Bitcoin dipped to almost $43,000 over the past 24 hours but has managed to erase most losses and currently stands close to $44,000 once again.

In contrast, most alternative coins continue to bleed out, with ADA, MATIC, UNIS, and SHIB losing more than 5% daily once again.

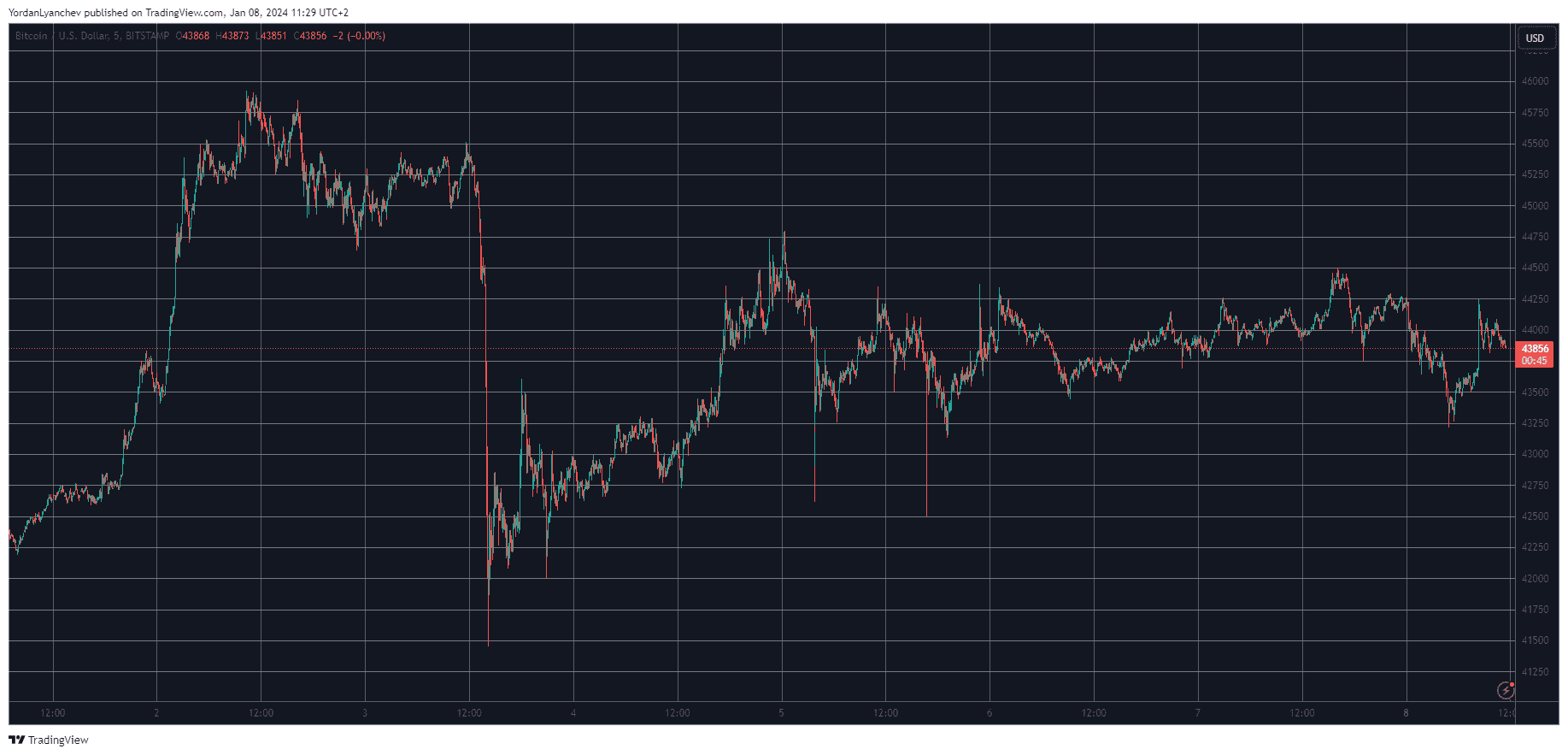

BTC Calms at $44K

The primary cryptocurrency faced enhanced volatility at the start of the new year, with a massive price surge to almost $46,000 on Tuesday and a violent rejection a day later that pushed it south by nearly five grand.

This all came amid ongoing reports on whether or not the US Securities and Exchange Commission will indeed approve a spot Bitcoin ETF. As most experts refuted the FUD that the agency plans to reject all current applications, BTC started to recover and jumped above $44,000 by Thursday.

However, it failed there and dipped a few more times by the end of the week. Once the weekend arrived, BTC had calmed and has since remained in a tight range between $43,250 and $44,500.

