In recent weeks, the market has observed a notable decline in Theta coin price, with a marked decrease in trader interest. The sentiment is increasingly bearish, evidenced by a sharp drop in Open Interest. Over the next few hours, there’s a risk that Theta coin will fail to maintain buyer confidence, potentially leading to a significant drop in its price.

Theta Coin Faces A Decline In Open Interest

According to Coinglass, Theta coin witnessed a liquidation due to the recent market volatility. Data shows that the total liquidation surpassed $78K worth of positions, out of which buyers liquidated $44K and sellers liquidated $34K worth of positions.

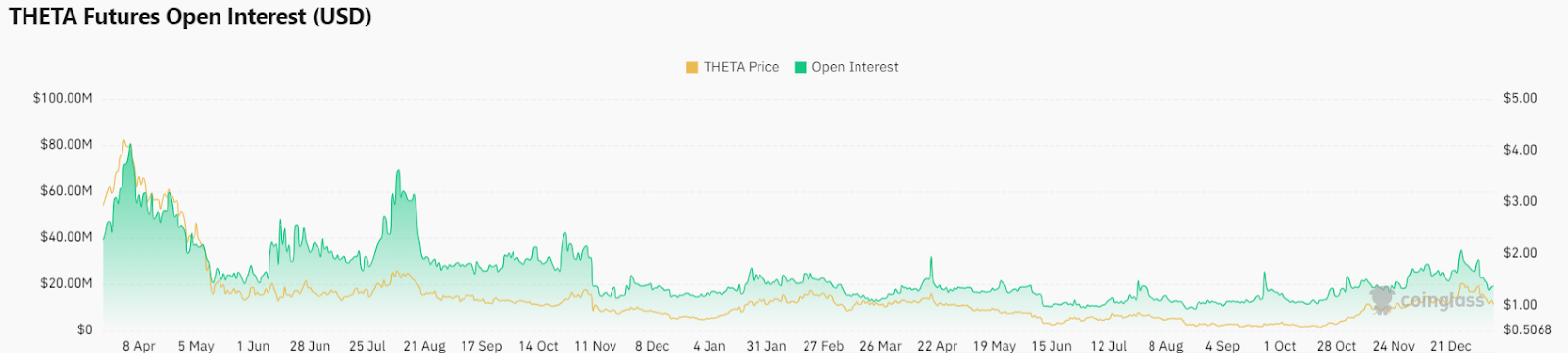

Additionally, there has been a notable decline in the open interest as traders’ interest decline in recent days. Open interest refers to the total number of outstanding derivative contracts, such as futures and options, that have not yet been settled.

A decline in open interest typically signifies a reduction in trading activity and can be seen in various ways. In a bearish market scenario, decreasing open interest indicates that investors are closing their positions due to uncertainty or negative sentiment, leading to a decrease in the Theta’s price. It can also suggest a lack of new money entering the market, which is essential for sustaining or increasing the value.

Conversely, in a bullish market amid SEC’s pending decision on ETFs, declining open interest might signal that the Theta market is consolidating before a potential upward move. Declining open interest can also affect the liquidity of the coin. Lower liquidity means fewer buyers and sellers in the market, which can lead to increased price volatility.

In such a scenario, even small trades can have a disproportionate impact on the altcoin, making the market more susceptible to sharp, unpredictable movements.

What’s Next For Theta Price?

Theta price has experienced a significant downturn over the past few days, indicating a rapid exit by bullish investors.

The bulls are likely to attempt halting this downward trend at the 20-day EMA (Exponential Moving Average), valued at $1.052. However, bears continue to defend this level. A robust rebound above the 20-day EMA would imply that the market sentiment is still bullish and traders are seizing the opportunity to buy during these dips. Following this, the bulls might try to drive the Theta price towards the moving averages and hold above $1.2.

However, there is a risk involved in this scenario. The Relative Strength Index (RSI) has shown a negative divergence, a sign of bearish momentum. Should the price fall and consistently close below the 20-day EMA, it could indicate that the current uptrend might be losing steam in the short term.

The moving averages have undergone a bearish crossover, and the RSI is currently trading at level 38, pointing to a short-term trend that favors bearish sentiment. A drop below $0.9 could see the price potentially plummeting to $0.85, and then further down to $0.6.

For the bulls to signal an end to this correction, they need to push and maintain the price above the $0.9 level and moving averages. Achieving this could initiate a rise towards $1.2 and possibly extend to $1.4. However, this level might again face stiff resistance from bearish sellers.

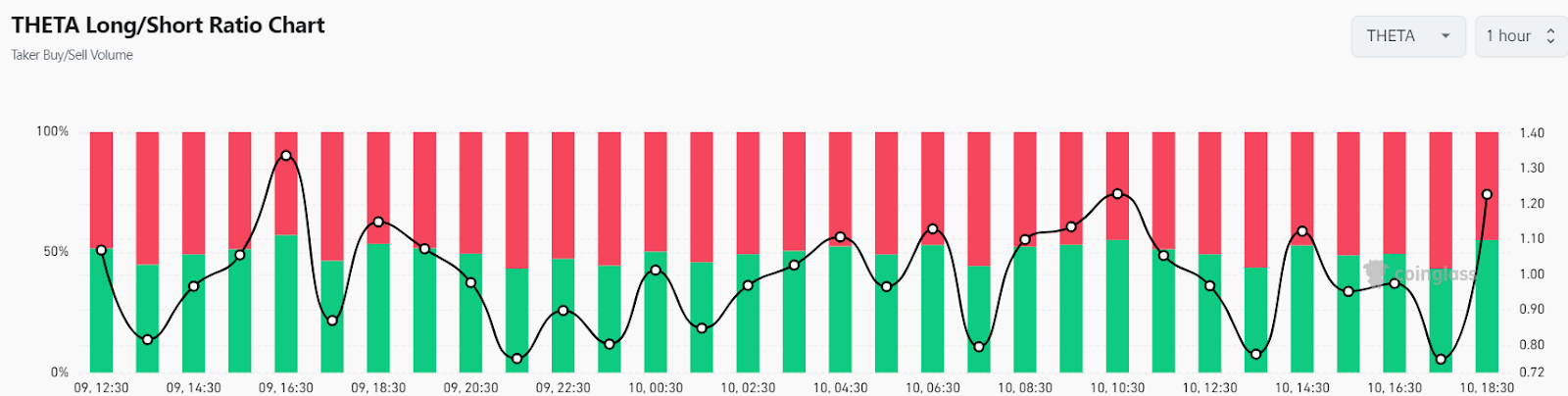

However, the long/short ratio is currently turning bullish as the ratio now trades above 1, currently trading at 1.2277. This suggests that bullish dominance is currently surging as 55% of total positions now expect a surge in Theta coin price chart.