Terra Classic (LUNC) experienced a massive sell-off, losing nearly two-thirds of its capitalization from December 2023. With that, LUNC left the top 100 cryptocurrencies ranked by market cap, sitting among the underdogs.

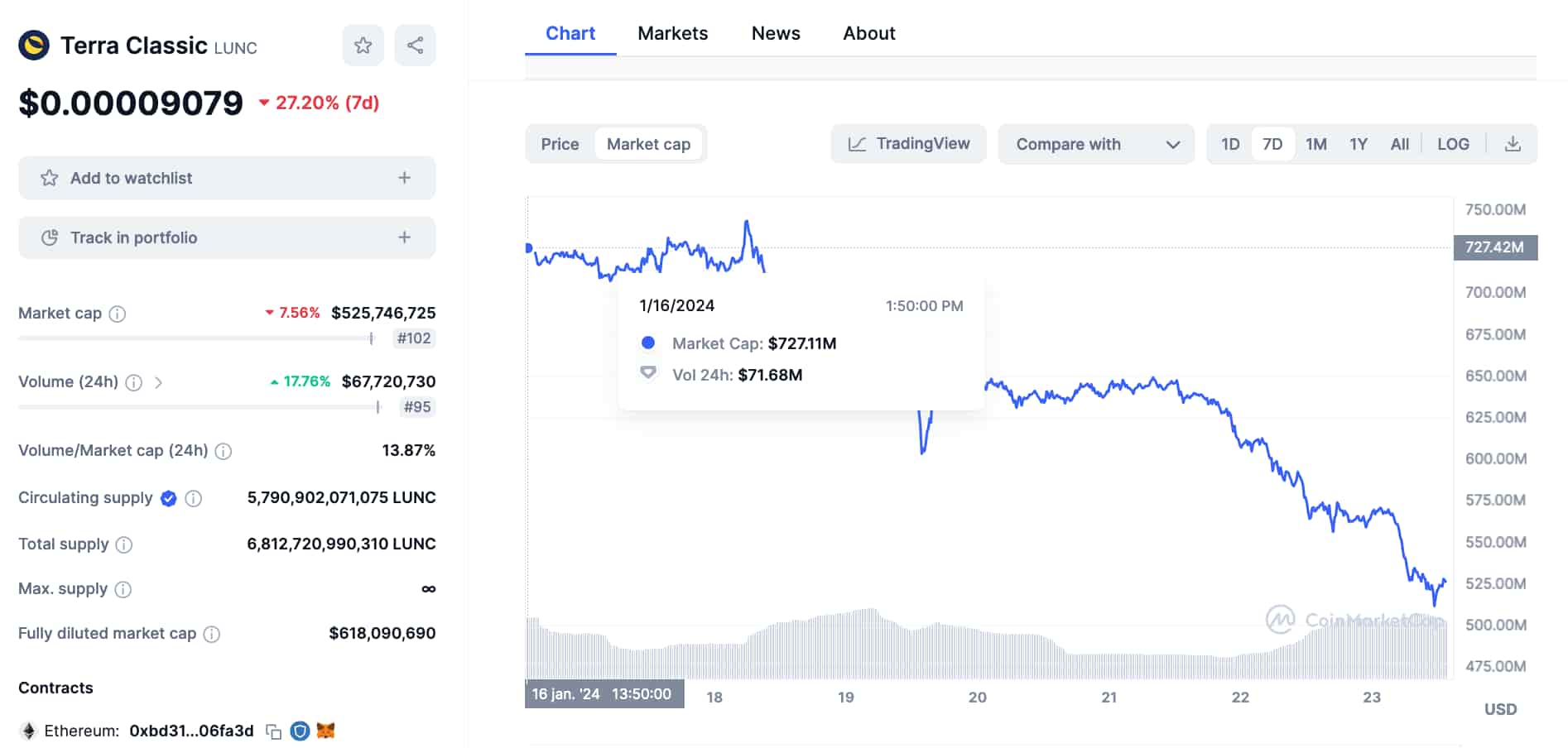

In particular, LUNC shows a $525.74 million capitalization on January 23, trading at $0.0000908 by press time. This represents a drop of $200 million in the cryptocurrency market value in one week. On January 16, the token had a $727.11 million market cap, according to CoinMarketCap.

Notably, Terra Classic reached a $1.5 billion market cap peak on December 4. This bull rally happened amid overall enthusiasm for altcoins. However, it was a short surge for LUNC, which experienced a huge sell-off event just a few weeks later.

Sell-off: Terraform Labs filed for bankruptcy under Chapter 11

In the meantime, Terraform Labs, creator of TerraUSD, declared Chapter 11 bankruptcy in the U.S., court documents revealed Sunday. The Singapore-based firm filed for bankruptcy in Delaware, citing assets and liabilities between $100-$500 million.

