Maker (MKR) has experienced a remarkable bullish trend since June, skyrocketing by as much as 300% to its current levels. This surge has caught many traders off guard, especially in a market that is still recovering from the 2022 crash. In the past 24 hours, the price of MKR has shattered its previous bearish patterns, climbing to new heights after several months and significantly boosting its on-chain metrics. Nevertheless, there is growing concern about a possible selloff, as buyers currently hold a substantial profit margin with MKR’s price.

Historical Profitable Addresses Touch 2-Year Peak

For an extended period, MakerDAO has consistently held a robust position in the DeFi sector. Its significant influence in the market is largely due to its native token, MKR, and its stablecoin, DAI. This strong performance and market dominance have led many analysts to express bullish bets on MakerDAO’s price, forecasting that the company is poised to generate sustainable profits in 2024.

With the anticipation of the SEC’s decision on a spot Bitcoin ETF looming, set to be announced by January 10, the market has already begun to witness a significant upturn since the start of the new year. This positive momentum has sent both BTC and ETH to break through their key resistance levels, reaching $45,000 and $2,400, respectively. Consequently, rising altcoins like Maker are experiencing strong gains this week.

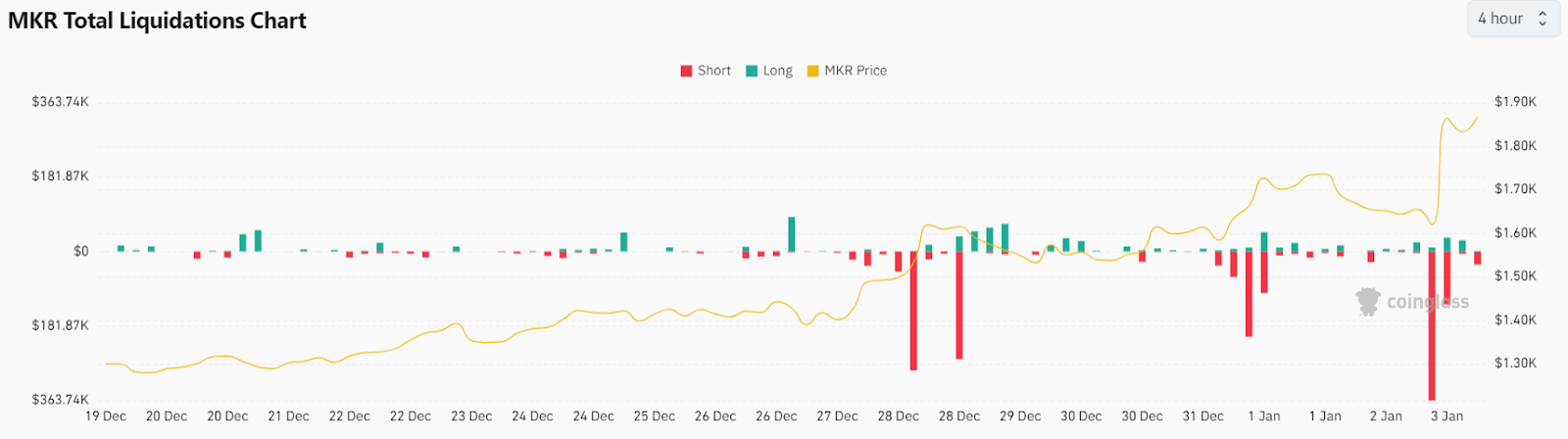

Data from Coinglass reveals that Maker’s climb from a low of $1,826 to a high of $1,928 has triggered a substantial wave of liquidations. At present, over $500K in short positions have been sold off, as MKR’s unexpected rise countered the bearish predictions of sellers.