As of now, the asset stands close to $44,000. Its market capitalization remains around $860 billion, while its dominance over the altcoins has further increased to 52.7% on CMC.

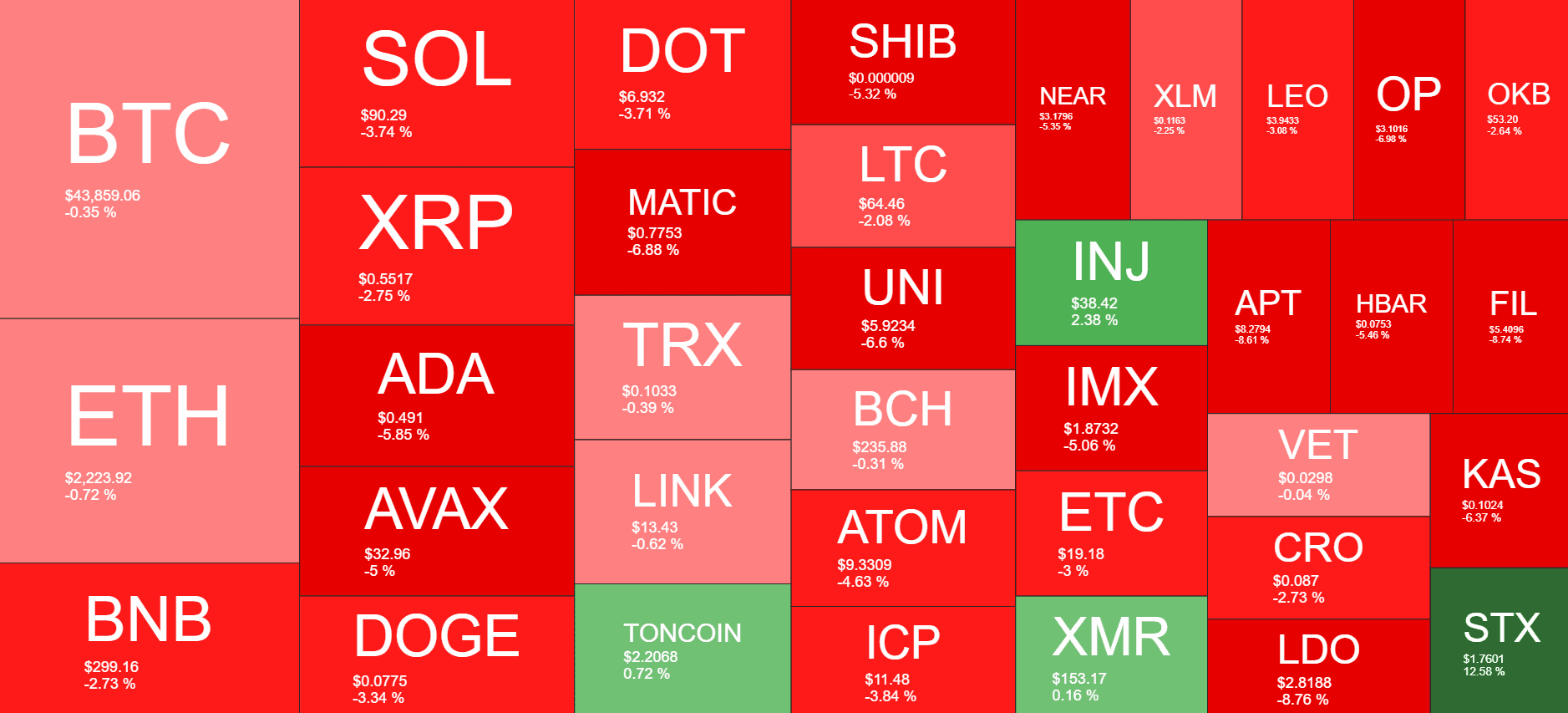

Alts See Red, Not STX

Most alternative coins have charted losses today once again. Cardano, avalanche, Polygon, Uniswap, and Shiba Inu lead the adverse trend, with losses of up to 7% in the case of MATIC. Solana has slumped to $90, XRP is down to $0.55, and BNB has slipped to just under $300.

ETH, TRX, LINK, and BCH are also in the red, albeit in a less painful way. Stacks is the only top 36 altcoin with a noteworthy price increase. STX has soared by 13% and sits at $1.75.

The total crypto market cap has seen about $20 billion gone daily once again. The metric is down to $1.630 trillion on CMC. Recall that it had soared to over $1.760 trillion after the price increases last Tuesday.

cryptopotato.com

cryptopotato.com