This recent news could have affected the Terra Classic ecosystem and LUNC investors’ confidence. Moreover, the whole crypto market is experiencing a downfall, hitting LUNC even harder due to the bankruptcy filings.

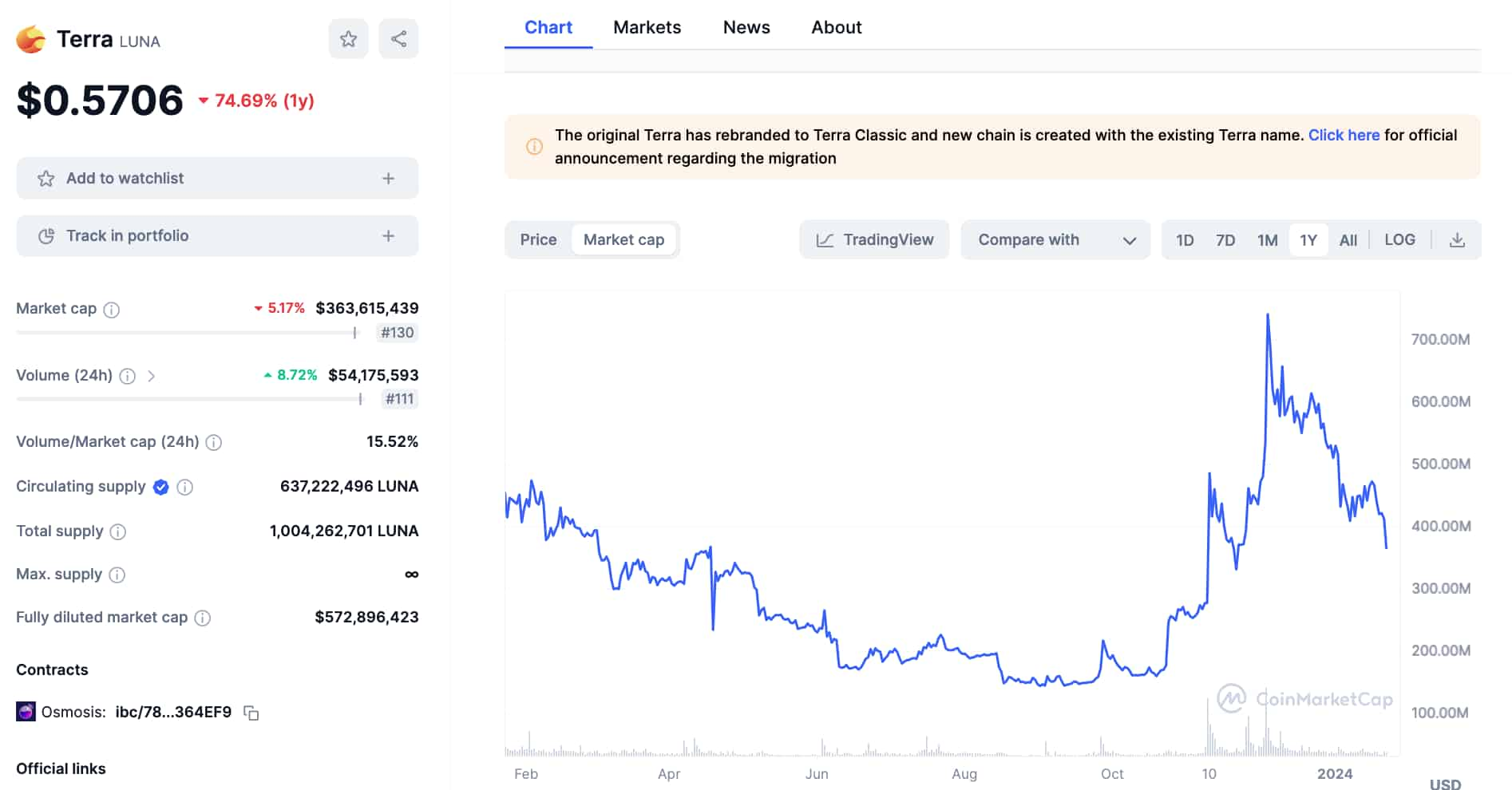

Interestingly, Terra (LUNA) has experienced over half its market cap losses in the same period. LUNA currently trades at $0.5706 with $363.61 in capitalization at the 130th position. Both cryptocurrencies now have an uncertain future.

All in all, the project faces another huge public relations challenge, with no guarantees that it will regain its strength. The price may continue falling moving forward. Therefore, investors must act cautiously while LUNC’s community calls for “buying the dip.”

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com