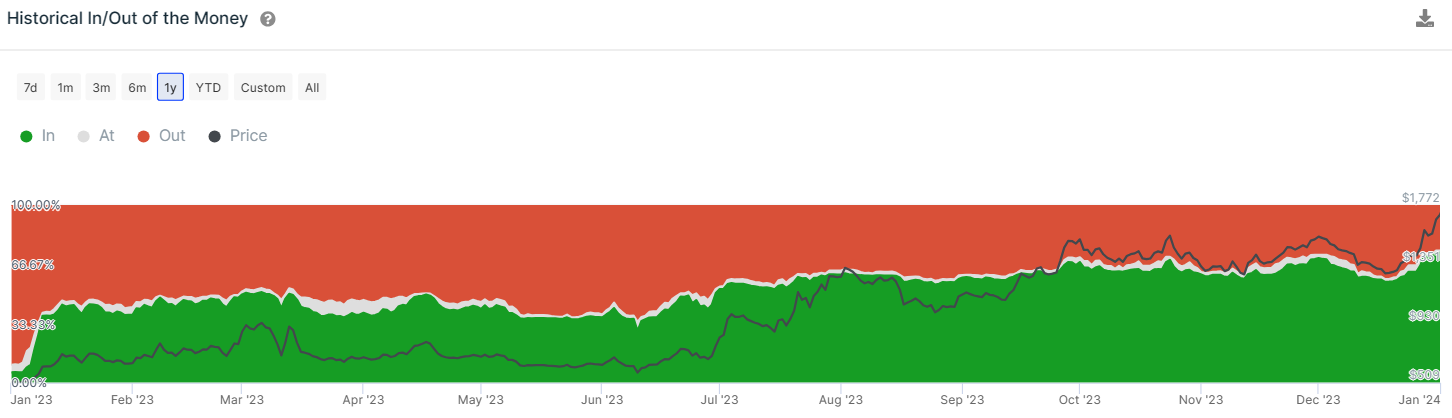

Interestingly, an increase in profitable addresses could lead to both bullish and bearish outcomes for Maker’s price. According to IntoTheBlock data, addresses in profit are at a two-year peak, now standing at 74% or 69,400 addresses. This uptick might boost bullish sentiments for Maker, as confident holders may accumulate more coins expecting further increases, potentially bringing buying pressure.

Conversely, these holders, now in a position of significant profit, might opt to liquidate their holdings to explore other top altcoins, given Maker’s lower volatility recently. This shift in strategy could lead to selling pressure, particularly around the $2,000 resistance level.

Will MKR Price Touch $2,000 Resistance?

Maker price gained solid buying pressure and continued to break immediate Fib channels. However, bears were active around a minor resistance at $1,930 as selling pressure intensified. Sellers are currently attempting to defend a surge above the ascending resistance channel; however, bulls continue to accumulate more near price dips. As of writing, MKR price trades at $1,860, surging over 13.1% from yesterday’s rate.

One positive for the bulls is their ability to prevent MKR price from dropping below the 20-day Exponential Moving Average (EMA) at $1,723. Nonetheless, there’s a risk of intensified selling if the price doesn’t break back above the channel soon.

The overbought RSI can soon call a correction for Maker. Should the 20-day EMA be breached, the MKR price might fall to the support zone of $1,460-$1,590. Conversely, a successful break and close above the channel would indicate that the bulls are still in the game. This could lead buyers to attempt pushing the price beyond $2,000-$2100, aiming for an uptrend toward $2,600.

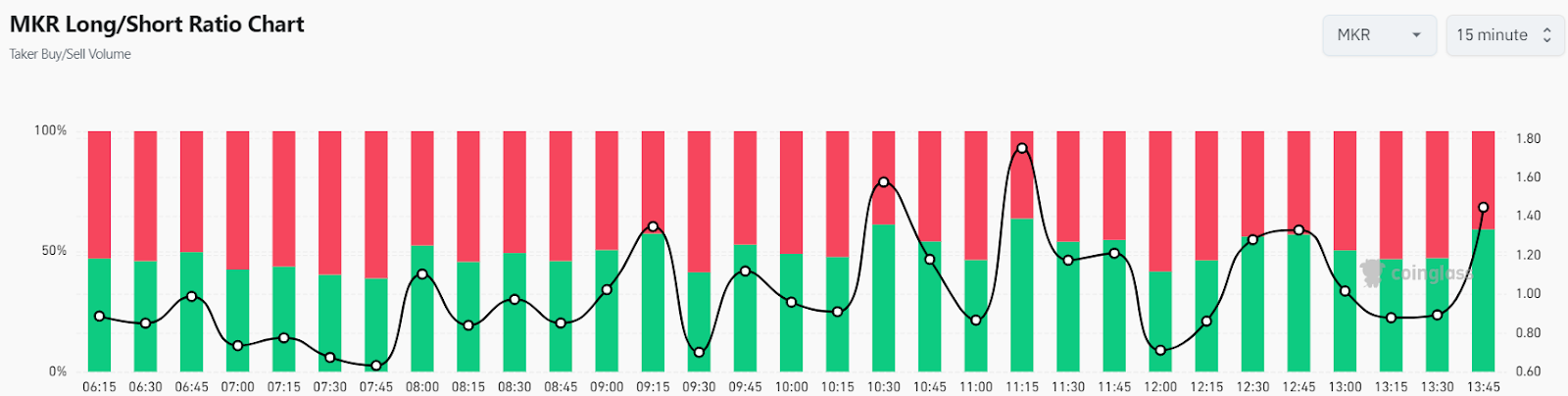

On the 15-minute chart, the ratio of long to short positions is shifting towards a bullish trend, presently at 1.448. This indicates a growing bullish control, with more than 59% of positions being long. Conversely, sellers are maintaining their position with 41% of short positions.