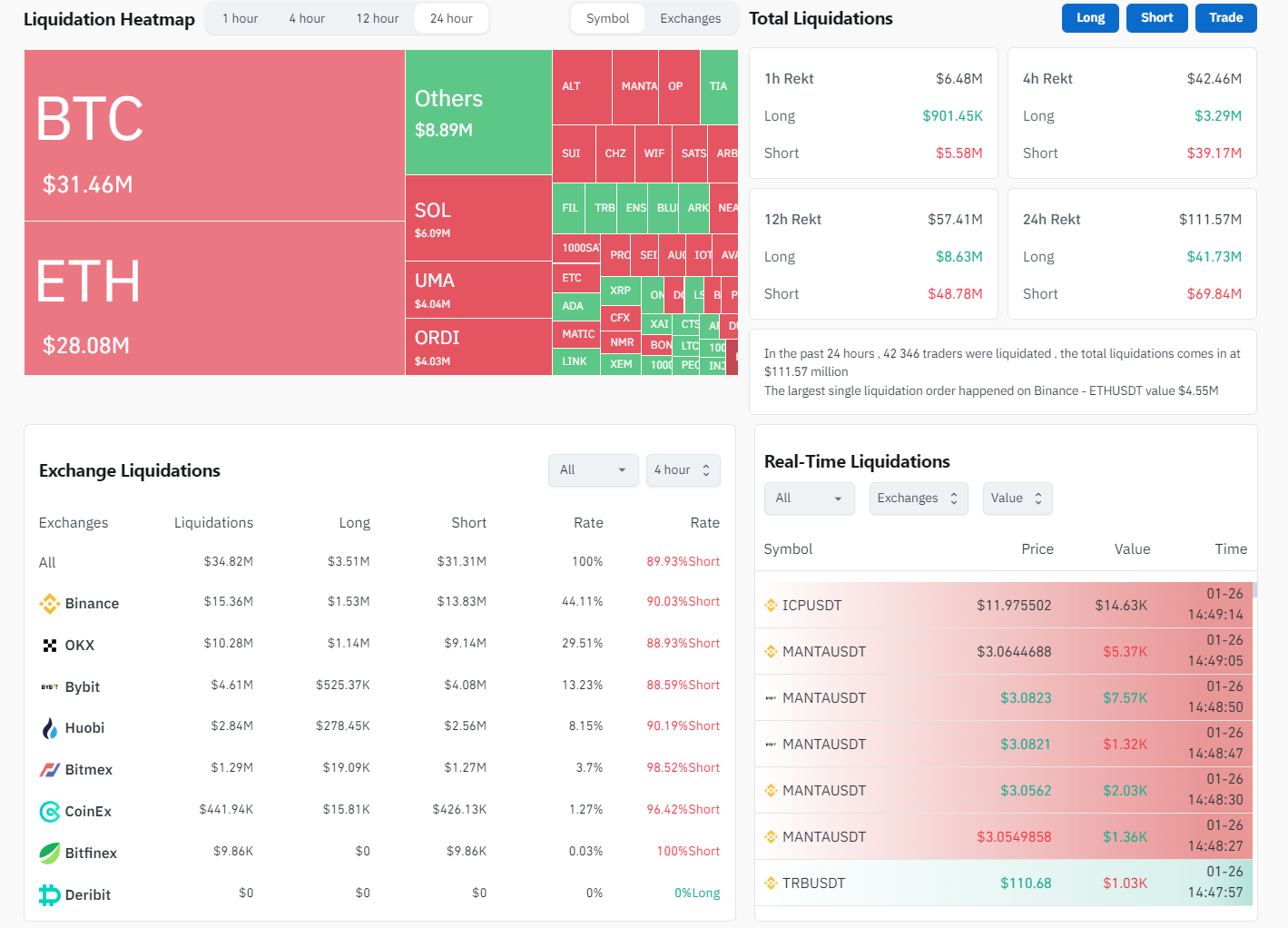

The cryptocurrency market is witnessing a strong bullish momentum as Bitcoin and Ethereum bulls start to assert control. In a significant development, shorts worth approximately $60 million have been liquidated, signaling a potential shift in market sentiment as we approach the weekend.

Analyzing the current charts, Bitcoin has demonstrated resilience, managing to sustain above the crucial support level of $40,000. The coin has recently experienced a rebound from this level, which has historically acted as a strong psychological barrier for both bulls and bears.

If BTC maintains its position above this support, the next key resistance to watch will be around $42,000, a level where we might expect some consolidation before a further push. On the downside, if the $40,000 level fails to hold, traders should look for potential support near the $38,500 region.

Ethereum, on the other hand, is also showing signs of recovery after a recent sell-off. The coin has found support near the $2,100 mark, just above the 200-day exponential moving average, which is often considered a significant indicator of long-term trends.

If ETH can sustain this rebound, the immediate resistance is expected at $2,400. A breakthrough above this could open the path toward $2,500, a level that previously acted as both support and resistance. A fall below the current support level could see the price testing the next support zone around $2,000.

The liquidation heatmap provides additional context, illustrating the pressure on short sellers as the market moves against their positions. This liquidation is particularly evident in the case of Bitcoin and Ethereum, which have seen a significant number of short positions being closed in a short span of time. Overall, the market is currently displaying bullish signs, with strong support levels holding up.

u.today

u.today