The crypto market has been in a continuous bearish trend since the emergence of crypto ETFs, with market participants searching for reasons to remain optimistic amid the prevailing red candles.

In a recent post on X, the popular YouTube channel Crypto Banter drew attention to an emerging development traditionally known to be a bullish signal. Specifically, Crypto Banter cited statistics from renowned analytic firm Glassnode on the unfolding trend in the stablecoin landscape.

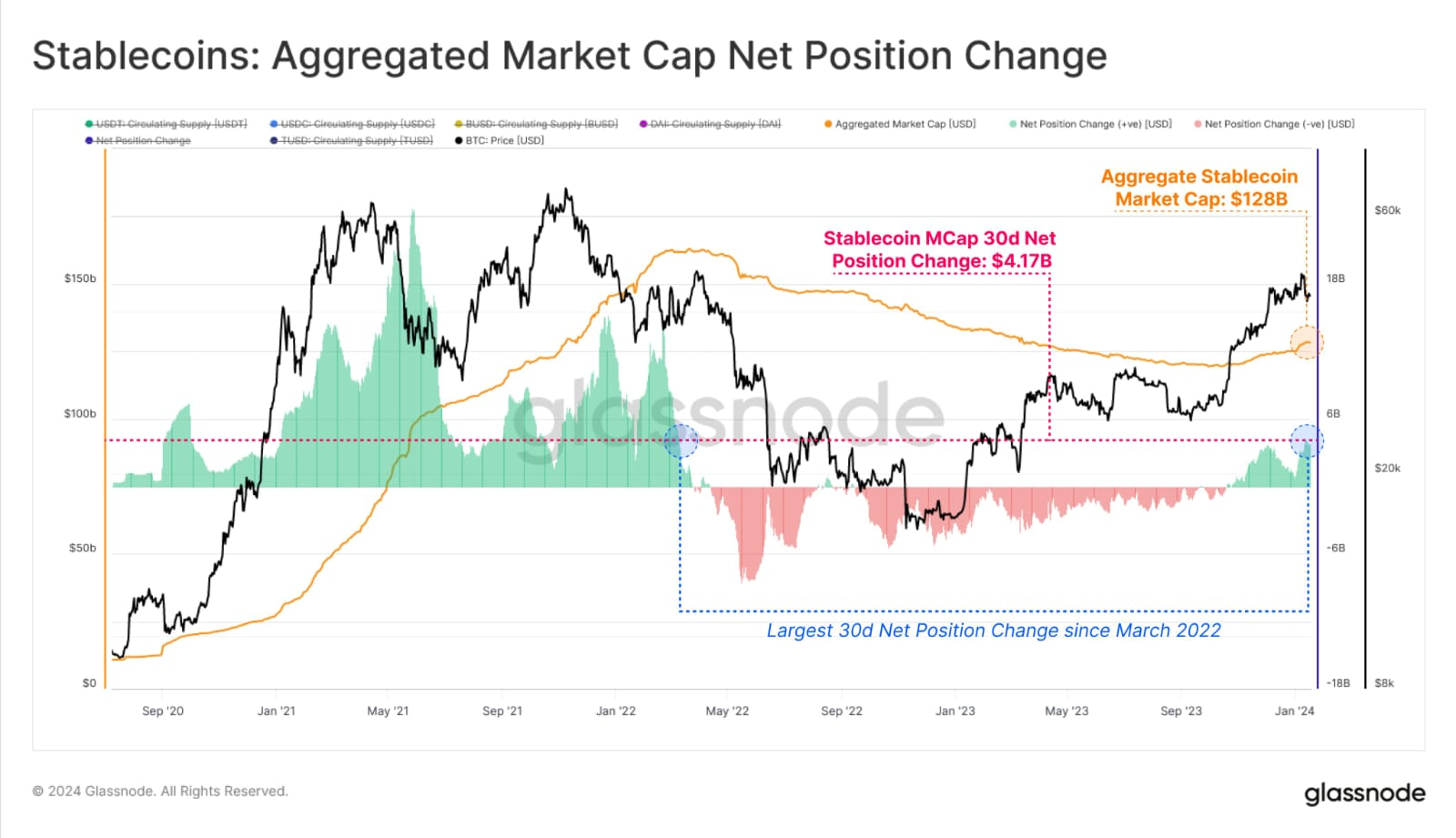

Glassnode data revealed that the supply of stablecoins has soared to a new yearly high this month. In particular, the report indicated that the overall valuations of stablecoins clocked $128 billion at the time of the disclosure. However, the figure has since increased to over $134.3 billion, per real-time data from CoinMarketCap.

Furthermore, the Glassnode report noted that the surge in stablecoin supply followed a significant rise of $4.17 billion in the market cap’s 30-day net position change. In other words, over $4 billion entered the crypto market in the past month via stablecoin.

According to the analytic report, the 30-day inflow represents the most substantial net position change since March 2022.

Notably, Crypto Banter understated that the surge in stablecoin supply directly translates into a significant increase in liquidity or funds readily available to be invested in volatile tokens. According to the analyst, it sets the stage for a bullish market, attracting more participants and propelling prices to new highs.

Furthermore, before the new observed trend, the net flows into stablecoins were negative, as depicted in the chart. Additionally, the chart illustrated that stablecoin’s all-time high inflow mirrored the crypto market’s peak in 2021. It also reflected the bearish trend that followed.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com