The general cryptocurrency market is experiencing bearish sentiments, led by Bitcoin (BTC), which is struggling to maintain its price above the $40,000 mark. Although the markets appear grim, proponents maintain that there is upside potential, banking on factors such as the Bitcoin halving.

Despite the current market sentiments, several projects will likely experience notable price growth and target new resistance levels in 2024. With a focus on the $10 level, Finbold has identified the following three cryptocurrencies likely to attain this value in 2024.

Filecoin (FIL)

Filecoin (FIL) tackles the ever-growing demand for secure and cost-effective data storage. Its decentralized network offers an alternative to traditional cloud storage platforms, promising enhanced security, lower costs, and user control.

As awareness of data privacy concerns rises and Web3 applications gain traction, Filecoin’s unique value proposition could propel FIL toward the $10 mark. The token will likely receive a boost if the overall market turns bullish.

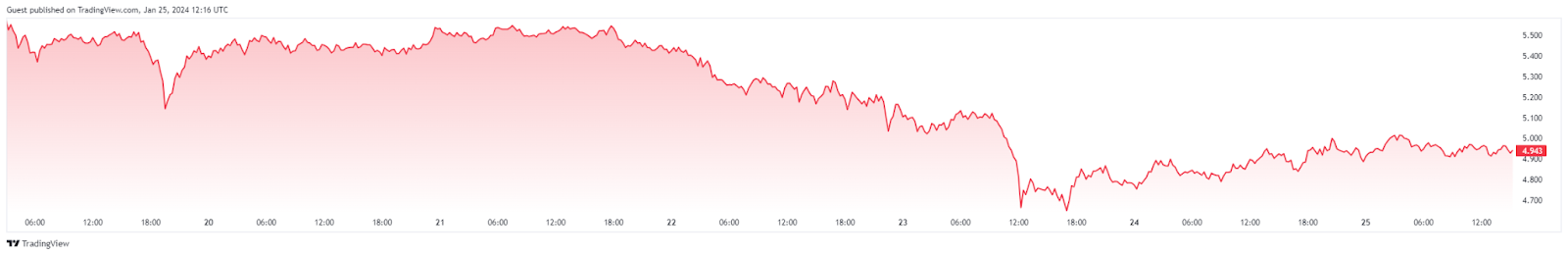

Notably, FIL had a stellar run in 2023, but the recent market downturn has impacted the token. In the last seven days, the token has plunged by 15% to trade at $4.96 by press time. Indeed, reclaiming the $5 support zone is key.

Lido DAO (LDO)

Lido DAO (LDO) simplifies participating in Proof-of-Stake (PoS) blockchains like Ethereum (ETH). By pooling user funds, Lido allows anyone to earn staking rewards without the technical hurdles of running their own validator nodes.

This accessibility, coupled with Lido’s growing influence in the Ethereum ecosystem, positions LDO as a potential frontrunner in the DeFi space, paving the way for a potential surge in its price.

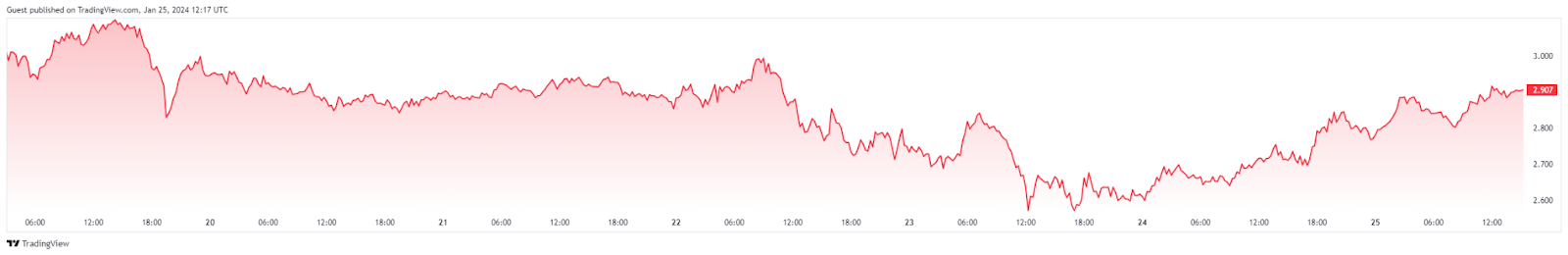

By press time, LDO was trading at $2.91 with daily gains of about 7%. Meanwhile, on the weekly chart, LDO is down over 7%.

Arbitrum (ARB)

Ethereum, the leading blockchain platform, often struggles with congestion and high transaction fees. Arbitrum emerges as a Layer 2 scaling solution, offering faster and cheaper transactions while inheriting Ethereum’s robust security.

As DeFi activity continues to boom on Ethereum, Arbitrum’s ability to alleviate scalability woes could attract a wave of users, driving up demand for ARB.

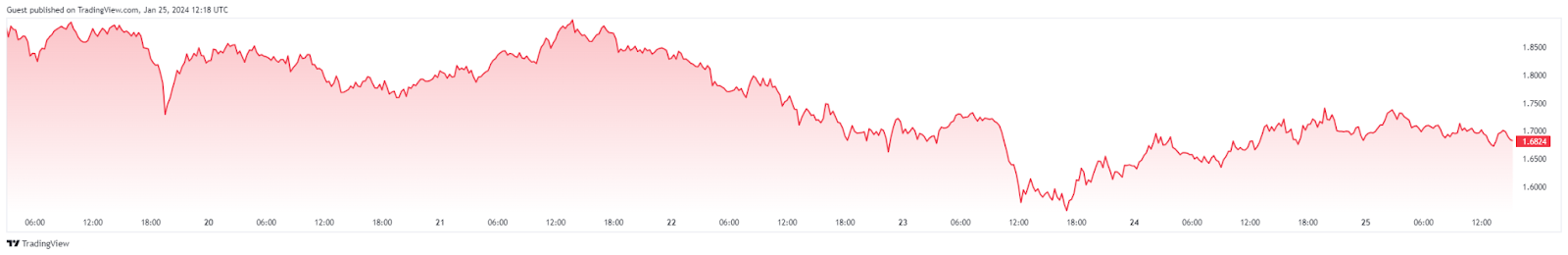

By press time, ARB was trading at $$1.69 with weekly losses of 13%.

In conclusion, reaching $10 is not guaranteed, as various factors, such as volatility and unforeseen events, influence the crypto market. However, the underlying trends in decentralized storage, DeFi accessibility, and Ethereum scalability paint a promising picture for FIL, LDO, and ARBI.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com